125 Easthampton E Unit 125 West Palm Beach, FL 33417

Century Village-West Palm Beach NeighborhoodEstimated Value: $82,622

1

Bed

2

Baths

783

Sq Ft

$106/Sq Ft

Est. Value

About This Home

This home is located at 125 Easthampton E Unit 125, West Palm Beach, FL 33417 and is currently priced at $82,622, approximately $105 per square foot. 125 Easthampton E Unit 125 is a home located in Palm Beach County with nearby schools including Grassy Waters Elementary School, Bear Lakes Middle School, and Palm Beach Lakes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 8, 2018

Sold by

Easthampton F Condominium Association Io

Bought by

Sausa Rosolino G

Current Estimated Value

Purchase Details

Closed on

Nov 28, 2017

Sold by

Latulippe Sheran

Bought by

Easthampton F Condominium

Purchase Details

Closed on

Sep 6, 2011

Sold by

Latulippe Harriett May

Bought by

Latulippe Sherman Charles

Purchase Details

Closed on

Jun 12, 2006

Sold by

Maloney Lorraine and Estate Of Louis M Perretta

Bought by

Latulippe Harriett

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$36,985

Interest Rate

6.57%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sausa Rosolino G | $40,000 | Attorney | |

| Easthampton F Condominium | $6,700 | None Available | |

| Latulippe Sherman Charles | -- | Attorney | |

| Latulippe Harriett | $45,500 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Latulippe Harriett | $36,985 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,297 | $51,096 | -- | -- |

| 2023 | $1,205 | $46,451 | $0 | $0 |

| 2022 | $1,072 | $42,228 | $0 | $0 |

| 2021 | $944 | $38,389 | $0 | $38,389 |

| 2020 | $946 | $38,389 | $0 | $38,389 |

| 2019 | $919 | $36,260 | $0 | $36,260 |

| 2018 | $814 | $32,260 | $0 | $32,260 |

| 2017 | $236 | $16,052 | $0 | $0 |

| 2016 | $234 | $15,722 | $0 | $0 |

| 2015 | $232 | $15,613 | $0 | $0 |

| 2014 | $233 | $15,489 | $0 | $0 |

Source: Public Records

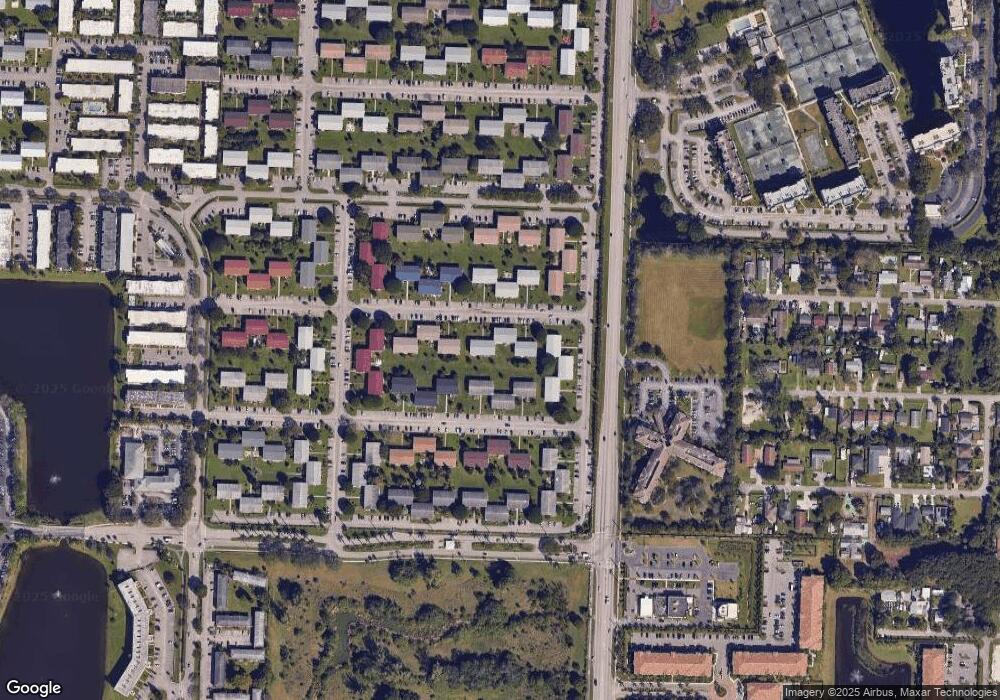

Map

Nearby Homes

- 162 Easthampton G Unit 162

- 150 Easthampton G Unit 150

- 152 Easthampton G

- 160 Easthampton G

- 159 Easthampton G

- 155 Easthampton G

- 102 Easthampton E Unit 102

- 113 Easthampton E Unit 113

- 116 Easthampton E

- 168 Salisbury G

- 99 Easthampton E

- 119 Salisbury E Unit E

- 118 Salisbury E Unit 118

- 147 Salisbury G

- 110 Salisbury E

- 205 Salisbury I

- 158 Norwich G

- 19 Norwich A Unit 19

- 87 Salisbury D Unit 87

- 204 Salisbury I Unit 204

- 125 Easthampton F E Unit 125

- 139 Easthampton E Unit 139F

- 161 Easthampton E Unit G

- 173 Easthampton E Unit H

- 114 Easthampton E Unit 114

- 100 Easthampton E Unit 100 E

- 100 Easthampton E

- 112 Easthampton E Unit 112

- 115 Easthampton E Unit 115E

- 115 Easthampton E

- 67 Easthampton E Unit 67 c

- 111 Easthampton - (Clint Unit 111

- 116 Easthampton E Unit 116

- 116 Easthampton E Unit E

- 111 Easthampton E Unit E

- 111 Easthampton E Unit 111

- 57 Easthampton E Unit C

- 101 Easthampton E Unit 101

- 49 Easthampton E Unit C

- 105 Easthampton E Unit 105