118 Heathrow Dr Murfreesboro, TN 37129

Estimated Value: $326,746 - $384,000

3

Beds

2

Baths

1,232

Sq Ft

$297/Sq Ft

Est. Value

About This Home

This home is located at 118 Heathrow Dr, Murfreesboro, TN 37129 and is currently estimated at $366,437, approximately $297 per square foot. 118 Heathrow Dr is a home located in Rutherford County with nearby schools including Brown's Chapel Elementary School, Blackman Middle School, and Blackman High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 5, 2018

Sold by

Myburgh Sonette

Bought by

Myburgh Sonette and The Pretoria Remtals Trust

Current Estimated Value

Purchase Details

Closed on

Oct 6, 2014

Sold by

Odendaal Jacobus Johannes

Bought by

Odendaal Trust and Toit Sonette Du (Tr)

Purchase Details

Closed on

Aug 5, 2011

Sold by

Myburgh Herman Preservatio

Bought by

Odendaal Jacobus Johannes

Purchase Details

Closed on

May 23, 2011

Sold by

Myburgh Sonette

Bought by

Myburgh Herman Preservation and Myburgh Sonette

Purchase Details

Closed on

May 18, 2011

Sold by

Thda

Bought by

Myburgh Sonette

Purchase Details

Closed on

Mar 11, 2011

Sold by

Vest Terry

Bought by

Thda

Purchase Details

Closed on

Sep 2, 1999

Sold by

Grw Developers

Bought by

Terry Vest

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

7.91%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Myburgh Sonette | $150,000 | Watauga Title And Escrow Co | |

| Odendaal Trust | -- | -- | |

| Odendaal Jacobus Johannes | $120,000 | -- | |

| Myburgh Herman Preservation | -- | -- | |

| Myburgh Sonette | $90,000 | -- | |

| Thda | $88,703 | -- | |

| Terry Vest | $100,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Terry Vest | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,156 | $61,600 | $13,750 | $47,850 |

| 2024 | $1,156 | $61,600 | $13,750 | $47,850 |

| 2023 | $1,156 | $61,600 | $13,750 | $47,850 |

| 2022 | $996 | $61,600 | $13,750 | $47,850 |

| 2021 | $924 | $41,625 | $7,750 | $33,875 |

| 2020 | $924 | $41,625 | $7,750 | $33,875 |

| 2019 | $924 | $41,625 | $7,750 | $33,875 |

| 2018 | $874 | $41,625 | $0 | $0 |

| 2017 | $754 | $28,150 | $0 | $0 |

| 2016 | $754 | $28,150 | $0 | $0 |

| 2015 | $754 | $28,150 | $0 | $0 |

| 2014 | $700 | $28,150 | $0 | $0 |

| 2013 | -- | $29,400 | $0 | $0 |

Source: Public Records

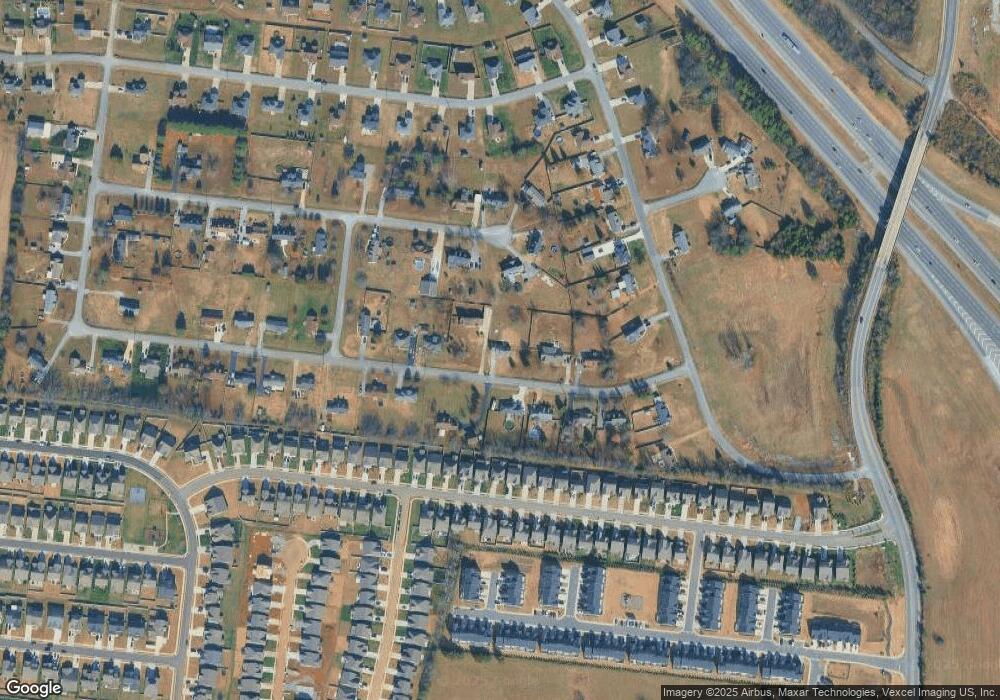

Map

Nearby Homes

- 4511 Wachovia Way

- 3229 Chatfield Dr

- 228 Heatherwood Dr

- 5319 Normandy Cob Dr

- 5225 Normandy Cob Dr Unit 33

- 5116 Bridgemore Blvd

- 5329 Bridgemore Blvd

- 2816 Lightning Bug Dr

- 5048 Bridgemore Blvd

- 3033 Asbury Rd

- 416 Heatherwood Dr

- 2922 Kapia Mera Ct

- 5416 Bridgemore Blvd

- 2921 Kapia Mera Ct

- 2917 Chaudoin Ct

- The Arrington Plan at Shelton Square

- The Waverly Plan at Shelton Square

- The Jamestown Plan at Shelton Square

- The Bristol Plan at Shelton Square

- The Brunswick Plan at Shelton Square

- 120 Heathrow Dr

- 114 Heathrow Dr

- 103 Heatherwood Ct

- 122 Heathrow Dr

- 117 Heathrow Dr

- 110 Heathrow Dr

- 121 Heathrow Dr

- 113 Heathrow Dr

- 107 Heatherwood Ct

- 100 Heatherwood Ct

- 126 Heathrow Dr

- 205 Heatherwood Dr

- 109 Heathrow Dr

- 111 Heatherwood Ct

- 125 Heathrow Dr

- 209 Heatherwood Dr

- 106 Heathrow Dr

- 203 Heatherwood Dr

- 5338 Pointer Place

- 5338 Pointer Place