11804 County 32 Park Rapids, MN 56470

Estimated Value: $82,000 - $192,000

1

Bed

1

Bath

668

Sq Ft

$225/Sq Ft

Est. Value

About This Home

This home is located at 11804 County 32, Park Rapids, MN 56470 and is currently estimated at $150,261, approximately $224 per square foot. 11804 County 32 is a home located in Hubbard County with nearby schools including Century Elementary School, Century School, and Park Rapids Area High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 30, 2019

Sold by

Truebenbach Annette M and Andersen Mark

Bought by

Lako David C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,500

Outstanding Balance

$51,346

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$98,915

Purchase Details

Closed on

Aug 29, 2011

Sold by

Blevins Marita L

Bought by

Mehr Dustin R and Pelkey Michelle M

Purchase Details

Closed on

May 12, 2010

Sold by

The First National Bank Of Walker

Bought by

Blevins Marita L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,400

Interest Rate

5.3%

Mortgage Type

Unknown

Purchase Details

Closed on

Sep 4, 2007

Sold by

Borst Warren D and Borts Christine C

Bought by

Manz Burton and Manz Debra J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,000

Interest Rate

6.72%

Mortgage Type

Future Advance Clause Open End Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lako David C | $83,500 | -- | |

| Mehr Dustin R | $43,000 | None Available | |

| Blevins Marita L | $38,000 | None Available | |

| Manz Burton | $60,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lako David C | $58,500 | |

| Previous Owner | Blevins Marita L | $30,400 | |

| Previous Owner | Manz Burton | $60,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $732 | $115,600 | $47,200 | $68,400 |

| 2023 | $786 | $112,800 | $39,800 | $73,000 |

| 2022 | $586 | $108,000 | $35,100 | $72,900 |

| 2021 | $780 | $76,300 | $33,900 | $42,400 |

| 2020 | $606 | $78,600 | $31,800 | $46,800 |

| 2019 | $552 | $55,400 | $26,800 | $28,600 |

| 2018 | $544 | $49,900 | $25,300 | $24,600 |

| 2016 | $500 | $50,200 | $25,300 | $24,900 |

| 2015 | $346 | $42,500 | $21,400 | $21,100 |

| 2014 | $318 | $39,800 | $22,100 | $17,700 |

Source: Public Records

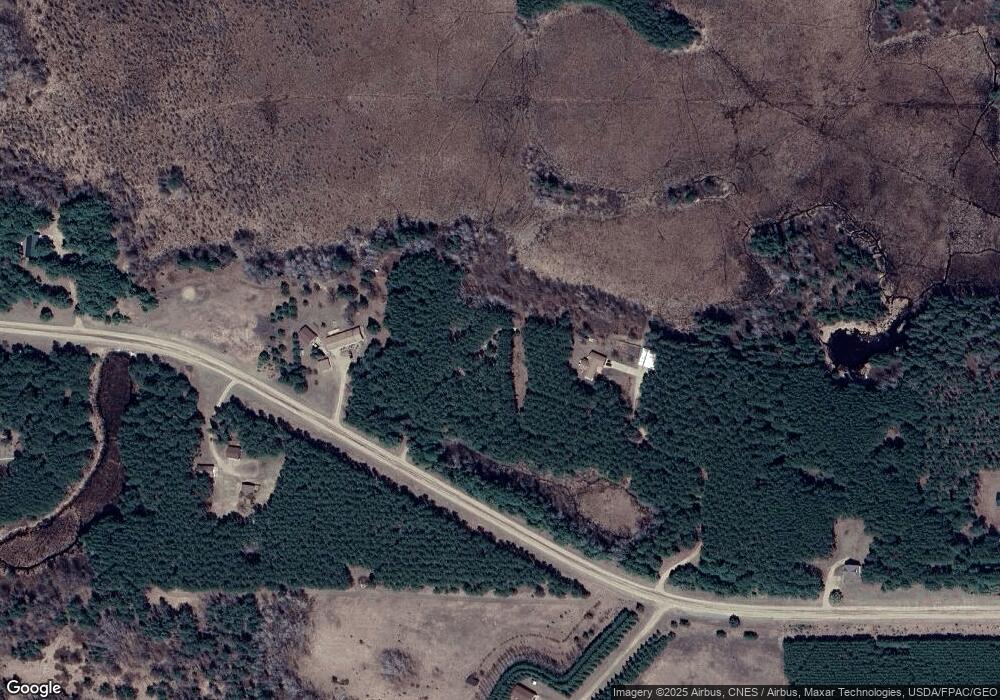

Map

Nearby Homes

- 23505 Gracewood Dr

- 13330 230th St

- 11100 Fisher Ln

- 12665 Far Portage Dr

- 13895 Gazelle Trail

- 13455 County 40

- 23590 Great Ridge Trail

- 14612 Gazebo Dr Unit 21

- 14590 Gazebo Dr Unit 18

- 14590 Gazebo Dr Unit 10

- 14590 Gazebo Dr Unit 9

- 20122 US 71

- 25673 Happy Hollow Rd

- 14588 230th St

- 26361 Hammock Dr

- 26142 Isoline Loop

- 26315 Icon Dr Unit 103

- 26451 Us 71

- 26298 County 89

- 26575 Us 71

- 11770 County 32

- 11713 County 32

- 11944 County 32

- 11961 County 32

- 11634 County 32

- 11579 County 32

- 12048 County 32

- 11495 County 32

- 12140 County 32

- TBD County 32

- 23288 Gracewood Dr

- 11570 County 32

- 12455 County 32

- S Lot Gracewood Dr

- N Lot Gracewood Dr

- 12529 County 32

- 12529 County 32

- 12529 County 32

- 23391 Gracewood Dr

- 23289 Gracewood Dr