12409 Mills St Unit 34 Groveland, CA 95321

Estimated Value: $305,000 - $335,302

3

Beds

2

Baths

1,248

Sq Ft

$256/Sq Ft

Est. Value

About This Home

This home is located at 12409 Mills St Unit 34, Groveland, CA 95321 and is currently estimated at $319,076, approximately $255 per square foot. 12409 Mills St Unit 34 is a home located in Tuolumne County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 1, 2020

Sold by

Welch Gary Allan and Welch Linda Diann

Bought by

Manzano Edgar

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$196,500

Outstanding Balance

$174,243

Interest Rate

3.1%

Mortgage Type

New Conventional

Estimated Equity

$144,833

Purchase Details

Closed on

Mar 6, 2012

Sold by

Citimortgage Inc

Bought by

Welch Gary Allan and Welch Linda Diann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,500

Interest Rate

3.84%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 1, 2011

Sold by

Ilovar Valdi and Ilovar Elizabeth

Bought by

Citimortgage Inc

Purchase Details

Closed on

Jul 9, 2007

Sold by

Ilovar Valdi and Ilovar Elizabeth

Bought by

Ilovar Valdi M and Ilovar Elizabeth R

Purchase Details

Closed on

Jul 12, 2004

Sold by

Constantini Anthony T and Constantini Giovanna

Bought by

Kuhn Paul F and Kuhn Judith A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,400

Interest Rate

6.27%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Manzano Edgar | $218,500 | First American Title Company | |

| Welch Gary Allan | $123,500 | None Available | |

| Citimortgage Inc | $218,868 | Cr Title Services Inc | |

| Ilovar Valdi M | -- | None Available | |

| Kuhn Paul F | $216,000 | Yosemite Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Manzano Edgar | $196,500 | |

| Previous Owner | Welch Gary Allan | $110,500 | |

| Previous Owner | Kuhn Paul F | $194,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,633 | $236,509 | $37,884 | $198,625 |

| 2024 | $2,633 | $231,873 | $37,142 | $194,731 |

| 2023 | $2,576 | $227,327 | $36,414 | $190,913 |

| 2022 | $2,528 | $222,870 | $35,700 | $187,170 |

| 2021 | $2,493 | $218,500 | $35,000 | $183,500 |

| 2020 | $1,640 | $141,833 | $28,708 | $113,125 |

| 2019 | $1,593 | $139,053 | $28,146 | $110,907 |

| 2018 | $1,558 | $136,328 | $27,595 | $108,733 |

| 2017 | $1,519 | $133,655 | $27,054 | $106,601 |

| 2016 | $1,483 | $131,035 | $26,524 | $104,511 |

| 2015 | $1,464 | $129,068 | $26,126 | $102,942 |

| 2014 | $1,432 | $126,541 | $25,615 | $100,926 |

Source: Public Records

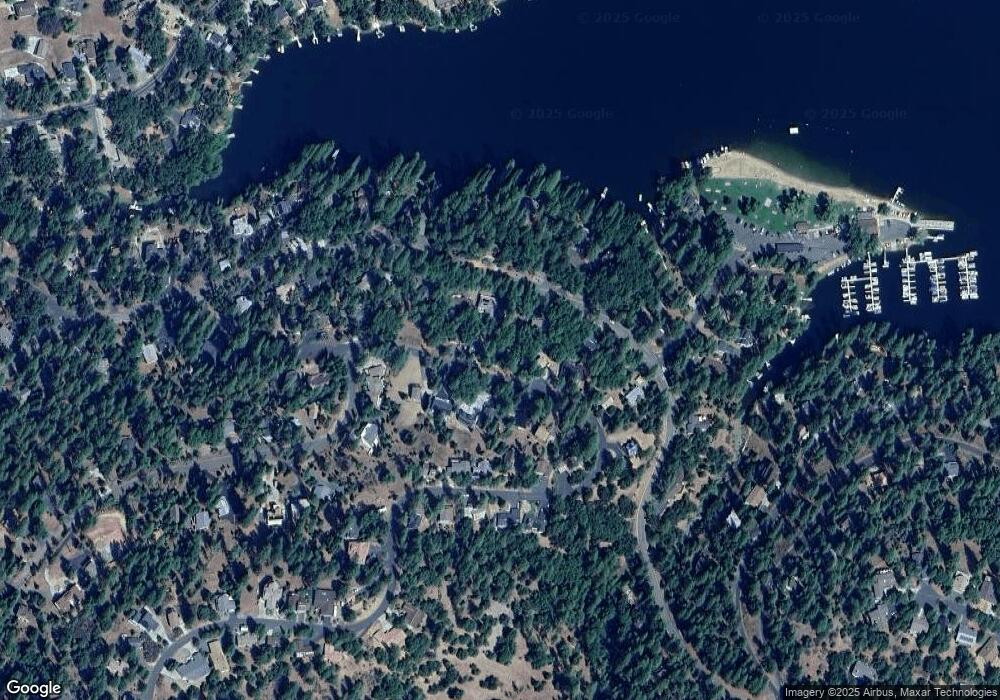

Map

Nearby Homes

- 19779 Pine Mountain Dr

- 0 Pine Mountain Dr Unit SW25250311

- 19709 Pine Mountain Dr

- 19824 Pine Mountain Dr

- 12435 Cassaretto Ct

- 20029 Upper Skyridge Dr Unit 15

- 19673 Jonny Degnan Ct

- 12295 Sunnyside Way

- 19513 Grizzly Cir

- 19710 Butler Way

- 12309 Shooting Star Ct

- 12080 Breckenridge Rd

- 19574 Butler Way

- 12780 Mount Jefferson St

- 12064 Hillhurst Cir

- 19501 Chaffee Cir

- 19935 Pine Mountain Dr

- 20059 Pleasantview Dr

- 12409 Mills St

- 12415 Mills St Unit 33

- 12415 Mills St

- 12401 Mills St

- 19759 Pine Mountain Dr Unit 470

- 19759 Pine Mountain Dr

- 19749 Pine Mountain Dr Unit 471

- 19749 Pine Mountain Dr

- 19769 Pine Mountain Dr

- 12414 Mills St Unit 8-44

- 12414 Mills St

- 19739 Pine Mountain Dr

- 19779 Pine Mountain Dr Unit 468

- 12402 Mills St

- 12420 Mills St

- 12396 Mills St

- 12429 Mills St

- 19729 Pine Mountain Dr Unit 473

- 19729 Pine Mountain Dr

- 19754 Pine Mountain Dr