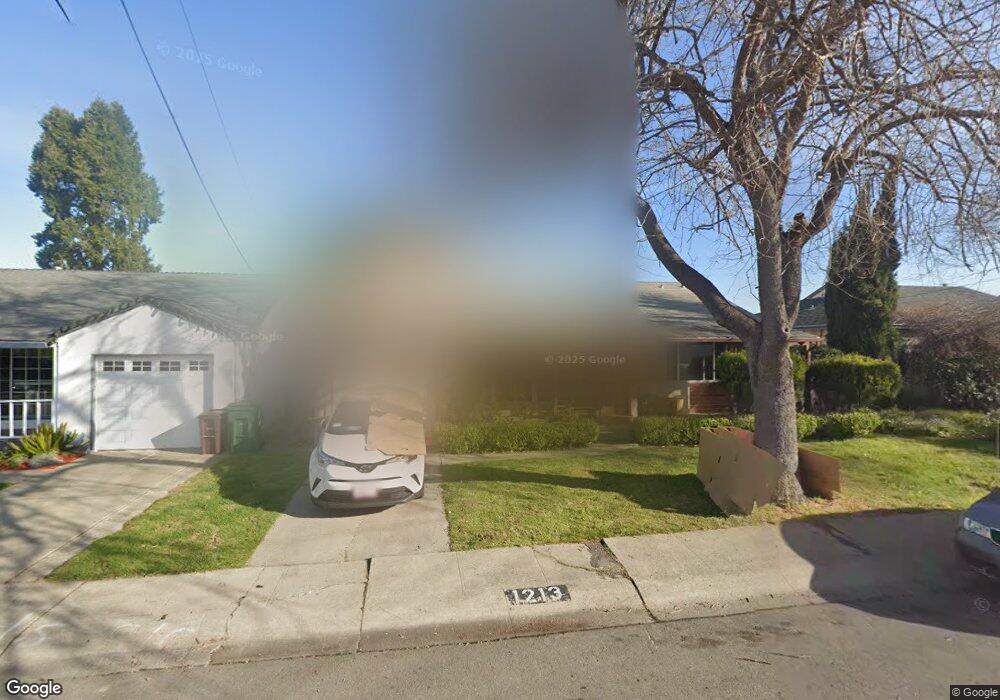

1213 Via Los Trancos San Lorenzo, CA 94580

Estimated Value: $933,000 - $996,000

4

Beds

2

Baths

2,018

Sq Ft

$475/Sq Ft

Est. Value

About This Home

This home is located at 1213 Via Los Trancos, San Lorenzo, CA 94580 and is currently estimated at $957,569, approximately $474 per square foot. 1213 Via Los Trancos is a home located in Alameda County with nearby schools including Del Rey Elementary School, Bohannon Middle School, and Arroyo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 8, 2019

Sold by

Wesley Natalie

Bought by

Li Po Lien and Zheng Yunchao

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$588,750

Outstanding Balance

$515,954

Interest Rate

3.73%

Mortgage Type

New Conventional

Estimated Equity

$441,615

Purchase Details

Closed on

Sep 9, 1999

Sold by

Moroney Ruth M

Bought by

Wesley Natalie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,395

Interest Rate

7.89%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 2, 1995

Sold by

Moroney Ruth M

Bought by

Moroney Ruth M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Li Po Lien | $785,000 | Chicago Title Company | |

| Wesley Natalie | $200,000 | Fidelity National Title Co | |

| Moroney Ruth M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Li Po Lien | $588,750 | |

| Previous Owner | Wesley Natalie | $197,395 | |

| Closed | Wesley Natalie | $10,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,786 | $858,498 | $257,549 | $600,949 |

| 2024 | $10,786 | $841,668 | $252,500 | $589,168 |

| 2023 | $10,720 | $825,167 | $247,550 | $577,617 |

| 2022 | $10,577 | $808,988 | $242,696 | $566,292 |

| 2021 | $10,297 | $793,131 | $237,939 | $555,192 |

| 2020 | $10,088 | $785,000 | $235,500 | $549,500 |

| 2019 | $6,041 | $443,691 | $82,666 | $361,025 |

| 2018 | $5,702 | $434,993 | $81,045 | $353,948 |

| 2017 | $5,442 | $426,465 | $79,456 | $347,009 |

| 2016 | $5,191 | $418,106 | $77,899 | $340,207 |

| 2015 | $5,077 | $411,827 | $76,729 | $335,098 |

| 2014 | $5,001 | $403,761 | $75,226 | $328,535 |

Source: Public Records

Map

Nearby Homes

- 18005 Sunol Rd

- 17354 Via el Cerrito

- 18003 Incline Place

- 1401 Via Coralla

- 18018 Sahara Rd

- 819 Bockman Rd

- 18251 Via Jose

- 17316 Via Flores

- 17347 Via Encinas

- 1311 Via Manzanas

- 17761 Via Arriba

- 1608 Keller Ave

- 1867 Via Buena Vista

- 19150 Hesperian Blvd Unit 19

- 1575 Via Lucas

- 769 Bartlett Ave

- 16050 Via Olinda

- 16011 Via Conejo

- 1766 Via Redondo

- 19665 Royal Ave

- 1207 Via Los Trancos

- 1219 Via Los Trancos

- 1201 Via Los Trancos

- 1184 Via Esperanza

- 1190 Via Esperanza

- 1178 Via Esperanza

- 1172 Via Esperanza

- 1196 Via Esperanza

- 1193 Via Los Trancos

- 1214 Via Los Trancos

- 17324 Via Alamitos

- 1208 Via Los Trancos

- 1220 Via Los Trancos

- 17316 Via Alamitos

- 1166 Via Esperanza

- 1202 Via Los Trancos

- 1232 Via Los Trancos

- 1187 Via Los Trancos

- 17308 Via Alamitos

- 17348 Via Alamitos