120 Shorebird Cir Unit U39 Redwood City, CA 94065

Redwood Shores NeighborhoodEstimated Value: $707,116 - $999,000

1

Bed

1

Bath

823

Sq Ft

$996/Sq Ft

Est. Value

About This Home

This home is located at 120 Shorebird Cir Unit U39, Redwood City, CA 94065 and is currently estimated at $819,529, approximately $995 per square foot. 120 Shorebird Cir Unit U39 is a home located in San Mateo County with nearby schools including Ralston Intermediate School, Carlmont High School, and Design Tech High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 14, 2021

Sold by

Jamali Chehrzad

Bought by

Jamali Chehrzad

Current Estimated Value

Purchase Details

Closed on

Nov 4, 2004

Sold by

Noack Alfred F and Noach Doris F

Bought by

Jamali Chehrzad

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$336,800

Outstanding Balance

$169,081

Interest Rate

5.87%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$650,448

Purchase Details

Closed on

Oct 11, 1999

Sold by

Jensen Richard and Jensen Caroline

Bought by

Noack Alfred F and Noack Doris F

Purchase Details

Closed on

Nov 29, 1994

Sold by

Citibank Fsb

Bought by

Jensen Richard and Jensen Caroline

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,800

Interest Rate

6.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 20, 1994

Sold by

Citibank

Bought by

Citibank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jamali Chehrzad | -- | None Available | |

| Jamali Chehrzad | $421,500 | First American Title Co | |

| Noack Alfred F | $265,000 | First American Title Co | |

| Jensen Richard | $163,500 | First American Title Company | |

| Citibank | $142,375 | North American Title Insuran |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jamali Chehrzad | $336,800 | |

| Previous Owner | Jensen Richard | $130,800 | |

| Closed | Jamali Chehrzad | $84,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,604 | $587,518 | $176,250 | $411,268 |

| 2023 | $6,604 | $564,706 | $169,407 | $395,299 |

| 2022 | $6,267 | $553,635 | $166,086 | $387,549 |

| 2021 | $6,217 | $542,780 | $162,830 | $379,950 |

| 2020 | $6,153 | $537,216 | $161,161 | $376,055 |

| 2019 | $6,090 | $526,683 | $158,001 | $368,682 |

| 2018 | $5,978 | $516,356 | $154,903 | $361,453 |

| 2017 | $5,792 | $506,232 | $151,866 | $354,366 |

| 2016 | $5,652 | $496,307 | $148,889 | $347,418 |

| 2015 | $5,638 | $488,853 | $146,653 | $342,200 |

| 2014 | $5,420 | $479,278 | $143,781 | $335,497 |

Source: Public Records

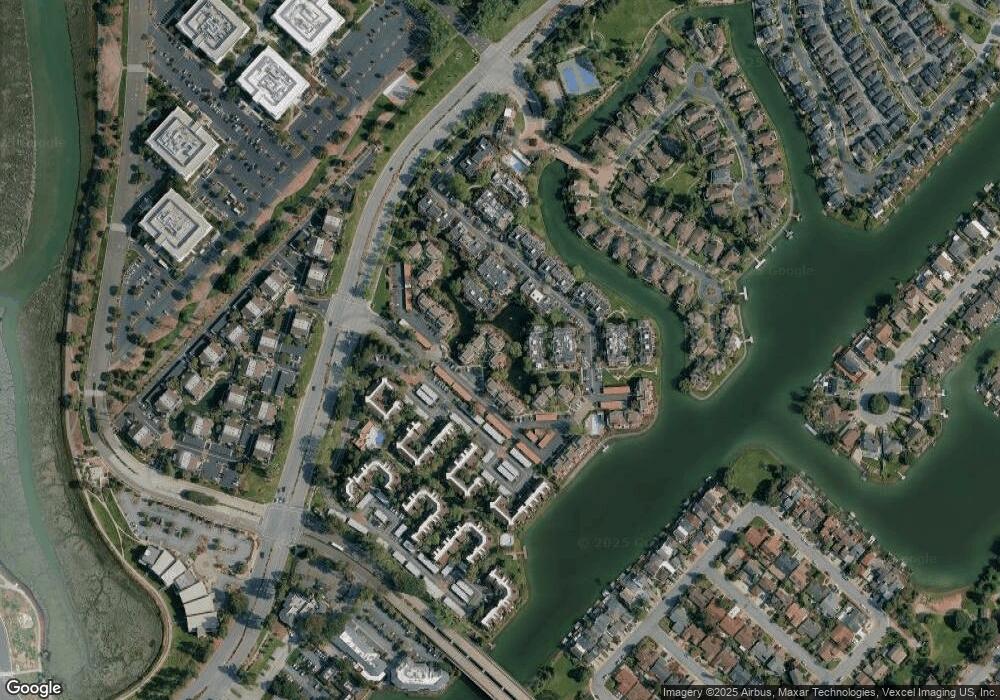

Map

Nearby Homes

- 223 Shorebird Cir

- 221 Shorebird Cir

- 69 Cove Ln

- 59 Cove Ln

- 203 Shorebird Cir

- 101 Shorebird Cir

- 24 Pelican Ln

- 588 Marlin Ct

- 756 Newport Cir

- 610 Marlin Ct

- 830 Portwalk Place

- 535 Lanyard Dr

- 26 Binnacle Ln

- 2309 Hastings Shore Ln

- 530 Barkentine Ln

- 2508 Hastings Shore Ln

- 816 Corriente Point Dr

- 2604 Hastings Shore Ln Unit G278

- 578 Seahorse Ln

- 856 Lakeshore Dr

- 119 Shorebird Cir Unit U37

- 121 Shorebird Cir

- 222 Shorebird Cir

- 117 Shorebird Cir

- 122 Shorebird Cir

- 116 Shorebird Cir

- 223 Shorebird Cir Unit 46

- 215 Shorebird Cir Unit U30

- 224 Shorebird Cir

- 110 Shorebird Cir Unit U19

- 113 Shorebird Cir

- 123 Shorebird Cir

- 110 Shorebird Cir

- 130 Shorebird Cir Unit U59

- 128 Shorebird Cir

- 127 Shorebird Cir

- 126 Shorebird Cir Unit U51

- 124 Shorebird Cir Unit U47

- 220 Shorebird Cir

- 219 Shorebird Cir