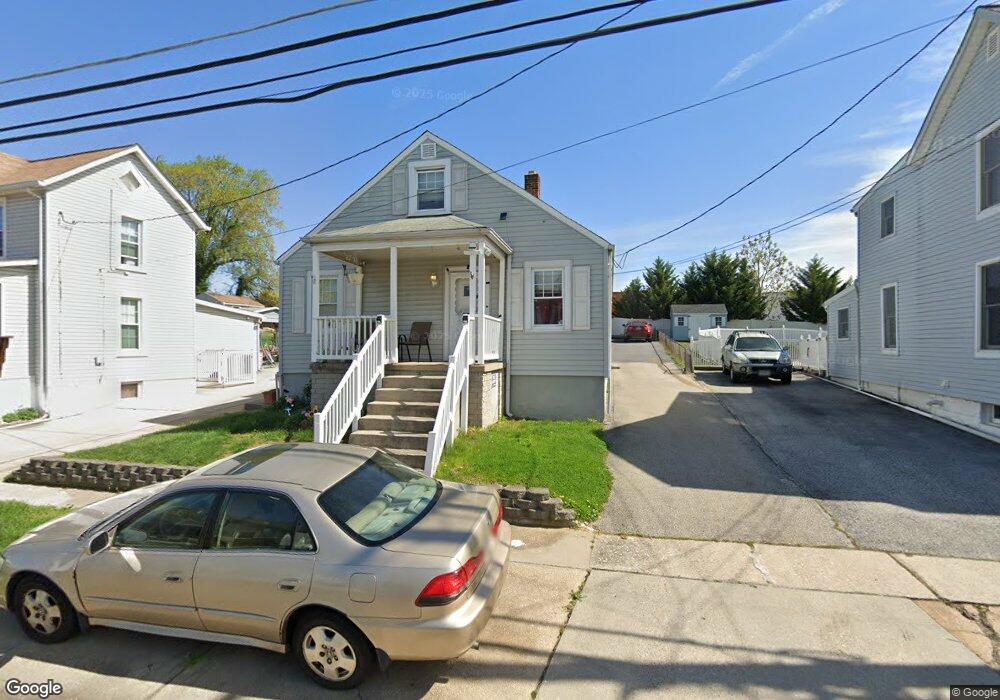

1221 64th St Rosedale, MD 21237

Estimated Value: $275,000 - $319,000

--

Bed

1

Bath

1,326

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 1221 64th St, Rosedale, MD 21237 and is currently estimated at $300,188, approximately $226 per square foot. 1221 64th St is a home located in Baltimore County with nearby schools including Elmwood Elementary School, Golden Ring Middle School, and Overlea High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 20, 2007

Sold by

Kight Mark Douglas

Bought by

Melendez Gaston

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,415

Outstanding Balance

$157,528

Interest Rate

6.19%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$142,660

Purchase Details

Closed on

May 31, 2007

Sold by

Kight Mark Douglas

Bought by

Melendez Gaston

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,415

Outstanding Balance

$157,528

Interest Rate

6.19%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$142,660

Purchase Details

Closed on

Jun 2, 2003

Sold by

Kight William J

Bought by

Kight Mark Douglas

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Melendez Gaston | $190,000 | -- | |

| Melendez Gaston | $190,000 | -- | |

| Kight Mark Douglas | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Melendez Gaston | $195,415 | |

| Closed | Melendez Gaston | $195,415 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,828 | $222,967 | -- | -- |

| 2024 | $3,828 | $203,233 | $0 | $0 |

| 2023 | $2,077 | $183,500 | $60,700 | $122,800 |

| 2022 | $3,765 | $179,000 | $0 | $0 |

| 2021 | $2,988 | $174,500 | $0 | $0 |

| 2020 | $2,988 | $170,000 | $60,700 | $109,300 |

| 2019 | $2,744 | $166,367 | $0 | $0 |

| 2018 | $2,600 | $162,733 | $0 | $0 |

| 2017 | $2,439 | $159,100 | $0 | $0 |

| 2016 | $2,468 | $159,100 | $0 | $0 |

| 2015 | $2,468 | $159,100 | $0 | $0 |

| 2014 | $2,468 | $161,000 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 2000 Longview Ct

- 7853 Oakdale Ave

- 2308 Hamiltowne Cir

- 5502 Sinclair Greens Dr

- 2316 Hamiltowne Cir

- 7747 Eastdale Rd

- 1127 Chesaco Ave

- 5013 Schaub Ave

- 2354 Hamiltowne Cir

- 1059 Bunbury Way

- 7339 Conley St

- 5900 Hamilton Ave

- 8102 Sumter Ave

- 7309 Bridgewood Dr

- 8003 Woodhaven Rd

- 5218 Darien Rd

- 7273 Bridgewood Dr

- 1109 Quantril Way

- 5900 Laclede Rd

- 1015 Sumter Ave