120 Morgan Way Upland, CA 91786

Estimated Value: $740,000 - $784,000

3

Beds

2

Baths

1,682

Sq Ft

$452/Sq Ft

Est. Value

About This Home

This home is located at 120 Morgan Way, Upland, CA 91786 and is currently estimated at $760,690, approximately $452 per square foot. 120 Morgan Way is a home located in San Bernardino County with nearby schools including Citrus Elementary, Upland Junior High School, and Upland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 23, 1998

Sold by

Jacob Glenn

Bought by

Rodriguez Juanita Conriquez

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$148,674

Outstanding Balance

$27,583

Interest Rate

7.18%

Mortgage Type

FHA

Estimated Equity

$733,107

Purchase Details

Closed on

Jan 24, 1994

Sold by

Copp James R

Bought by

Jacob Glen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,620

Interest Rate

7%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 7, 1993

Sold by

Copp Rosaura

Bought by

Copp James R and Copp James R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$146,620

Interest Rate

7%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rodriguez Juanita Conriquez | $142,000 | Fidelity National Title | |

| Jacob Glen | $148,000 | Old Republic Title | |

| Copp James R | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rodriguez Juanita Conriquez | $148,674 | |

| Previous Owner | Jacob Glen | $146,620 | |

| Previous Owner | Copp James R | $32,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,538 | $224,968 | $56,281 | $168,687 |

| 2024 | $2,538 | $220,556 | $55,177 | $165,379 |

| 2023 | $2,498 | $216,231 | $54,095 | $162,136 |

| 2022 | $2,444 | $211,991 | $53,034 | $158,957 |

| 2021 | $2,438 | $207,834 | $51,994 | $155,840 |

| 2020 | $2,372 | $205,703 | $51,461 | $154,242 |

| 2019 | $2,365 | $201,670 | $50,452 | $151,218 |

| 2018 | $2,309 | $197,716 | $49,463 | $148,253 |

| 2017 | $2,243 | $193,839 | $48,493 | $145,346 |

| 2016 | $2,058 | $190,038 | $47,542 | $142,496 |

| 2015 | $2,011 | $187,184 | $46,828 | $140,356 |

| 2014 | $1,960 | $183,518 | $45,911 | $137,607 |

Source: Public Records

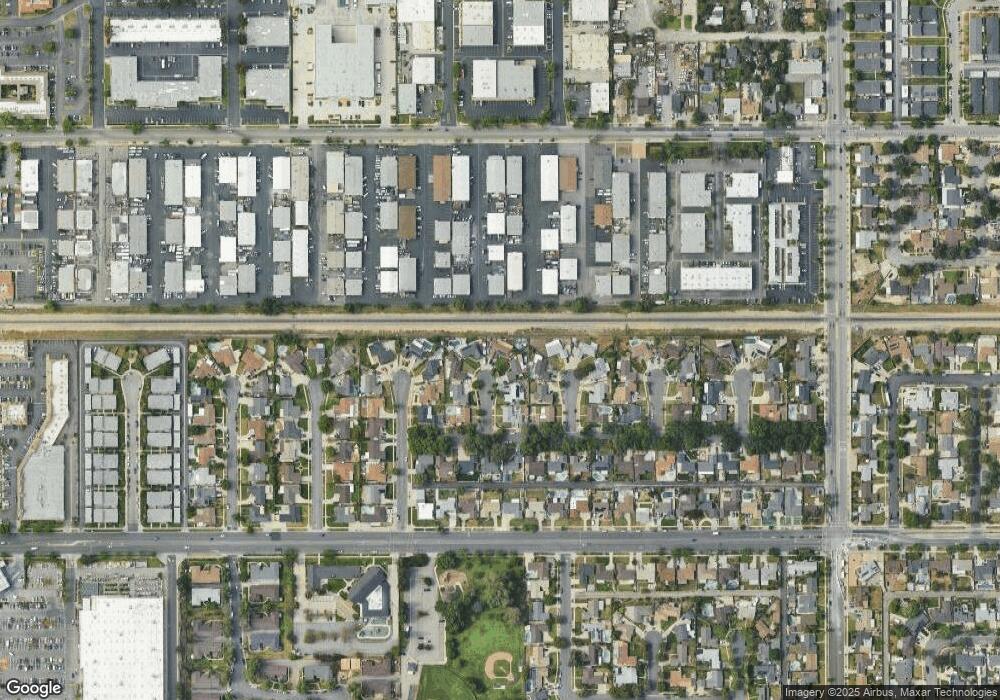

Map

Nearby Homes

- 537 W 9th St

- 435 W 9th St Unit A6

- 435 W 9th St Unit F5

- 435 W 9th St Unit B3

- 595 Juniper Ave

- 228 Greentree Rd

- 424 W 7th St

- 384 W 7th St

- 173 W 8th St

- 164 Euclid Place

- 681 Birch Ave

- 173 Elizabeth Ln

- 946 W La Deney Dr

- 321 Spencer Ave

- 125 Towns Ave

- 0 Bay St Unit AR25093919

- 340 W Caroline Ct

- 345 S Euclid Ave

- 1428 Fredericks Ln

- 1459 Fredericks Ln