1174 Silverleaf Canyon Rd Beaumont, CA 92223

Estimated Value: $485,000 - $504,000

2

Beds

3

Baths

2,127

Sq Ft

$232/Sq Ft

Est. Value

About This Home

This home is located at 1174 Silverleaf Canyon Rd, Beaumont, CA 92223 and is currently estimated at $493,357, approximately $231 per square foot. 1174 Silverleaf Canyon Rd is a home located in Riverside County with nearby schools including Brookside Elementary School, Mountain View Middle School, and Beaumont Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2010

Sold by

Cabal Emil and Cabal Josephine

Bought by

Cabal Emil and Cabal Josephine

Current Estimated Value

Purchase Details

Closed on

Apr 13, 2010

Sold by

Appa Consulting Corp

Bought by

Cabal Emil and Cabal Josephine

Purchase Details

Closed on

Mar 17, 2010

Sold by

Wells Fargo Bank Na

Bought by

Appa Consulting Corp

Purchase Details

Closed on

Jan 21, 2010

Sold by

Sanchez Francisco and Sanchez Maria

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

May 15, 2006

Sold by

Pulte Home Corp

Bought by

Sanchez Francisco J and Sanchez Maria E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$283,120

Interest Rate

6.56%

Mortgage Type

Stand Alone First

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cabal Emil | -- | None Available | |

| Cabal Emil | $215,000 | Fidelity National Title | |

| Appa Consulting Corp | $170,000 | Fidelity National Title Comp | |

| Wells Fargo Bank Na | $193,200 | None Available | |

| Sanchez Francisco J | $355,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sanchez Francisco J | $283,120 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,335 | $277,509 | $64,531 | $212,978 |

| 2023 | $5,335 | $266,734 | $62,026 | $204,708 |

| 2022 | $5,235 | $261,505 | $60,810 | $200,695 |

| 2021 | $5,164 | $256,378 | $59,618 | $196,760 |

| 2020 | $5,117 | $253,750 | $59,007 | $194,743 |

| 2019 | $5,052 | $248,775 | $57,850 | $190,925 |

| 2018 | $5,020 | $243,898 | $56,716 | $187,182 |

| 2017 | $5,013 | $239,116 | $55,604 | $183,512 |

| 2016 | $5,388 | $234,428 | $54,514 | $179,914 |

| 2015 | $5,331 | $230,909 | $53,697 | $177,212 |

| 2014 | $4,963 | $226,389 | $52,647 | $173,742 |

Source: Public Records

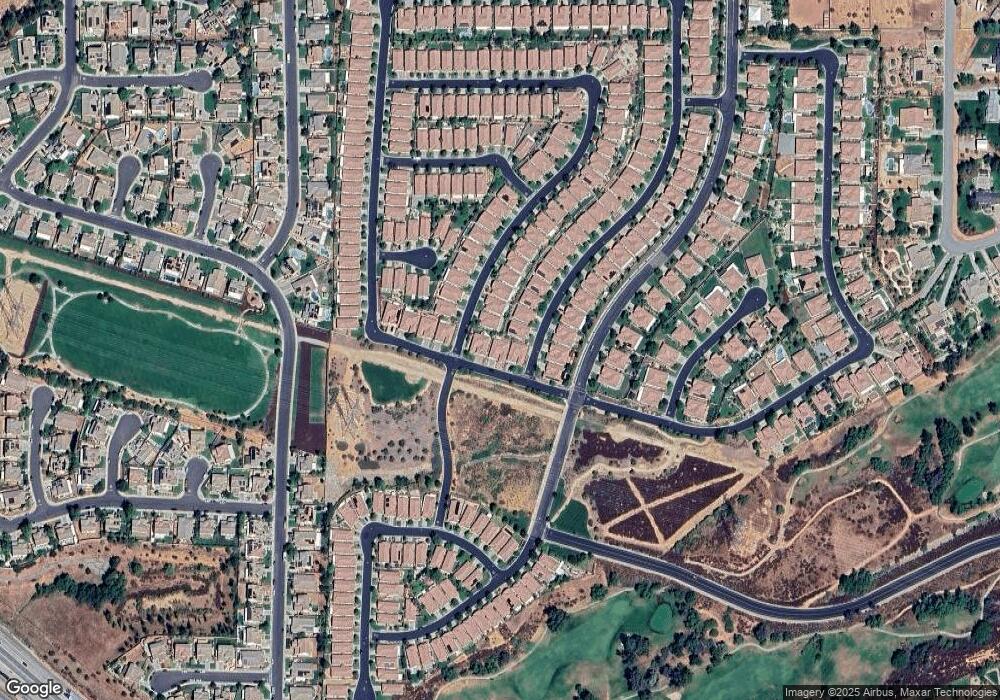

Map

Nearby Homes

- 1746 Dalea Way

- 1185 Lantana Rd

- 1140 Lantana Rd

- 1776 Desert Almond Way

- 1791 Hannon Rd

- 1244 Katherine Ct

- 1222 Tumbleweed Ct

- 1566 High Meadow Dr

- 11514 Bunker Place

- 11582 Bunker Place

- 979 Ironwood Rd

- 0 Champions Dr

- 949 Pebble Beach Rd

- 1700 Sarazen St

- 956 Gleneagles Rd

- 1577 Valhalla Ct

- 1710 N Forest Oaks Dr

- 930 Gleneagles Rd

- 883 Eastlake Rd

- 37981 Gallery Ln

- 1170 Silverleaf Canyon Rd

- 1176 Silverleaf Canyon Rd

- 1711 Brittney Rd

- 1710 Dalea Way

- 1236 Brittney Rd

- 1715 Brittney Rd

- 1714 Dalea Way

- 1180 Silverleaf Canyon Rd

- 1718 Dalea Way

- 1717 Brittney Rd

- 1710 Brittney Rd

- 1709 Dalea Way

- 1714 Brittney Rd

- 1182 Silverleaf Canyon Rd

- 1711 Dalea Way

- 1722 Dalea Way

- 1719 Brittney Rd

- 1716 Brittney Rd

- 1715 Dalea Way

- 1726 Dalea Way

Your Personal Tour Guide

Ask me questions while you tour the home.