1222 S Westlake Blvd Unit I Westlake Village, CA 91361

Estimated Value: $914,000 - $969,000

3

Beds

3

Baths

1,936

Sq Ft

$488/Sq Ft

Est. Value

About This Home

This home is located at 1222 S Westlake Blvd Unit I, Westlake Village, CA 91361 and is currently estimated at $945,055, approximately $488 per square foot. 1222 S Westlake Blvd Unit I is a home located in Ventura County with nearby schools including Westlake Elementary School, Colina Middle School, and Westlake High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2010

Sold by

Medina Jose and Medina Georgina

Bought by

Holzner Peter and Takacs Ildiko

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$290,000

Outstanding Balance

$192,575

Interest Rate

4.94%

Mortgage Type

New Conventional

Estimated Equity

$752,480

Purchase Details

Closed on

May 10, 2006

Sold by

Gootsan Greg G and Gootsan Rebekah C

Bought by

Medina Jose and Medina Georgina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$536,000

Interest Rate

6.5%

Mortgage Type

Negative Amortization

Purchase Details

Closed on

Feb 23, 2005

Sold by

Gootsan Rebekah C

Bought by

Gootsan Greg G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$367,000

Interest Rate

5.66%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 20, 2002

Sold by

Heirshberg Gregory Martin

Bought by

Heiershberg Gregory Martin and Heirshberg Deborah

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,500

Interest Rate

8.99%

Purchase Details

Closed on

Dec 11, 2002

Sold by

Heirshberg Gregory Martin and Heirsberg Deborah

Bought by

Gootsan Greg G and Gootsan Rebekah C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$332,500

Interest Rate

8.99%

Purchase Details

Closed on

Jan 29, 1998

Sold by

Honma Steven R and Honma Christine J

Bought by

Heirshberg Gregory Martin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$142,000

Interest Rate

6.97%

Purchase Details

Closed on

Jul 29, 1997

Sold by

Honma Steven R and Honma Christine J

Bought by

Honma Steven R and Honma Christine J

Purchase Details

Closed on

Aug 30, 1994

Sold by

Moore Michael A and Moore Victoria A

Bought by

Honma Steven R and Honma Christine J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,300

Interest Rate

5.25%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Holzner Peter | $390,000 | Consumers Title Company | |

| Medina Jose | $675,000 | Equity Title Company | |

| Gootsan Greg G | -- | Financial Title Company | |

| Heiershberg Gregory Martin | -- | Fidelity National Title Co | |

| Gootsan Greg G | $350,000 | Fidelity National Title Co | |

| Heirshberg Gregory Martin | $177,500 | Fidelity National Title | |

| Honma Steven R | -- | -- | |

| Honma Steven R | $173,000 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Holzner Peter | $290,000 | |

| Previous Owner | Medina Jose | $536,000 | |

| Previous Owner | Gootsan Greg G | $367,000 | |

| Previous Owner | Gootsan Greg G | $332,500 | |

| Previous Owner | Heirshberg Gregory Martin | $142,000 | |

| Previous Owner | Honma Steven R | $164,300 | |

| Closed | Gootsan Greg G | $18,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,814 | $503,403 | $251,703 | $251,700 |

| 2024 | $6,814 | $493,533 | $246,768 | $246,765 |

| 2023 | $6,588 | $483,856 | $241,929 | $241,927 |

| 2022 | $6,324 | $474,369 | $237,185 | $237,184 |

| 2021 | $6,084 | $465,068 | $232,534 | $232,534 |

| 2020 | $5,889 | $460,300 | $230,150 | $230,150 |

| 2019 | $5,646 | $451,276 | $225,638 | $225,638 |

| 2018 | $5,485 | $442,428 | $221,214 | $221,214 |

| 2017 | $5,335 | $433,754 | $216,877 | $216,877 |

| 2016 | $5,251 | $425,250 | $212,625 | $212,625 |

| 2015 | $5,132 | $418,864 | $209,432 | $209,432 |

| 2014 | $5,032 | $410,662 | $205,331 | $205,331 |

Source: Public Records

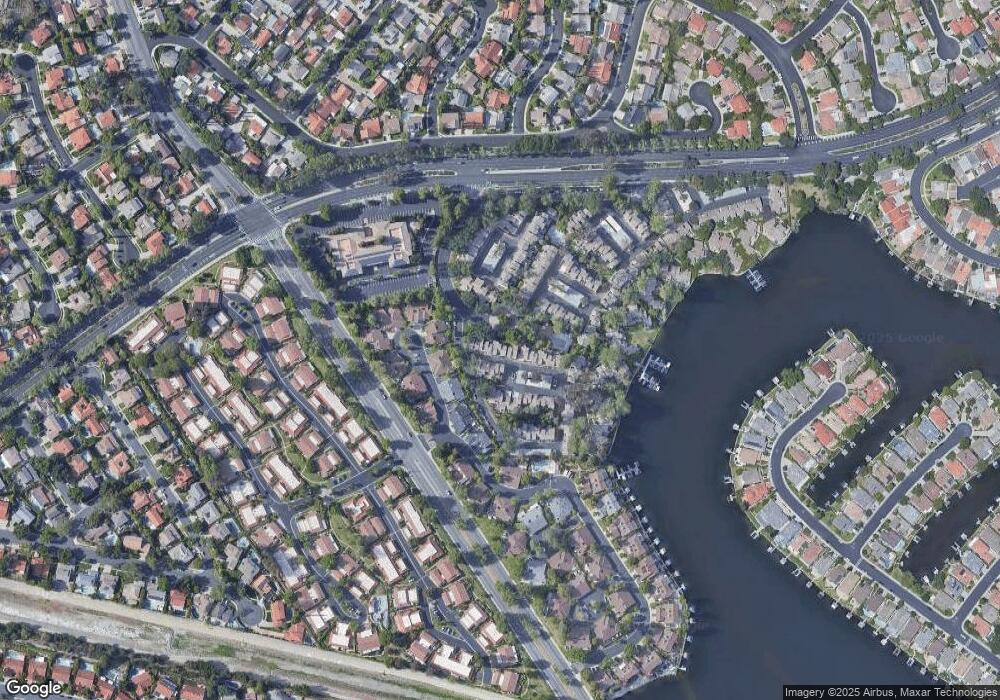

Map

Nearby Homes

- 1218 S Westlake Blvd Unit A

- 1176 S Westlake Blvd

- 1228 S Westlake Blvd Unit B

- 1174 S Westlake Blvd Unit C

- 1206 S Westlake Blvd Unit D

- 1206 S Westlake Blvd Unit E

- 2255 Portola Ln

- 1248 Clippers Cir Unit 51

- 1275 Westwind Cir

- 2271 Westshore Ln

- 2270 Portola Ln

- 1321 Bluesail Cir

- 1161 Triunfo Canyon Rd

- 1042 Barrow Ct

- 1023 Barrow Ct

- 2546 Oakshore Dr

- 2567 Oakshore Dr

- 1127 Glenbridge Cir

- 1222 S Westlake Blvd Unit F

- 1222 S Westlake Blvd Unit E

- 1222 S Westlake Blvd

- 1222 S Westlake Blvd

- 1222 S Westlake Blvd Unit 2

- 1222 S Westlake Blvd Unit J

- 1222 S Westlake Blvd Unit H

- 1222 S Westlake Blvd Unit 129

- 1222 S Westlake Blvd Unit F

- 1222 S Westlake Blvd Unit D

- 1222 S Westlake Blvd Unit C

- 1220 S Westlake Blvd Unit B

- 1220 S Westlake Blvd Unit C

- 1220 S Westlake Blvd

- 1220 S Westlake Blvd Unit A

- 1210 S Westlake Blvd

- 1210 S Westlake Blvd Unit A

- 1210 S Westlake Blvd Unit D

- 1210 S Westlake Blvd

- 1212 S Westlake Blvd Unit D