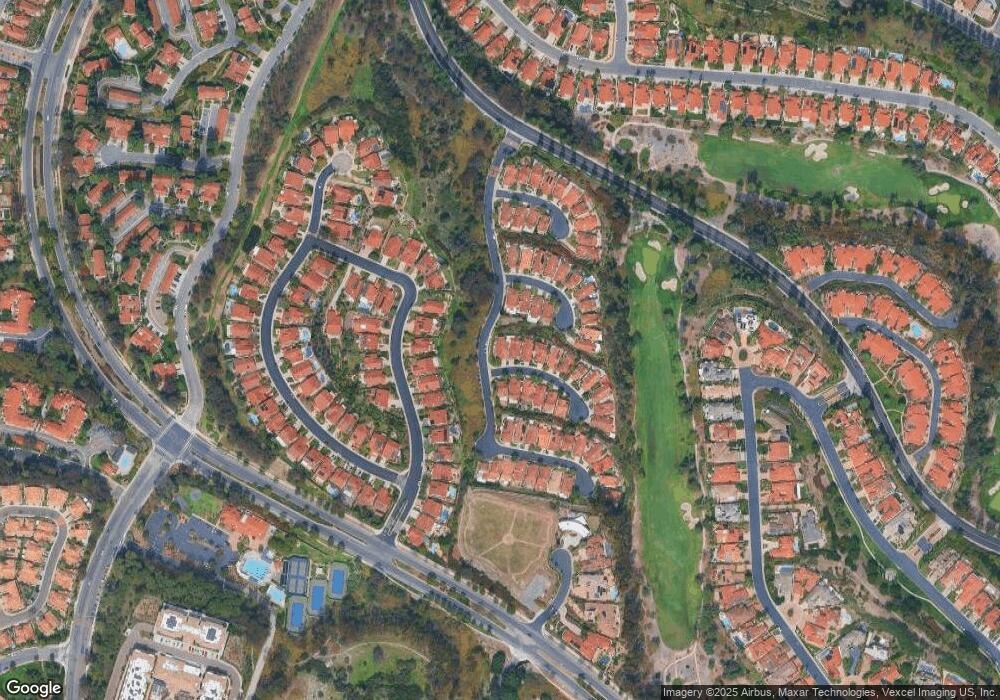

12106 Sand Trap Row San Diego, CA 92128

Rancho Bernardo NeighborhoodEstimated Value: $1,088,440 - $1,255,000

3

Beds

2

Baths

1,651

Sq Ft

$732/Sq Ft

Est. Value

About This Home

This home is located at 12106 Sand Trap Row, San Diego, CA 92128 and is currently estimated at $1,207,860, approximately $731 per square foot. 12106 Sand Trap Row is a home located in San Diego County with nearby schools including Highland Ranch Elementary School, Bernardo Heights Middle, and Rancho Bernardo High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2019

Sold by

Moehle Diane M and Claspill David F

Bought by

Claspill Diane F

Current Estimated Value

Purchase Details

Closed on

Sep 11, 2018

Sold by

Claspill Lois C and Moehle Diane M

Bought by

Claspill Lois C and Moehle Diane M

Purchase Details

Closed on

Jun 30, 2003

Sold by

Claspill Lois C

Bought by

George G & Lois C Claspill Family Trust

Purchase Details

Closed on

Feb 18, 2003

Sold by

Claspill Lois C

Bought by

George G & Lois C Claspill Family Trust

Purchase Details

Closed on

Oct 16, 2001

Sold by

Glancy Roberta and Hartnel Elizabeth Finlay

Bought by

Claspill George G and Claspill Lois C

Purchase Details

Closed on

Aug 16, 1996

Sold by

Finlay Catherine C

Bought by

Finlay Catherine C

Purchase Details

Closed on

Jul 18, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Claspill Diane F | -- | None Available | |

| Claspill Lois C | -- | None Available | |

| George G & Lois C Claspill Family Trust | -- | -- | |

| George G & Lois C Claspill Family Trust | -- | -- | |

| Claspill George G | $369,000 | California Title Company | |

| Finlay Catherine C | -- | -- | |

| -- | $165,900 | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,050 | $545,103 | $332,381 | $212,722 |

| 2024 | $6,050 | $534,415 | $325,864 | $208,551 |

| 2023 | $5,921 | $523,937 | $319,475 | $204,462 |

| 2022 | $5,822 | $513,664 | $313,211 | $200,453 |

| 2021 | $5,747 | $503,593 | $307,070 | $196,523 |

| 2020 | $5,669 | $498,430 | $303,922 | $194,508 |

| 2019 | $5,522 | $488,658 | $297,963 | $190,695 |

| 2018 | $5,289 | $479,077 | $292,121 | $186,956 |

| 2017 | $5,146 | $469,685 | $286,394 | $183,291 |

| 2016 | $5,038 | $460,477 | $280,779 | $179,698 |

| 2015 | $4,963 | $453,561 | $276,562 | $176,999 |

| 2014 | $4,921 | $444,677 | $271,145 | $173,532 |

Source: Public Records

Map

Nearby Homes

- 12115 Caddy Row

- 16205 Via Embeleso

- 12131 View Pointe Row

- 16396 Avenida Suavidad

- 12206 Fairway Pointe Row

- 12047 Avenida Consentido

- 12105 View Pointe Row

- 16244 Avenida Venusto Unit A

- 16232 Avenida Venusto Unit B

- 16464 Avenida Venusto Unit C

- 16430 Avenida Venusto Unit D

- 12257 Avenida Consentido

- 12093 Callado Rd

- 16096 Caminito Tomas

- 12195 San Tomas Place

- 11781 Caminito de Las Missiones

- 12085 Calle de Maria

- 12249 Horado Rd

- 16421 Ramada Dr

- 12132 Royal Birkdale Row Unit 303 E

- 12116 Sand Trap Row

- 12126 Sand Trap Row

- 12136 Sand Trap Row

- 12105 Sand Trap Row

- 12115 Sand Trap Row

- 12127 Putting Green Row

- 12107 Putting Green Row

- 12135 Sand Trap Row

- 12117 Putting Green Row

- 12146 Sand Trap Row

- 12137 Putting Green Row

- 12145 Sand Trap Row

- 12701 Putting Green Row

- 12155 Sand Trap Row

- 16279 Via Embeleso

- 16287 Via Embeleso

- 16271 Via Embeleso

- 12118 Iron View Row

- 16249 Via Embeleso

- 12166 Sand Trap Row