12482 Abrams Rd Unit 807 Dallas, TX 75243

Lake Highlands NeighborhoodEstimated Value: $152,239 - $169,000

2

Beds

2

Baths

958

Sq Ft

$168/Sq Ft

Est. Value

About This Home

This home is located at 12482 Abrams Rd Unit 807, Dallas, TX 75243 and is currently estimated at $160,810, approximately $167 per square foot. 12482 Abrams Rd Unit 807 is a home located in Dallas County with nearby schools including Aikin Elementary School, Forest Meadow Junior High School, and Lake Highlands High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 3, 2024

Sold by

Moreno Mario M and Duarte Sirle A

Bought by

Gebretsadik Senait Kidane

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,500

Outstanding Balance

$120,490

Interest Rate

7.29%

Mortgage Type

New Conventional

Estimated Equity

$40,320

Purchase Details

Closed on

Aug 11, 2014

Sold by

Wells Maria Jose

Bought by

Moreno Mario M and Duarte Sirle A

Purchase Details

Closed on

May 1, 2007

Sold by

Carr Marcus

Bought by

Wells Fargo Bank Na and Registered Holders Of The Structured Ass

Purchase Details

Closed on

May 31, 2002

Sold by

Henry James V and Henry Sylvia

Bought by

Carr Marcus

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$42,400

Interest Rate

6.89%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gebretsadik Senait Kidane | -- | Magnolia Title | |

| Moreno Mario M | $11,000 | None Available | |

| Moreno Mario Marcos | $11,000 | None Available | |

| Wells Fargo Bank Na | $39,525 | None Available | |

| Carr Marcus | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gebretsadik Senait Kidane | $122,500 | |

| Previous Owner | Carr Marcus | $42,400 | |

| Closed | Carr Marcus | $10,600 | |

| Closed | Moreno Mario Marcos | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,704 | $158,070 | $24,450 | $133,620 |

| 2024 | $3,704 | $158,070 | $24,450 | $133,620 |

| 2023 | $3,704 | $129,330 | $24,450 | $104,880 |

| 2022 | $3,401 | $129,330 | $24,450 | $104,880 |

| 2021 | $2,664 | $95,800 | $24,450 | $71,350 |

| 2020 | $2,702 | $95,800 | $24,450 | $71,350 |

| 2019 | $2,829 | $95,800 | $24,450 | $71,350 |

| 2018 | $1,625 | $57,480 | $10,190 | $47,290 |

| 2017 | $799 | $57,480 | $10,190 | $47,290 |

| 2016 | $1,299 | $45,960 | $10,190 | $35,770 |

| 2015 | $163 | $43,110 | $10,190 | $32,920 |

| 2014 | $163 | $42,150 | $10,190 | $31,960 |

Source: Public Records

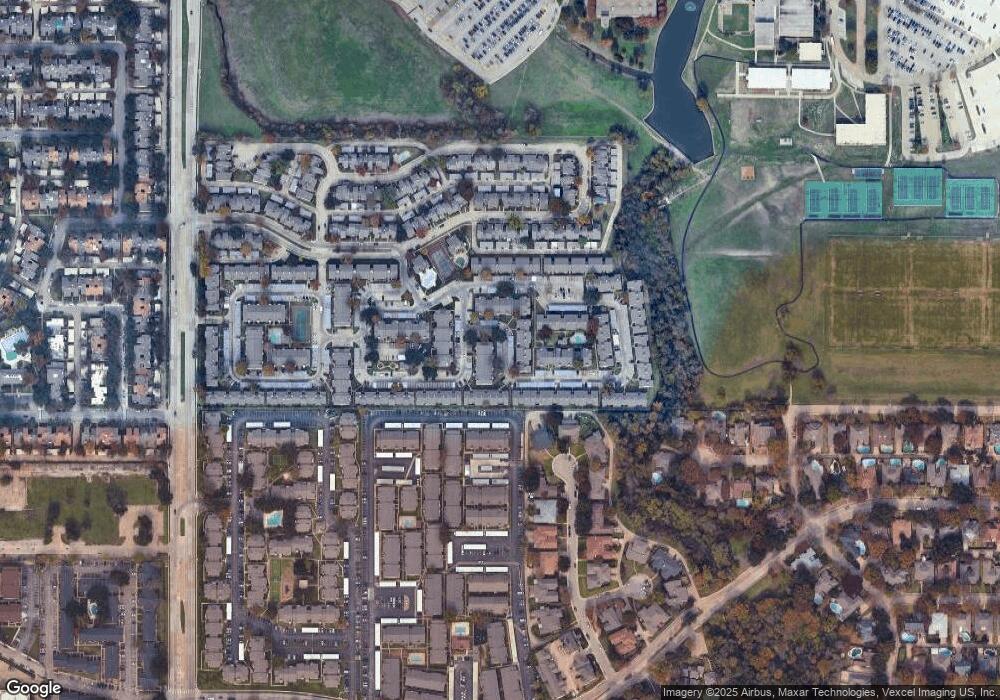

Map

Nearby Homes

- 12480 Abrams Rd Unit 705

- 12482 Abrams Rd Unit 1301

- 12484 Abrams Rd Unit 2121

- 12482 Abrams Rd Unit 1421

- 12480 Abrams Rd Unit 2801

- 12482 Abrams Rd Unit 1427

- 12480 Abrams Rd Unit 508

- 12480 Abrams Rd Unit 208

- 13220 Woodbend Ln

- 12554 Burninglog Ln

- 12502 Burninglog Ln

- 12317 Cross Creek Dr

- 9603 Baseline Dr

- 9317 Chimney Sweep Ln

- 12209 Wightman Place

- 9250 Flickering Shadow Dr

- 9806 Bent Branch Ln

- 9228 Flickering Shadow Dr

- 9838 Baseline Dr

- 104 Bower Ln

- 12482 Abrams Rd Unit 1428

- 12480 Abrams Rd Unit 226

- 12484 Abrams Rd Unit 1926

- 12480 Abrams Rd Unit 127

- 12480 Abrams Rd Unit 405J

- 12480 Abrams Rd Unit 227G

- 12480 Abrams Rd Unit 225G

- 12480 Abrams Rd Unit 123A

- 12480 Abrams Rd Unit 503K

- 12480 Abrams Rd Unit 706

- 12480 Abrams Rd Unit 605L

- 12482 Abrams Rd Unit 1206

- 12484 Abrams Rd Unit 1724Y

- 12480 Abrams Rd Unit 208G

- 12480 Abrams Rd Unit 601L

- 12480 Abrams Rd Unit 626L

- 12480 Abrams Rd Unit 226

- 12480 Abrams Rd Unit 704E

- 12480 Abrams Rd Unit 128A

- 12482 Abrams Rd Unit 1202S