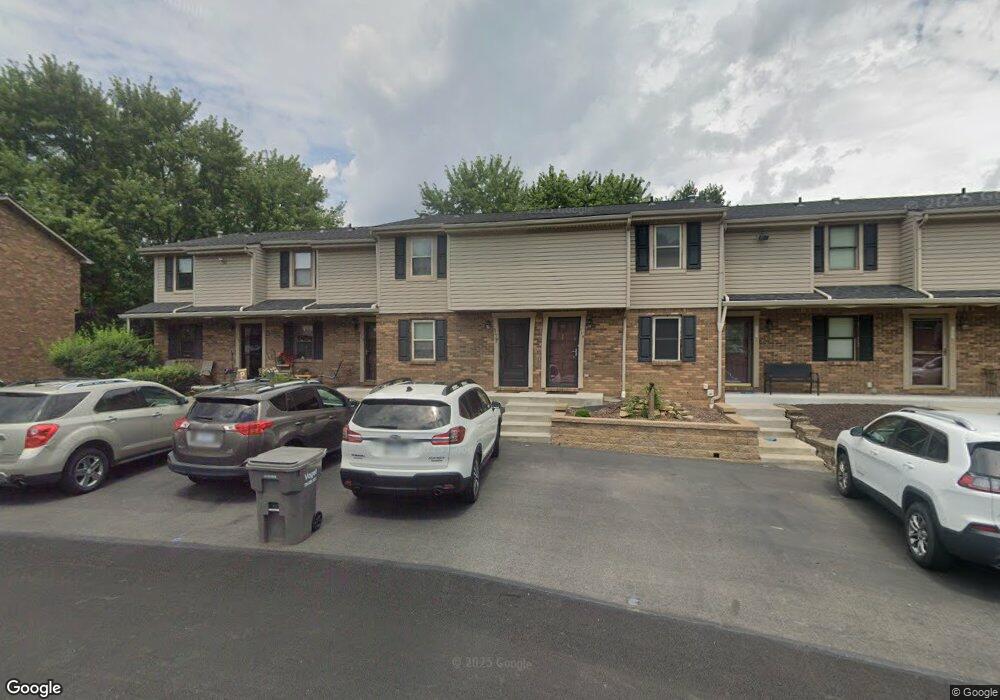

117 Forest Dr Seven Fields, PA 16046

Estimated Value: $216,000 - $313,890

--

Bed

--

Bath

--

Sq Ft

1,089

Sq Ft Lot

About This Home

This home is located at 117 Forest Dr, Seven Fields, PA 16046 and is currently estimated at $253,723. 117 Forest Dr is a home located in Butler County with nearby schools including Rowan Elementary School, Haine Middle School, and Ryan Gloyer Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 5, 2020

Sold by

Steckbeck Jonathan D and Steckbeck Jodi K

Bought by

Freewill Properties Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,500

Outstanding Balance

$130,103

Interest Rate

3.3%

Mortgage Type

Commercial

Estimated Equity

$123,620

Purchase Details

Closed on

Nov 30, 2007

Sold by

Primrose Home Incor

Bought by

Marziotto Steven M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,000,000

Interest Rate

6.17%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 15, 2004

Sold by

Cardosi Andrew D

Bought by

Steckbeck Jonathan D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,784

Interest Rate

6.25%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 31, 2002

Sold by

Repine Edward B

Bought by

Cardosi Andrew D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,400

Interest Rate

6.9%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Freewill Properties Llc | $146,500 | None Available | |

| Marziotto Steven M | $225,000 | -- | |

| Steckbeck Jonathan D | $115,980 | -- | |

| Cardosi Andrew D | $90,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Freewill Properties Llc | $146,500 | |

| Previous Owner | Marziotto Steven M | $1,000,000 | |

| Previous Owner | Steckbeck Jonathan D | $92,784 | |

| Previous Owner | Cardosi Andrew D | $72,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,985 | $11,480 | $340 | $11,140 |

| 2024 | $1,924 | $11,480 | $340 | $11,140 |

| 2023 | $1,895 | $11,480 | $340 | $11,140 |

| 2022 | $1,895 | $11,480 | $340 | $11,140 |

| 2021 | $1,866 | $11,480 | $0 | $0 |

| 2020 | $1,866 | $11,480 | $340 | $11,140 |

| 2019 | $1,844 | $11,480 | $340 | $11,140 |

| 2018 | $1,844 | $11,480 | $340 | $11,140 |

| 2017 | $1,810 | $11,480 | $340 | $11,140 |

| 2016 | $437 | $11,480 | $340 | $11,140 |

| 2015 | $233 | $11,480 | $340 | $11,140 |

| 2014 | $233 | $11,480 | $340 | $11,140 |

Source: Public Records

Map

Nearby Homes

- 115 Forest Dr

- 121 Hillvue Dr

- 134 Enclave Dr

- 110 Aspen Ln

- 327 Crest Ln

- 321 Crest Ln

- 114 Southern Valley Ct

- 313 Crest Ln

- 304 Scenic Ridge Ct

- 238 Cumberland Dr

- 6755 Mars Crider Rd

- 120 Hidden Oak Dr

- 104 Broadstone Dr

- 6742 Old Mars Crider Rd

- 1304 Pointe View Dr

- 809 Mount Pleasant Rd

- 1703 Pointe View Dr

- 3001 Pointe View Dr

- 703 Ivy Ln

- 219 Adams Pointe Blvd Unit 9