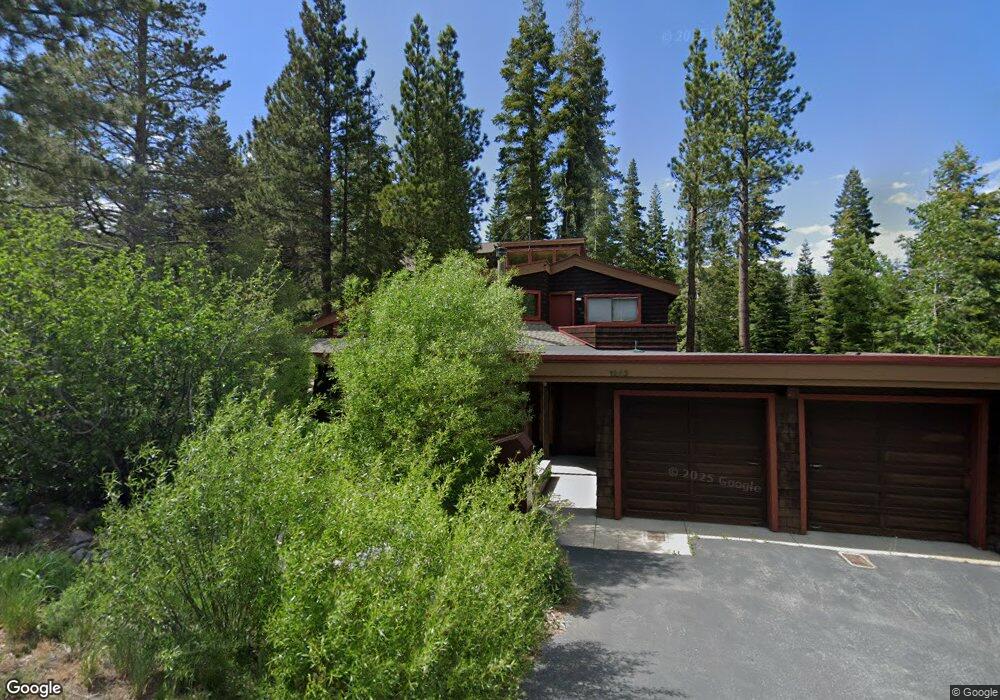

1242 Mineral Springs Trail Alpine Meadows, CA 96146

Estimated Value: $915,000 - $1,288,000

4

Beds

2

Baths

1,634

Sq Ft

$691/Sq Ft

Est. Value

About This Home

This home is located at 1242 Mineral Springs Trail, Alpine Meadows, CA 96146 and is currently estimated at $1,129,510, approximately $691 per square foot. 1242 Mineral Springs Trail is a home located in Placer County with nearby schools including Tahoe Lake Elementary School, North Tahoe School, and North Tahoe High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2025

Sold by

Baron Jennifer

Bought by

Jennifer Baron Trust and Baron

Current Estimated Value

Purchase Details

Closed on

Jun 19, 2014

Sold by

Baron Jane E and Baron Alan L

Bought by

Baron Jennifer

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$474,950

Interest Rate

4.17%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 6, 2014

Sold by

Baron Family Limited Partnership

Bought by

Baron Jane E and Baron Alan L

Purchase Details

Closed on

Feb 1, 1995

Sold by

Baron Alan L and Baron Jane E

Bought by

Baron Alan L and Baron Jane E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jennifer Baron Trust | -- | None Listed On Document | |

| Baron Jennifer | $650,000 | Chicago Title | |

| Baron Jane E | -- | None Available | |

| Baron Alan L | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Baron Jennifer | $474,950 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,897 | $796,799 | $306,461 | $490,338 |

| 2023 | $8,897 | $765,860 | $294,561 | $471,299 |

| 2022 | $8,605 | $750,844 | $288,786 | $462,058 |

| 2021 | $8,285 | $736,123 | $283,124 | $452,999 |

| 2020 | $8,301 | $728,576 | $280,221 | $448,355 |

| 2019 | $8,388 | $714,291 | $274,727 | $439,564 |

| 2018 | $7,865 | $700,287 | $269,341 | $430,946 |

| 2017 | $7,720 | $686,557 | $264,060 | $422,497 |

| 2016 | $7,643 | $673,096 | $258,883 | $414,213 |

| 2015 | $7,492 | $662,987 | $254,995 | $407,992 |

| 2014 | $3,026 | $261,753 | $42,855 | $218,898 |

Source: Public Records

Map

Nearby Homes

- 1037 Snow Crest Rd

- 1334 Mineral Springs Trail

- 1141 Snow Crest Rd

- 1191 Snow Crest Rd

- xxxxx Alpine Meadows Rd

- 1585 Zurs Ct

- 5 Fir Crags Rd

- 400 + Resort Rd Unit 932

- 400 Resort Rd Unit 418 & 420

- 400 Resort Rd Unit 532

- 400 Resort Rd Unit 310 + 312

- 400 Resort Rd Unit 722-724

- 400 Resort Rd Unit 822, 824

- 400 Resort Rd Unit 958

- 400 Resort Rd Unit 655

- 400 Resort Rd Unit 809 811

- 400 Resort Rd Unit 236

- 400 Resort Rd Unit 508

- 400 Resort Rd Unit 710-712

- 400 Resort Rd Unit 314 316

- 1252 Mineral Springs Trail

- 1245 Mineral Springs Trail

- 1235 Mineral Springs Trail

- 1222 Mineral Springs Trail

- 1257 Mineral Springs Trail

- 1229 Mineral Springs Trail

- 1018 Snow Crest Rd

- 1012 Snow Crest Rd

- 1264 Mineral Springs Trail

- 1024 Snow Crest Rd

- 1220 Mineral Springs Trail

- 1238 Mineral Springs Trail

- 1311 Pine Trail

- 1324 Mineral Springs Trail

- 1006 Snow Crest Rd

- 1030 Snow Crest Rd

- 1320 Mineral Springs Trail

- 1272 Mineral Springs Trail

- 1330 Pine Trail

- 1209 Mineral Springs Trail