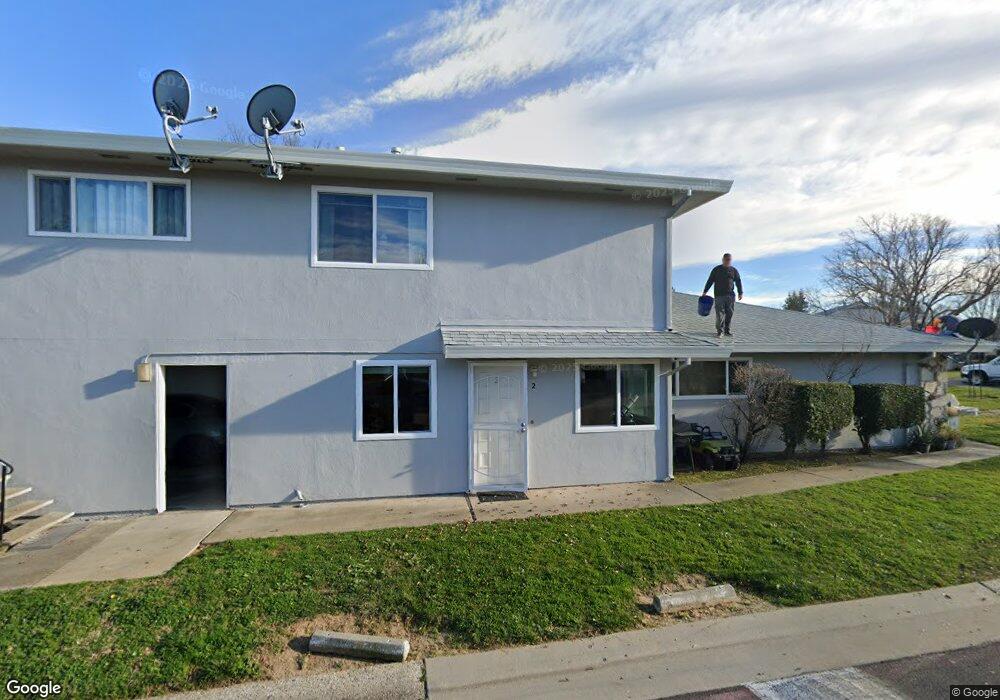

11691 Garnet Way Unit 4 Auburn, CA 95602

Northwest Auburn NeighborhoodEstimated Value: $197,000 - $236,000

2

Beds

1

Bath

840

Sq Ft

$257/Sq Ft

Est. Value

About This Home

This home is located at 11691 Garnet Way Unit 4, Auburn, CA 95602 and is currently estimated at $216,104, approximately $257 per square foot. 11691 Garnet Way Unit 4 is a home located in Placer County with nearby schools including Placer High School, EV Cain Middle, and St. Joseph Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 27, 2023

Sold by

Popanz Veronica S

Bought by

Murillo Jeanette D and Murillo Jerome K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,250

Outstanding Balance

$214,047

Interest Rate

7.23%

Mortgage Type

New Conventional

Estimated Equity

$2,057

Purchase Details

Closed on

Sep 9, 1998

Sold by

Graves Helen P

Bought by

Popanz Veronica S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$43,602

Interest Rate

6.92%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 26, 1998

Sold by

Popanz Christopher F

Bought by

Popanz Vernonica S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$43,602

Interest Rate

6.92%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 29, 1996

Sold by

Graves Helen and Graves Schuyler

Bought by

Graves Helen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Murillo Jeanette D | $225,000 | Chicago Title | |

| Popanz Veronica S | $45,000 | First American Title Ins Co | |

| Popanz Vernonica S | -- | First American Title Ins Co | |

| Graves Helen | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Murillo Jeanette D | $218,250 | |

| Previous Owner | Popanz Veronica S | $43,602 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,368 | $229,500 | $10,200 | $219,300 |

| 2023 | $3,368 | $67,706 | $27,079 | $40,627 |

| 2022 | $1,602 | $66,380 | $26,549 | $39,831 |

| 2021 | $1,576 | $65,079 | $26,029 | $39,050 |

| 2020 | $1,571 | $64,413 | $25,763 | $38,650 |

| 2019 | $1,558 | $63,151 | $25,258 | $37,893 |

| 2018 | $1,521 | $61,913 | $24,763 | $37,150 |

| 2017 | $1,509 | $60,700 | $24,278 | $36,422 |

| 2016 | $1,496 | $59,510 | $23,802 | $35,708 |

| 2015 | $1,480 | $58,617 | $23,445 | $35,172 |

| 2014 | $1,471 | $57,470 | $22,986 | $34,484 |

Source: Public Records

Map

Nearby Homes

- 11670 Garnet Way Unit 4

- 11632 Quartz Dr Unit 4

- 11582 Quartz Dr Unit 3

- 3677 Galena Dr Unit 3

- 11521 Garnet Way Unit 2

- 11510 Garnet Way Unit 4

- 3643 Galena Dr Unit 4

- 3681 Galena Dr Unit 4

- 3277 Professional Dr

- 3222 Fortune Ct

- 3765 Grass Valley Hwy Unit 282

- 3765 Grass Valley Hwy Unit 263

- 3765 Grass Valley Hwy Unit 14

- 3765 Grass Valley Hwy Unit 117

- 3765 Grass Valley Hwy Unit 226

- 0 Bell Rd Unit 225114567

- 11325 Tahoe St

- 2059 Bell Rd

- 2690 Commons Place

- 2660 Commons Place

- 11691 Garnet Way

- 11691 Garnet Way Unit 2

- 11691 Garnet Way Unit 1

- 11691 Garnet Way

- 11701 Garnet Way Unit 3

- 11701 Garnet Way Unit 2

- 11701 Garnet Way

- 11701 Garnet Way

- 3572 Opal Dr Unit 2

- 3572 Opal Dr

- 3572 Opal Dr Unit 3

- 3572 Opal Dr Unit 1

- 3572 Opal Dr Unit 1

- 3572 Opal Dr Unit 4

- 3562 Opal Dr Unit 3

- 3562 Opal Dr Unit 2

- 3562 Opal Dr Unit 1

- 3562 Opal Dr Unit 4

- 11710 Garnet Way Unit 3

- 11710 Garnet Way Unit 2