11935 Dancliff Trace Unit 11935 Alpharetta, GA 30009

Estimated Value: $755,000 - $833,000

4

Beds

4

Baths

2,812

Sq Ft

$281/Sq Ft

Est. Value

About This Home

This home is located at 11935 Dancliff Trace Unit 11935, Alpharetta, GA 30009 and is currently estimated at $791,510, approximately $281 per square foot. 11935 Dancliff Trace Unit 11935 is a home located in Fulton County with nearby schools including Manning Oaks Elementary School, Hopewell Middle School, and Alpharetta High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 6, 2025

Sold by

Wolf Jeanne Elizabeth

Bought by

Parker Matthew and Parker Molly

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$769,500

Outstanding Balance

$765,577

Interest Rate

6.89%

Mortgage Type

New Conventional

Estimated Equity

$25,933

Purchase Details

Closed on

Jun 29, 2018

Sold by

Burns Jill N

Bought by

Wolf Jeanne Elizabeth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,000

Interest Rate

4.25%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 23, 2004

Sold by

Hms John Wieland

Bought by

Berman Jill N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

5.63%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Parker Matthew | $810,000 | -- | |

| Wolf Jeanne Elizabeth | $420,000 | -- | |

| Berman Jill N | $324,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Parker Matthew | $769,500 | |

| Previous Owner | Wolf Jeanne Elizabeth | $104,000 | |

| Previous Owner | Berman Jill N | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $719 | $243,480 | $36,160 | $207,320 |

| 2023 | $719 | $243,480 | $36,160 | $207,320 |

| 2022 | $3,438 | $172,000 | $35,640 | $136,360 |

| 2021 | $4,030 | $172,000 | $35,640 | $136,360 |

| 2020 | $3,989 | $173,920 | $35,640 | $138,280 |

| 2019 | $600 | $149,560 | $6,360 | $143,200 |

| 2018 | $3,861 | $148,880 | $27,240 | $121,640 |

| 2017 | $3,447 | $130,080 | $20,920 | $109,160 |

| 2016 | $3,446 | $130,080 | $20,920 | $109,160 |

| 2015 | $4,007 | $130,080 | $20,920 | $109,160 |

| 2014 | $3,597 | $130,080 | $20,920 | $109,160 |

Source: Public Records

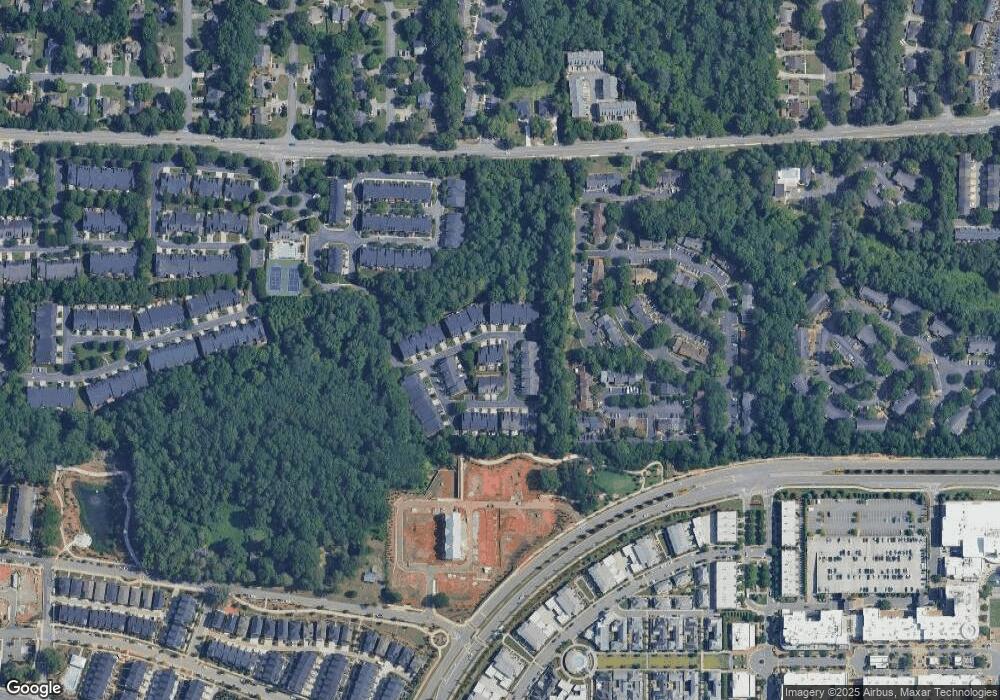

Map

Nearby Homes

- 11945 Dancliff Trace

- 11715 Dancliff Trace

- 11750 Dancliff Trace

- 2600 Milford Ln

- 435 Chiswick Cir Unit 21

- 405 Chiswick Cir Unit 24

- Harleigh Basement Plan at Chiswick

- Harleigh Plan at Chiswick

- 12120 Dancliff Trace

- 415 Chiswick Cir Unit 23

- 102 Grand Crescent

- 132 Grand Crescent

- 293 Thompson St

- 152 Grand Crescent

- 376 Concord St

- 107 Meeting St

- 341 S Esplanade

- 550 Fisher Dr Unit 47

- 560 Fisher Dr Unit 48

- 310 Crimson Pine Aly

- 11925 Dancliff Trace

- 11880 Dancliff Trace

- 11870 Dancliff Trace

- 11910 Dancliff Trace

- 11920 Dancliff Trace

- 11795 Dancliff Trace

- 11785 Dancliff Trace

- 11860 Dancliff Trace

- 11900 Dancliff Trace

- 11900 Dancliff Trace Unit 11900

- 11950 Dancliff Trace

- 11850 Dancliff Trace

- 11850 Dancliff Trace Unit 11850

- 11960 Dancliff Trace

- 11890 Dancliff Trace

- 11890 Dancliff Trace

- 11890 Dancliff Trace Unit 11890

- 11840 Dancliff Trace

- 11840 Dancliff Trace Unit 11840