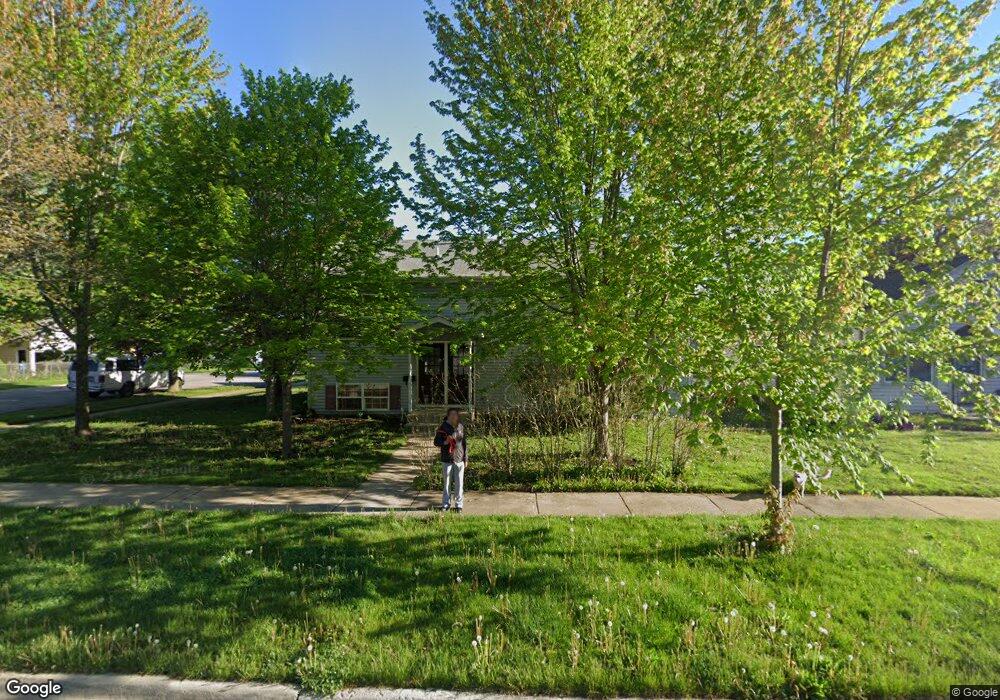

1202 Grove St Aurora, IL 60505

Light of the Community NeighborhoodEstimated Value: $304,000 - $371,000

5

Beds

3

Baths

2,184

Sq Ft

$154/Sq Ft

Est. Value

About This Home

This home is located at 1202 Grove St, Aurora, IL 60505 and is currently estimated at $336,652, approximately $154 per square foot. 1202 Grove St is a home located in Kane County with nearby schools including Oak Park Elementary School, Henry W Cowherd Middle School, and East Aurora High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 23, 2008

Sold by

Vargas Pedro

Bought by

Vargas Pedro and Vargas Ruben

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$207,000

Outstanding Balance

$135,986

Interest Rate

6.52%

Mortgage Type

New Conventional

Estimated Equity

$200,666

Purchase Details

Closed on

Aug 4, 2005

Sold by

Tovar Anastacio and Tovar Luz Maria

Bought by

Vargas Pedro

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,120

Interest Rate

7.5%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 2, 2003

Sold by

Arroyo Ruben

Bought by

Tovar Anastacio and Tovar Luz Maria

Purchase Details

Closed on

Aug 22, 2003

Sold by

Mendez Eduardo and Mendez Rita

Bought by

Arroyo Ruben

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vargas Pedro | -- | Carrington Title Corp | |

| Vargas Pedro | $199,000 | Chicago Title Insurance Comp | |

| Tovar Anastacio | $27,000 | Multiple | |

| Arroyo Ruben | $14,000 | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Vargas Pedro | $207,000 | |

| Previous Owner | Vargas Pedro | $159,120 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,962 | $109,554 | $8,015 | $101,539 |

| 2023 | $6,515 | $95,185 | $7,161 | $88,024 |

| 2022 | $6,109 | $86,409 | $6,534 | $79,875 |

| 2021 | $6,318 | $84,267 | $6,083 | $78,184 |

| 2020 | $6,010 | $78,271 | $5,650 | $72,621 |

| 2019 | $6,641 | $81,361 | $5,235 | $76,126 |

| 2018 | $6,080 | $72,772 | $4,842 | $67,930 |

| 2017 | $5,578 | $62,876 | $4,461 | $58,415 |

| 2016 | $5,133 | $54,775 | $3,824 | $50,951 |

| 2015 | -- | $49,259 | $3,288 | $45,971 |

| 2014 | -- | $47,236 | $3,022 | $44,214 |

| 2013 | -- | $54,543 | $2,888 | $51,655 |

Source: Public Records

Map

Nearby Homes

- 1038 Liberty St

- 1105 Indian Ave

- 257 Vermont Ave

- 226 N Ohio St

- 1311 Kane St

- 1147 Rural St Unit 41

- 131 N Kendall St

- 172 N East Ave

- 608 Front St

- 15 Hill Ave

- 409 Dayward Ct

- 1900 E New York St

- 574 E Galena Blvd

- 1671 Sheffer Rd

- 0000 N Farnsworth Ave

- 773 Aurora Ave

- 610 Four Seasons Blvd Unit A071

- 1653 Victoria Park Cir Unit A183

- 1825 Bluestem Cir

- 1009 Assell Ave