116 6th Ave W Cresco, IA 52136

Estimated Value: $141,000 - $162,000

3

Beds

2

Baths

1,518

Sq Ft

$103/Sq Ft

Est. Value

About This Home

This home is located at 116 6th Ave W, Cresco, IA 52136 and is currently estimated at $156,389, approximately $103 per square foot. 116 6th Ave W is a home located in Howard County with nearby schools including Crestwood High School and Notre Dame Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 6, 2022

Sold by

Macduff Jason A

Bought by

Jamie D & Associates Llc

Current Estimated Value

Purchase Details

Closed on

Jul 15, 2021

Sold by

Hasleiet Adam W

Bought by

Jamie D & Associates Llc

Purchase Details

Closed on

Jun 27, 2006

Sold by

Ollendieck Laurie A and Ollendieck Craig W

Bought by

Macduff Jason A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$68,800

Interest Rate

6.73%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jamie D & Associates Llc | -- | None Listed On Document | |

| Jamie D & Associates Llc | $60,000 | None Listed On Document | |

| Macduff Jason A | $86,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Macduff Jason A | $68,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,450 | $151,340 | $7,500 | $143,840 |

| 2024 | $2,450 | $132,990 | $7,500 | $125,490 |

| 2023 | $2,424 | $132,990 | $7,500 | $125,490 |

| 2022 | $2,180 | $109,120 | $7,500 | $101,620 |

| 2021 | $2,064 | $109,120 | $7,500 | $101,620 |

| 2020 | $2,030 | $97,740 | $7,500 | $90,240 |

| 2019 | $1,958 | $91,220 | $0 | $0 |

| 2018 | $1,940 | $91,220 | $0 | $0 |

| 2017 | $1,636 | $74,030 | $0 | $0 |

| 2016 | $1,642 | $74,030 | $0 | $0 |

| 2015 | $1,642 | $74,030 | $0 | $0 |

| 2014 | $1,676 | $74,030 | $0 | $0 |

Source: Public Records

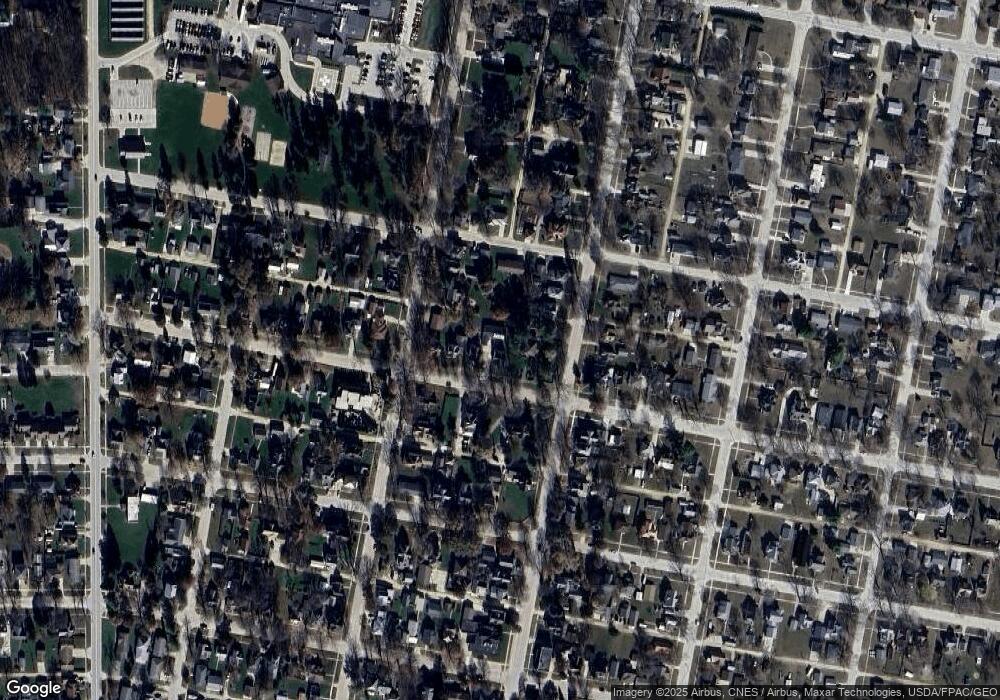

Map

Nearby Homes

- 106 6th Ave W

- 205 6th Ave W

- 120 5th Ave E

- 113 5th Ave E

- 732 N Elm St

- 306 5th Ave W Unit Condo

- 737 6th St E Unit Nelson

- 1014 Division St

- 530 4th Ave E

- 418 2nd Ave W

- 211 Royal Oaks Dr

- 716 6th Ave E

- 303 3rd St SW Unit Farley

- 1018 8th St E

- 309 Vernon Rd

- 111 4th Ave SW

- 729 2nd St SW

- 6549 Willow Ave

- 0 50th St

- 0 Co Rd A23 Unit NOC6333468