1196 Washington Green New Windsor, NY 12553

Estimated Value: $306,670 - $318,000

2

Beds

2

Baths

1,029

Sq Ft

$302/Sq Ft

Est. Value

About This Home

This home is located at 1196 Washington Green, New Windsor, NY 12553 and is currently estimated at $310,418, approximately $301 per square foot. 1196 Washington Green is a home located in Orange County with nearby schools including Newburgh Free Academy Main Campus, Little Harvard, and San Miguel Academy Of Newburgh.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 4, 2009

Sold by

Courter Sarah

Bought by

Flanagan James

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,500

Outstanding Balance

$100,808

Interest Rate

5.14%

Estimated Equity

$209,610

Purchase Details

Closed on

Mar 31, 2002

Sold by

Rinaldi Heather

Bought by

Berger Sarah J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,500

Interest Rate

6.12%

Purchase Details

Closed on

Jul 27, 2000

Sold by

Rinaldi Karen and Rinaldi Heather

Bought by

Rinaldi Heather

Purchase Details

Closed on

Aug 5, 1999

Sold by

Vanledtje Liesl and Potter Scott C

Bought by

Rinaldi Heather and Rinaldi Karen A

Purchase Details

Closed on

Sep 8, 1993

Sold by

Hippeli George J and Potter Carole A

Bought by

Hippeli George J and Potter Carole A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Flanagan James | $195,000 | Daniel J. Bloom | |

| Berger Sarah J | $118,500 | Fidelity National Title Ins | |

| Rinaldi Heather | -- | Fidelity National Title Ins | |

| Rinaldi Heather | $84,000 | -- | |

| Hippeli George J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Flanagan James | $175,500 | |

| Previous Owner | Berger Sarah J | $108,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,480 | $16,600 | $2,000 | $14,600 |

| 2023 | $3,456 | $16,600 | $2,000 | $14,600 |

| 2022 | $3,531 | $16,600 | $2,000 | $14,600 |

| 2021 | $3,537 | $16,600 | $2,000 | $14,600 |

| 2020 | $2,749 | $16,600 | $2,000 | $14,600 |

| 2019 | $1,027 | $16,600 | $2,000 | $14,600 |

| 2018 | $1,027 | $16,600 | $2,000 | $14,600 |

| 2017 | $2,598 | $16,600 | $2,000 | $14,600 |

| 2016 | $2,587 | $16,600 | $2,000 | $14,600 |

| 2015 | -- | $16,600 | $2,000 | $14,600 |

| 2014 | -- | $16,600 | $2,000 | $14,600 |

Source: Public Records

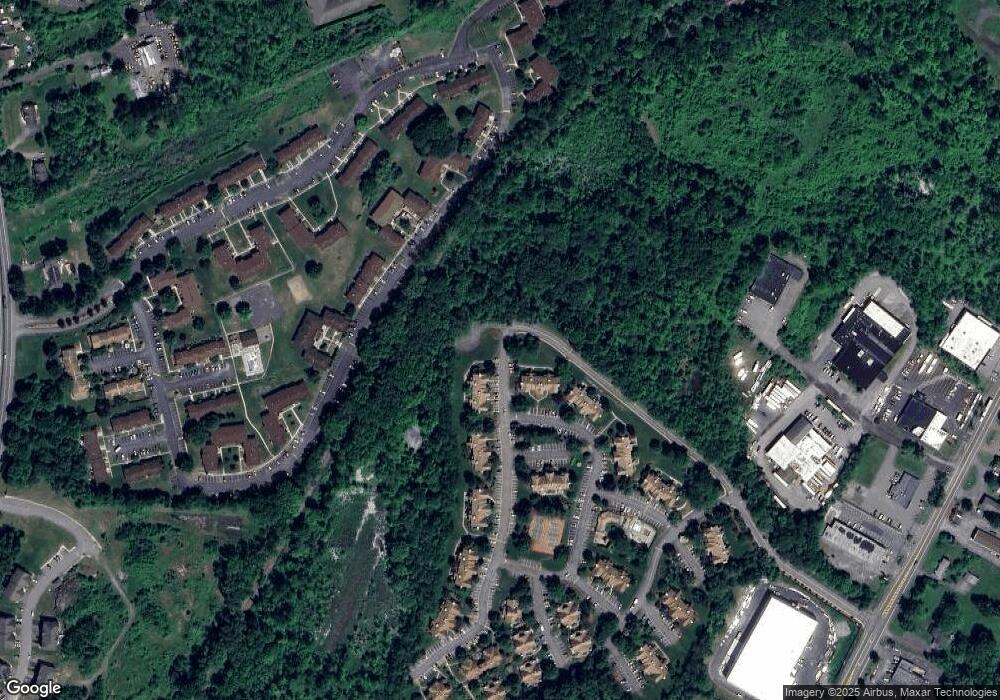

Map

Nearby Homes

- 1184 Washington Green Unit T4

- 1210 Washington Green

- 1020 Washington Green

- 1004 Washington Green Unit T2

- 276 Temple Hill Rd Unit 2606

- 276 Temple Hill Rd Unit 2513

- 276 Temple Hill Rd Unit 2201

- 501 Iron Forge Ln

- 2 Rocky Ln

- 12 Provost Dr

- 810 Blooming Grove Turnpike Unit 84

- 293 Garden St

- 307 Gazebo Ct

- 179 Riley Rd

- 807 Fairway Ct Unit 94

- 104 Riley Rd

- 11 Hudson Dr

- 35 Guernsey Dr

- 223 Margo St

- 1003 Ethan Allen Dr

- 1190 Washington Green Unit 1190

- 1189 Washington Green Unit Q

- 1190 Washington Green Unit QT2

- 1198 Washington Green Unit QP4

- 1197 Washington Green

- 1192 Washington Green Unit QP2

- 1191 Washington Green

- 1195 Washington Green

- 1190 Washington Green

- 1189 Washington Green

- 1194 Washington Green

- 1193 Washington Green

- 1188 Washington Green

- 1187 Washington Green

- 1086 Washington Green Unit 1086

- 1087 Washington Green

- 1082 Washington Green

- 1081 Washington Green

- 1085 Washington Green

- 1080 Washington Green