12 Rue Grand Vallee Newport Beach, CA 92660

Big Canyon NeighborhoodEstimated Value: $4,153,229 - $5,020,000

3

Beds

3

Baths

3,198

Sq Ft

$1,398/Sq Ft

Est. Value

About This Home

This home is located at 12 Rue Grand Vallee, Newport Beach, CA 92660 and is currently estimated at $4,472,307, approximately $1,398 per square foot. 12 Rue Grand Vallee is a home located in Orange County with nearby schools including Abraham Lincoln Elementary School, Corona del Mar Middle and High School, and Del Mar Lincoln Child Development Center.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 22, 2022

Sold by

Middleton Family Trust

Bought by

Middleton Family Bypass Trust

Current Estimated Value

Purchase Details

Closed on

Jul 16, 2021

Sold by

Ross Middleton Jr John

Bought by

Certain Declaration Of Trust

Purchase Details

Closed on

Aug 25, 2011

Sold by

Middleton John and Middleton Elizabeth

Bought by

Middleton John R and Middleton Elizabeth S

Purchase Details

Closed on

Jul 10, 1997

Sold by

Lemkin Joy F & Lemkin Family Trust

Bought by

Middleton John and Middleton Elizabeth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$617,000

Interest Rate

7.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 8, 1995

Sold by

Carney Claudette A and Carney Clauette A

Bought by

Lemkin E Robert and Lemkin Joy F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Middleton Family Bypass Trust | -- | -- | |

| Elizabeth S Middleton Survivors Trust | -- | -- | |

| Certain Declaration Of Trust | -- | -- | |

| Middleton John R | -- | None Available | |

| Middleton John | $620,000 | Fidelity National Title Ins | |

| Lemkin E Robert | $650,000 | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Middleton John | $617,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,532 | $989,986 | $636,673 | $353,313 |

| 2024 | $10,532 | $970,575 | $624,189 | $346,386 |

| 2023 | $10,282 | $951,545 | $611,950 | $339,595 |

| 2022 | $10,107 | $932,888 | $599,951 | $332,937 |

| 2021 | $9,913 | $914,597 | $588,188 | $326,409 |

| 2020 | $9,817 | $905,219 | $582,156 | $323,063 |

| 2019 | $9,617 | $887,470 | $570,741 | $316,729 |

| 2018 | $9,425 | $870,069 | $559,550 | $310,519 |

| 2017 | $9,258 | $853,009 | $548,578 | $304,431 |

| 2016 | $9,051 | $836,284 | $537,822 | $298,462 |

| 2015 | $8,963 | $823,723 | $529,744 | $293,979 |

| 2014 | $8,751 | $807,588 | $519,367 | $288,221 |

Source: Public Records

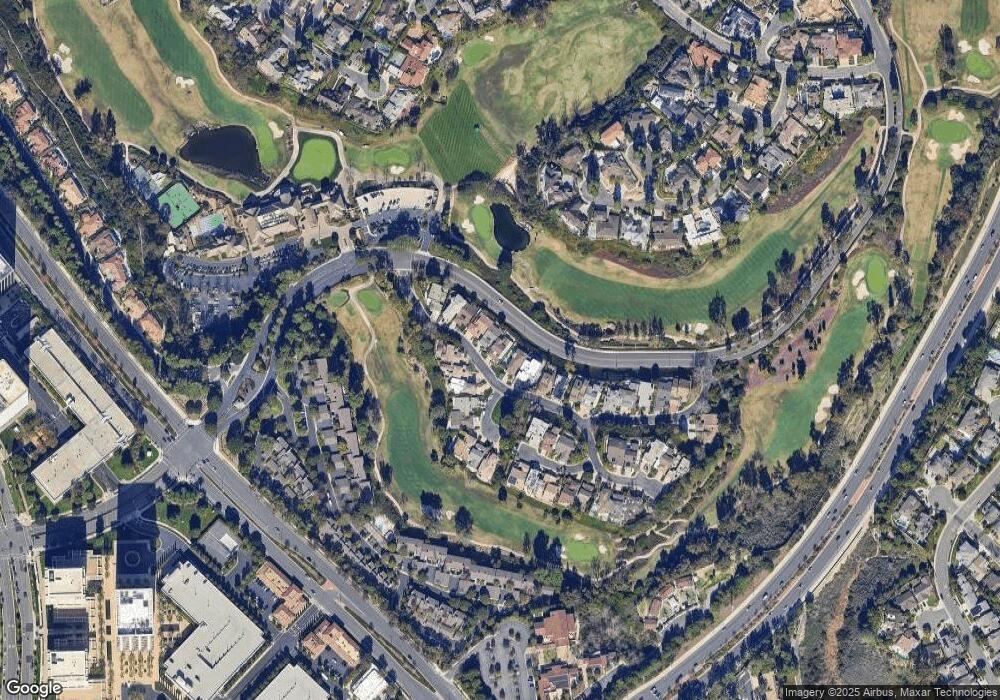

Map

Nearby Homes

- 18 Rue Grand Vallee

- 1 Rue du Parc

- 1 Cypress Point Ln

- 15 Cypress Point Ln

- 23 Lochmoor Ln

- 29 Augusta Ln

- 56 Royal Saint George Rd

- 38 Royal Saint George Rd

- 1808 Newport Hills Dr E

- 6 Harbor Pointe Dr

- 19 Harbor Pointe Dr

- 1935 Port Bishop Place

- 4 Summer House Ln

- 2 Royal Saint George Rd

- 5 Rue Marseille

- 51 Sea Pine Ln Unit 59

- 1963 Port Edward Place

- 14 Rue Chantilly

- 1700 Port Margate Place

- 49 Canyon Island Dr

- 10 Rue Grand Vallee

- 14 Rue Grand Vallee

- 8 Rue Grand Vallee

- 16 Rue Grand Vallee

- 9 Rue Grand Vallee

- 6 Rue Grand Vallee

- 5 Rue Fontaine

- 7 Rue Grand Vallee

- 7 Rue Fontaine

- 4 Rue Grand Vallee

- 20 Rue Grand Vallee

- 9 Rue Fontaine

- 2 Rue Grand Vallee

- 2 Rue du Parc

- 22 Rue Grand Vallee

- 11 Rue Fontaine

- 4 Rue du Parc

- 2 Rue Verte

- 15 Rue Fontaine

- 17 Rue Fontaine