12397 Rock Springs Ct Unit 109 Garden Grove, CA 92843

Estimated Value: $456,000 - $497,000

2

Beds

1

Bath

873

Sq Ft

$548/Sq Ft

Est. Value

About This Home

This home is located at 12397 Rock Springs Ct Unit 109, Garden Grove, CA 92843 and is currently estimated at $478,100, approximately $547 per square foot. 12397 Rock Springs Ct Unit 109 is a home located in Orange County with nearby schools including Clinton Elementary School, Doig Intermediate School, and Santiago High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 11, 2006

Sold by

Magdaleno Gerardo Licea and Licea Maria

Bought by

Magdaleno Gerardo Licea and Licea Maria

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$11,000

Interest Rate

6.56%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 24, 1997

Sold by

Federal Home Loan Mortgage Corporation

Bought by

Licea Gerardo and Licea Maria

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,200

Outstanding Balance

$9,150

Interest Rate

7.63%

Mortgage Type

FHA

Estimated Equity

$468,950

Purchase Details

Closed on

Dec 4, 1996

Sold by

Rafael Moreno and Rafael Maria Rosa

Bought by

American Svgs Bank Fa and American Svgs Bank

Purchase Details

Closed on

Dec 3, 1996

Sold by

American Svgs Bank Fa

Bought by

Federal National Mortgage Association

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Magdaleno Gerardo Licea | -- | First American Title Co | |

| Licea Gerardo | $78,000 | Fidelity National Title Ins | |

| American Svgs Bank Fa | $53,000 | Old Republic Title Company | |

| Federal National Mortgage Association | -- | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Magdaleno Gerardo Licea | $11,000 | |

| Open | Licea Gerardo | $76,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,905 | $127,025 | $14,515 | $112,510 |

| 2024 | $1,905 | $124,535 | $14,231 | $110,304 |

| 2023 | $1,866 | $122,094 | $13,952 | $108,142 |

| 2022 | $1,823 | $119,700 | $13,678 | $106,022 |

| 2021 | $1,798 | $117,353 | $13,409 | $103,944 |

| 2020 | $1,777 | $116,150 | $13,271 | $102,879 |

| 2019 | $1,757 | $113,873 | $13,011 | $100,862 |

| 2018 | $1,718 | $111,641 | $12,756 | $98,885 |

| 2017 | $1,700 | $109,452 | $12,505 | $96,947 |

| 2016 | $1,626 | $107,306 | $12,259 | $95,047 |

| 2015 | $1,605 | $105,695 | $12,075 | $93,620 |

| 2014 | $1,569 | $103,625 | $11,838 | $91,787 |

Source: Public Records

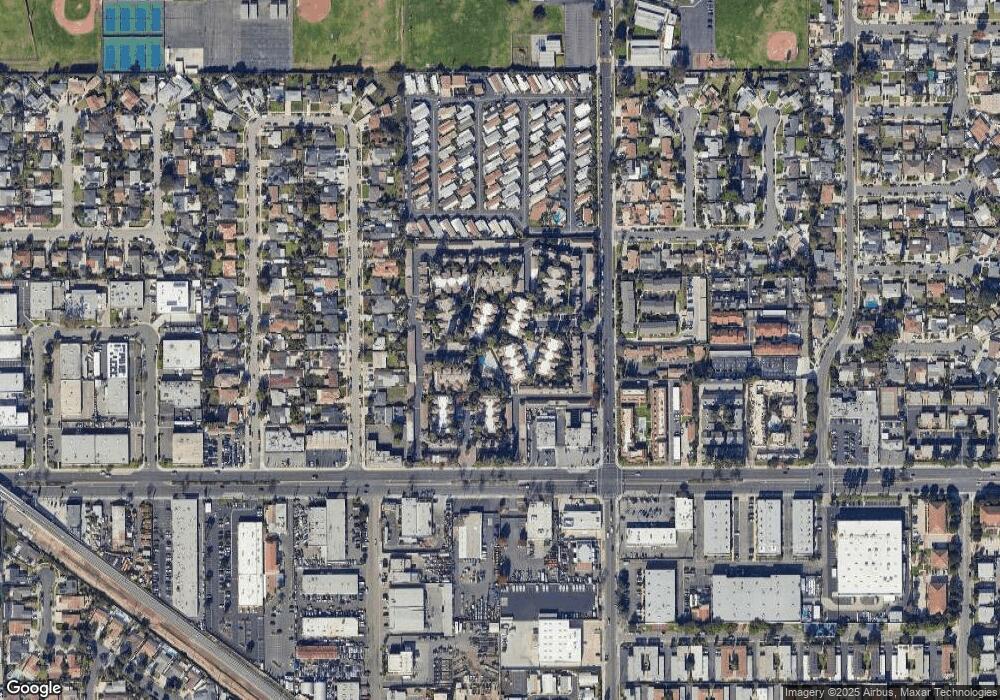

Map

Nearby Homes

- 12386 Rock Springs Ct Unit 52

- 12437 Bay Hill Ct Unit 182

- 12512 Tours Ave

- 3424 W Washington Ave Unit 309

- 3424 W Washington Ave Unit 228

- 12621 Morningside Ave

- 230 Green Dr

- 1423 Mar Les W

- 12152 Trask Ave Unit 29

- 2633 Monte Carlo Dr Unit 41

- 14300 Clinton St Unit 61

- 14300 Clinton St Unit 96

- 1314 N Bewley St

- 12681 Trask Ave

- 1806 N Fairview St Unit J

- 1416 N Harbor Blvd Unit 6

- 13431 Lilly St

- 932 Fair Way

- 1340 Fair Way

- 702 N Gunther St

- 12395 Rock Springs Ct

- 12393 Rock Springs Ct

- 12391 Rock Springs Ct

- 12401 Rock Springs Ct

- 12399 Rock Springs Ct Unit 104

- 12377 Rock Springs Ct Unit 1

- 12377 Rock Springs Ct

- 12375 Rock Springs Ct

- 12381 Rock Springs Ct Unit C

- 12381 Rock Springs Ct

- 12379 Rock Springs Ct Unit 110

- 12371 Rock Springs Ct

- 12389 Rock Springs Ct

- 12387 Rock Springs Ct

- 12405 Rock Springs Ct Unit 137

- 12385 Rock Springs Ct

- 12383 Rock Springs Ct Unit 114

- 12413 Rock Springs Ct

- 12398 Woodbridge Dr

- 12394 Woodbridge Dr