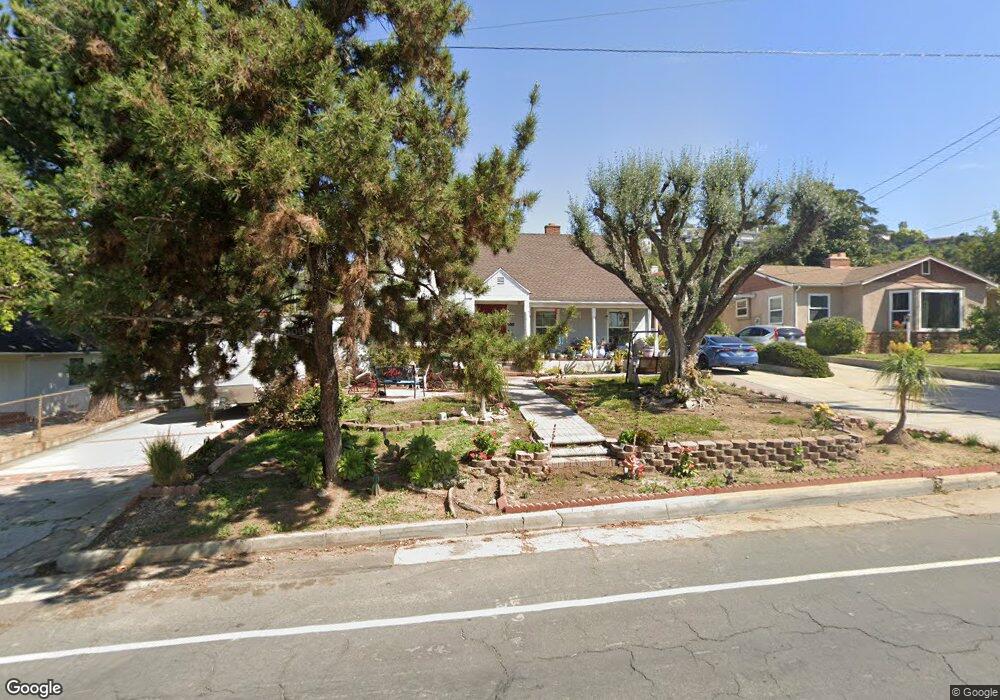

11831 Beverly Dr Whittier, CA 90601

West Whittier NeighborhoodEstimated Value: $832,000 - $1,017,000

3

Beds

3

Baths

1,588

Sq Ft

$597/Sq Ft

Est. Value

About This Home

This home is located at 11831 Beverly Dr, Whittier, CA 90601 and is currently estimated at $948,350, approximately $597 per square foot. 11831 Beverly Dr is a home located in Los Angeles County with nearby schools including Longfellow Elementary School, Walter F. Dexter Middle School, and Whittier High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 28, 2011

Sold by

Garcia Eduardo J

Bought by

Velasco Miguel and Velasco Yolanda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$311,080

Outstanding Balance

$214,468

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

$733,882

Purchase Details

Closed on

Nov 21, 2005

Sold by

Jimenez Larry C

Bought by

Garcia Eduardo J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$536,000

Interest Rate

1%

Mortgage Type

Negative Amortization

Purchase Details

Closed on

Jun 11, 2001

Sold by

Jumont Norma D

Bought by

Jimenez Larry C and Jimenez Mariaelena Garza

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$247,500

Interest Rate

7.09%

Purchase Details

Closed on

Jan 27, 2000

Sold by

Jumont Norma D

Bought by

Jumont Norma D and The Norma D Jumont Trust

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Velasco Miguel | $385,000 | Old Republic Title Company | |

| Garcia Eduardo J | $670,000 | Fidelity National Title Comp | |

| Jimenez Larry C | $275,000 | Chicago Title | |

| Jumont Norma D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Velasco Miguel | $311,080 | |

| Previous Owner | Garcia Eduardo J | $536,000 | |

| Previous Owner | Jimenez Larry C | $247,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,981 | $483,568 | $301,321 | $182,247 |

| 2024 | $5,981 | $474,087 | $295,413 | $178,674 |

| 2023 | $5,918 | $464,792 | $289,621 | $175,171 |

| 2022 | $5,789 | $455,680 | $283,943 | $171,737 |

| 2021 | $5,711 | $446,746 | $278,376 | $168,370 |

| 2019 | $5,572 | $433,497 | $270,120 | $163,377 |

| 2018 | $5,323 | $424,998 | $264,824 | $160,174 |

| 2016 | $5,088 | $408,497 | $254,542 | $153,955 |

| 2015 | $5,008 | $402,362 | $250,719 | $151,643 |

| 2014 | $4,935 | $394,481 | $245,808 | $148,673 |

Source: Public Records

Map

Nearby Homes

- 5315 Bihr Ct

- 5205 Tierra Bonita Dr

- 12408 Carinthia Dr

- 10602 Monaco Ct

- 5235 Andalucia Ct

- 5518 Rockne Ave

- 12208 Rose Dr

- 5029 Tierra Antigua Dr Unit 107

- 10605 Cordoba Ct

- 12530 Carinthia Dr

- 5628 Panorama Dr

- 4807 Cinco View Dr

- 4810 Cinco View Dr

- 10607 Orange Dr

- 5433 Mesagrove Ave

- 5522 Greenleaf Ave

- 11422 Ridgegate Dr

- 11141 Dorland St

- 5915 Morrill Ave

- 11835 Pocasset Dr

- 11837 Beverly Dr

- 11823 Beverly Dr

- 11836 Norino Dr

- 5082 Magnolia Ave

- 11824 Norino Dr

- 11845 Beverly Dr

- 11815 Beverly Dr

- 11818 Norino Dr

- 11830 Norino Dr

- 5401 Magnolia Ave

- 11855 Beverly Dr

- 11822 Beverly Dr

- 11810 Norino Dr

- 11816 Beverly Dr

- 11805 Beverly Dr

- 5407 Magnolia Ave

- 11854 Beverly Dr

- 11810 Beverly Dr

- 11802 Norino Dr

- 11831 Norino Dr

Your Personal Tour Guide

Ask me questions while you tour the home.