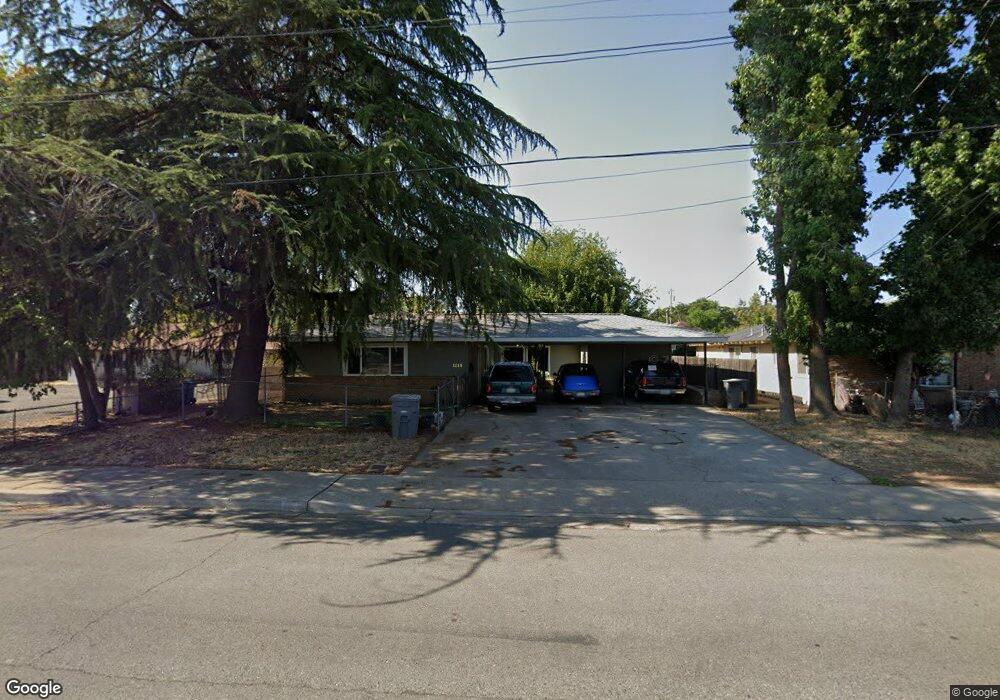

1218 Pomona Ave Oroville, CA 95965

Estimated Value: $180,000 - $471,000

7

Beds

3

Baths

2,988

Sq Ft

$102/Sq Ft

Est. Value

About This Home

This home is located at 1218 Pomona Ave, Oroville, CA 95965 and is currently estimated at $303,896, approximately $101 per square foot. 1218 Pomona Ave is a home located in Butte County with nearby schools including Oroville High School, Ipakanni Early College Charter School, and Come Back Butte Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 19, 2022

Sold by

Wood Richard and Wood Lee M

Bought by

Wood Family Trust

Current Estimated Value

Purchase Details

Closed on

Feb 26, 2002

Sold by

Kousa Paavo T and Kousa Anneli L

Bought by

Wood Richard and Wood Lee M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$93,000

Interest Rate

6.8%

Purchase Details

Closed on

Dec 22, 1997

Sold by

Mitchell Willie A

Bought by

Kousa Paavo T and Kousa Anneli L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,800

Interest Rate

7.22%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wood Family Trust | -- | -- | |

| Wood Richard | $116,500 | Mid Valley Title & Escrow Co | |

| Kousa Paavo T | $73,000 | Mid Valley Title & Escrow Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wood Richard | $93,000 | |

| Previous Owner | Kousa Paavo T | $72,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,485 | $172,712 | $29,533 | $143,179 |

| 2024 | $3,485 | $168,346 | $28,954 | $139,392 |

| 2023 | $3,566 | $166,046 | $28,387 | $137,659 |

| 2022 | $3,359 | $162,811 | $27,831 | $134,980 |

| 2021 | $3,264 | $159,639 | $27,286 | $132,353 |

| 2020 | $3,121 | $158,014 | $27,007 | $131,007 |

| 2019 | $3,093 | $154,936 | $26,478 | $128,458 |

| 2018 | $3,000 | $151,918 | $25,959 | $125,959 |

| 2017 | $2,945 | $148,959 | $25,450 | $123,509 |

| 2016 | $2,903 | $146,058 | $24,951 | $121,107 |

| 2015 | $2,780 | $143,880 | $24,577 | $119,303 |

| 2014 | $2,641 | $141,082 | $24,096 | $116,986 |

Source: Public Records

Map

Nearby Homes

- 1911 Veatch St

- 1502 Pomona Ave

- 1656 Pine St

- 916 High St

- 1281 Montgomery St

- 836 Pomona Ave

- 1132 Montgomery St

- 821 Robinson St

- 0 Bird St

- 868 Bird St

- 930 Montgomery St

- 1690 Lincoln St

- 680 Robinson St

- 720 Bird St

- 0 Feather River Blvd Unit SN25055813

- 0 Feather River Blvd Unit SN25214478

- 8 Cottonwood Cir

- 1616 Oro Dam Blvd E Unit 46

- 1616 Oro Dam Blvd E Unit 40

- 114 Cottonwood Cir

- 1238 Pomona Ave

- 0 Stone Mountain #2 Rd Unit PA18070196

- 1190 Pomona Ave

- 1260 Pomona Ave

- 1211 High St

- 1203 High St

- 1160 Pomona Ave

- 1241 High St

- 1270 Pomona Ave

- 1189 High St

- 1255 High St

- 1275 High St

- 1169 High St

- 0 Riverside Dr Unit CH17142106

- 1290 Pomona Ave

- 1291 High St

- 1635 3rd Ave

- 1306 Pomona Ave

- 1110 Pomona Ave

- 1565 2nd Ave