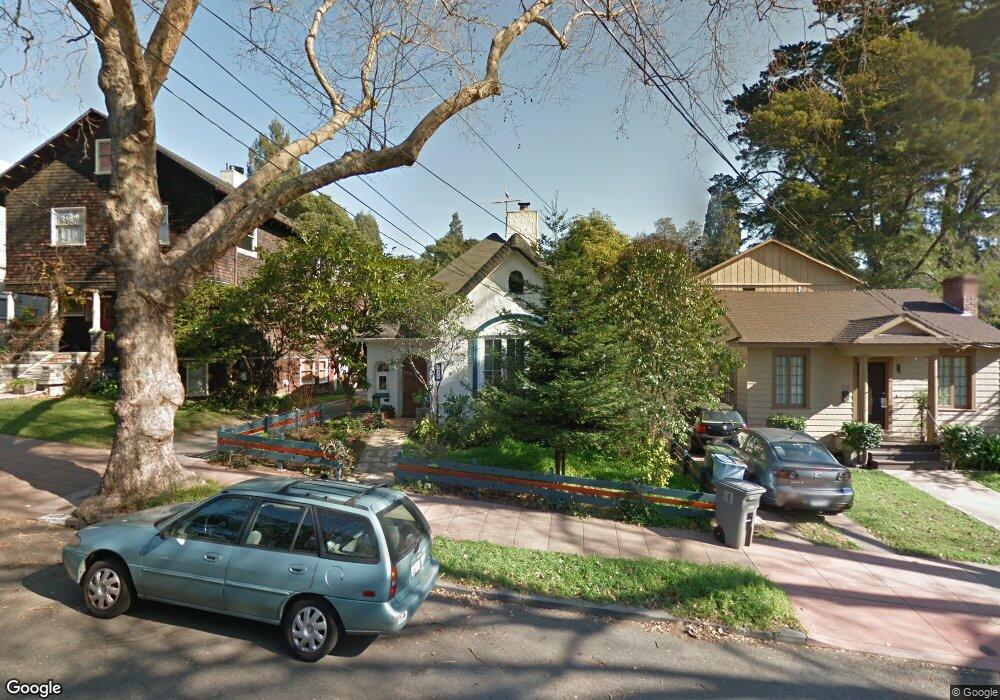

1219 Shattuck Ave Berkeley, CA 94709

North Berkeley NeighborhoodEstimated Value: $1,444,917 - $1,923,000

2

Beds

2

Baths

1,817

Sq Ft

$952/Sq Ft

Est. Value

About This Home

This home is located at 1219 Shattuck Ave, Berkeley, CA 94709 and is currently estimated at $1,729,229, approximately $951 per square foot. 1219 Shattuck Ave is a home located in Alameda County with nearby schools including Berkeley Arts Magnet at Whittier School, Cragmont Elementary School, and Washington Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 27, 2013

Sold by

Harte Carol

Bought by

Chipman Charles and Harte Carol E

Current Estimated Value

Purchase Details

Closed on

May 4, 1995

Sold by

Harte Carol

Bought by

Harte Carol

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chipman Charles | -- | None Available | |

| Harte Carol | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,353 | $105,584 | $49,278 | $63,306 |

| 2024 | $5,353 | $103,377 | $48,312 | $62,065 |

| 2023 | $5,156 | $108,213 | $47,365 | $60,848 |

| 2022 | $5,153 | $99,091 | $46,436 | $59,655 |

| 2021 | $5,116 | $97,011 | $45,526 | $58,485 |

| 2020 | $4,751 | $102,945 | $45,059 | $57,886 |

| 2019 | $4,441 | $100,926 | $44,175 | $56,751 |

| 2018 | $4,301 | $98,947 | $43,309 | $55,638 |

| 2017 | $4,120 | $97,007 | $42,460 | $54,547 |

| 2016 | $3,867 | $95,106 | $41,628 | $53,478 |

| 2015 | $3,781 | $93,677 | $41,002 | $52,675 |

| 2014 | $3,642 | $91,842 | $40,199 | $51,643 |

Source: Public Records

Map

Nearby Homes

- 1149 Amador Ave

- 1124 Walnut St

- 1141 Oxford St

- 1300 Martin Luther King Junior Way

- 1850 Berryman St

- 1444 Walnut St

- 1130 Oxford St

- 1512 Walnut St

- 971 Santa Barbara Rd

- 1175 Colusa Ave

- 1609 Bonita Ave Unit 3

- 1609 Bonita Ave Unit 5

- 1136 Keith Ave

- 1682 Oxford St

- 826 Indian Rock Ave

- 1668 Arch St

- 2201 Virginia St Unit 2

- 2201 Virginia St Unit 3

- 1614 Posen Ave

- 1642 Milvia St Unit 2

- 1215 Shattuck Ave

- 1221 Shattuck Ave

- 1209 Shattuck Ave

- 1203 Shattuck Ave

- 1214 Walnut St

- 1212 Walnut St

- 1230 Walnut St

- 2112 Eunice St

- 1201 Shattuck Ave

- 2108 Eunice St

- 1208 Walnut St

- 1210 Shattuck Ave

- 1208 Shattuck Ave

- 1204 Walnut St

- 1212 Shattuck Ave

- 1200 Shattuck Ave

- 2120 Eunice St

- 2044 Eunice St

- 1218 Shattuck Ave

- 1222 Shattuck Ave