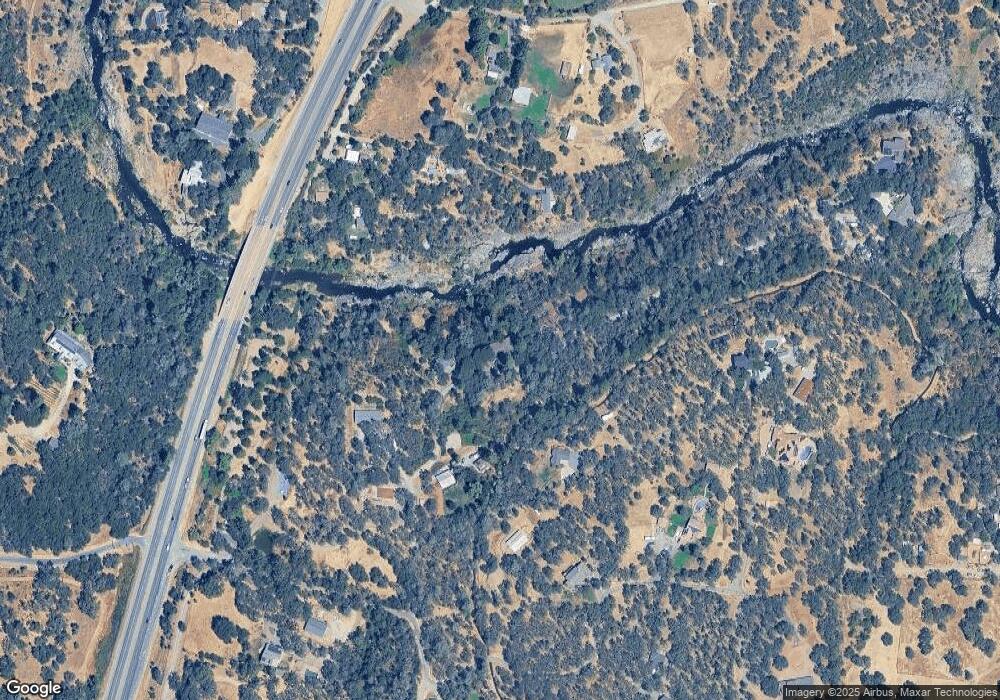

12335 Rio Oso Rd Auburn, CA 95602

Estimated Value: $341,000 - $579,000

3

Beds

2

Baths

1,056

Sq Ft

$435/Sq Ft

Est. Value

About This Home

This home is located at 12335 Rio Oso Rd, Auburn, CA 95602 and is currently estimated at $459,278, approximately $434 per square foot. 12335 Rio Oso Rd is a home located in Placer County with nearby schools including Placer High School, Cornerstone Christian Schools, and Taylor Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 27, 2014

Sold by

Deortega Marcelina Murguia

Bought by

Suarez Alberto O

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$131,000

Interest Rate

4.32%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 25, 2004

Sold by

Ortega Marcelina

Bought by

Suarez Alberto O

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$264,400

Outstanding Balance

$127,617

Interest Rate

5.92%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$331,661

Purchase Details

Closed on

Mar 31, 1995

Sold by

Mccaffrey John and Mccaffrey Virginia

Bought by

Mccaffrey John J and Mccaffrey Virginia S

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Suarez Alberto O | -- | Placer Title Company | |

| Suarez Alberto O | -- | Chicago Title | |

| Suarez Alberto O | $339,000 | Chicago Title | |

| Mccaffrey John J | -- | -- | |

| Mccaffrey John J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Suarez Alberto O | $131,000 | |

| Open | Suarez Alberto O | $264,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,574 | $339,789 | $156,388 | $183,401 |

| 2023 | $3,574 | $326,596 | $150,316 | $176,280 |

| 2022 | $3,520 | $320,193 | $147,369 | $172,824 |

| 2021 | $3,395 | $313,916 | $144,480 | $169,436 |

| 2020 | $3,205 | $295,000 | $135,800 | $159,200 |

| 2019 | $3,213 | $295,469 | $136,000 | $159,469 |

| 2018 | $2,953 | $281,000 | $129,300 | $151,700 |

| 2017 | $2,835 | $269,000 | $123,800 | $145,200 |

| 2016 | $2,574 | $244,000 | $112,300 | $131,700 |

| 2015 | $2,459 | $235,000 | $108,200 | $126,800 |

| 2014 | $2,337 | $222,000 | $102,200 | $119,800 |

Source: Public Records

Map

Nearby Homes

- 6715 Grass Valley Hwy

- 13399 Bell Brook Dr

- 22495 Hidden Ranch Rd

- 14580 Mcelroy Rd

- 6890 Country Side Ln

- 0 Mcelroy Rd Unit 225065625

- 4 La Dolce Vita

- 24316 Timber Ridge Dr

- 23427 Macy Place

- 24640 Scooter Bug Ln

- 0 Fawnridge Rd

- 4765 Garden Ct

- 3375 Sugar View Rd

- 25407 Table Meadow Rd

- 24550 Rodeo Flat Rd

- 9825 Spyglass Cir

- 0 Unit 225070524

- 1 Joeger Rd

- 6200 Viewridge Dr

- 6262 View Ridge Dr

- 12315 Rio Oso Rd

- 25081 State Highway 49

- 12250 Rio Oso Rd

- 12285 Rio Oso Rd

- 12270 Rio Oso Rd

- 25093 California 49

- 25087 State Highway 49

- 25069 State Highway 49

- 25099 State Highway 49

- 6850 Grass Valley Hwy

- 25039 State Highway 49

- 12240 Rio Oso Rd

- 12555 Big Sky Place

- 12777 Big Sky Place

- 10069 Linnet Ln

- 10075 Linnet Ln

- 10077 Linnet Ln

- 12999 Big Sky Place

- 0 Big Sky Place

- 25090 California 49