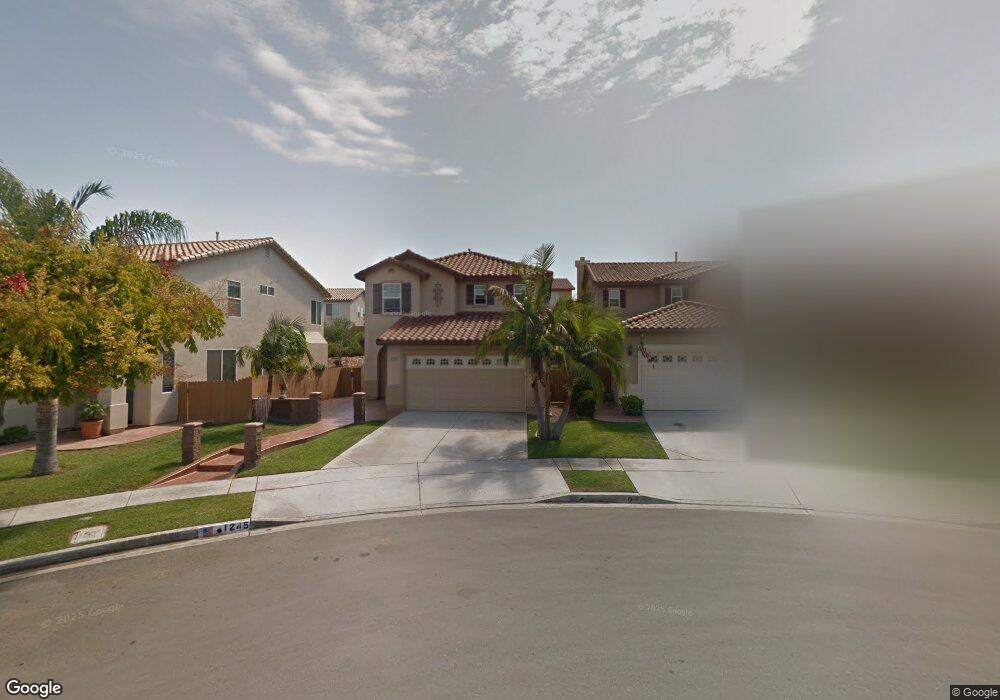

1245 Sand Drift Point Unit 7A San Diego, CA 92154

Ocean View Hills NeighborhoodEstimated Value: $729,000 - $929,000

3

Beds

3

Baths

1,653

Sq Ft

$505/Sq Ft

Est. Value

About This Home

This home is located at 1245 Sand Drift Point Unit 7A, San Diego, CA 92154 and is currently estimated at $834,669, approximately $504 per square foot. 1245 Sand Drift Point Unit 7A is a home located in San Diego County with nearby schools including Ocean View Hills, Vista Del Mar, and San Ysidro Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 2024

Sold by

Gutierrez Rene Rios and Cruz Vanessa

Bought by

Cruz Gutierrez Trust and Gutierrez

Current Estimated Value

Purchase Details

Closed on

Mar 14, 2002

Sold by

Pardee Homes

Bought by

Gutierrez Rene R and Cruz Vanessa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$249,755

Interest Rate

7.08%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cruz Gutierrez Trust | -- | None Listed On Document | |

| Gutierrez Rene R | $263,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Gutierrez Rene R | $249,755 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,031 | $388,355 | $140,329 | $248,026 |

| 2024 | $6,031 | $380,741 | $137,578 | $243,163 |

| 2023 | $5,908 | $373,277 | $134,881 | $238,396 |

| 2022 | $5,674 | $365,959 | $132,237 | $233,722 |

| 2021 | $5,675 | $358,785 | $129,645 | $229,140 |

| 2020 | $5,578 | $355,107 | $128,316 | $226,791 |

| 2019 | $5,347 | $348,145 | $125,800 | $222,345 |

| 2018 | $5,253 | $341,320 | $123,334 | $217,986 |

| 2017 | $81 | $334,628 | $120,916 | $213,712 |

| 2016 | $5,010 | $328,068 | $118,546 | $209,522 |

| 2015 | $4,964 | $323,141 | $116,766 | $206,375 |

| 2014 | $4,898 | $316,812 | $114,479 | $202,333 |

Source: Public Records

Map

Nearby Homes

- 1250 Sand Drift Point

- 1210 Jade Cove Ct

- 1270 Paseo Sea Breeze Unit 26

- 5211 Calle Rockfish Unit 90

- 1251 Paseo Sea Breeze Unit 14

- 1251 Paseo Sea Breeze Unit 17

- 1320 Calle Sandcliff Unit 41

- 5140 Calle Sand Arch Unit 61

- 5405 Calle Sand Arch Unit 197

- 5360 Calle Rockfish Unit 32

- 5402 Sand Arch Ln Unit 199

- 1233 Sandy Cape Ct

- 5317 Westport View Dr

- 5192 Emerald Cove

- 5208 Surfwalk Way Unit 153

- 5265 Beachfront Cove Unit 167

- 5261 Beachfront Cove Unit 175

- 5080 Sea Reef Place

- 5240 Beachfront Cove Unit 89

- 5280 Beachfront Cove Unit 239

- 1249 Sand Drift Point

- 1241 Sand Drift Point

- 1237 Sand Drift Point

- 1253 Sand Drift Point

- 1250 Jade Cove Ct Unit 7A

- 1246 Jade Cove Ct

- 1233 Sand Drift Point

- 1242 Jade Cove Ct

- 1254 Jade Cove Ct

- 1238 Jade Cove Ct Unit 7A

- 1229 Sand Drift Point

- 1234 Jade Cove Ct

- 1225 Sand Drift Point Unit 7A

- 1242 Sand Drift Point

- 1254 Sand Drift Point

- 1238 Sand Drift Point

- 1246 Sand Drift Point

- 1230 Jade Cove Ct

- 1234 Sand Drift Point Unit 7A

- 1223 Sand Drift Point