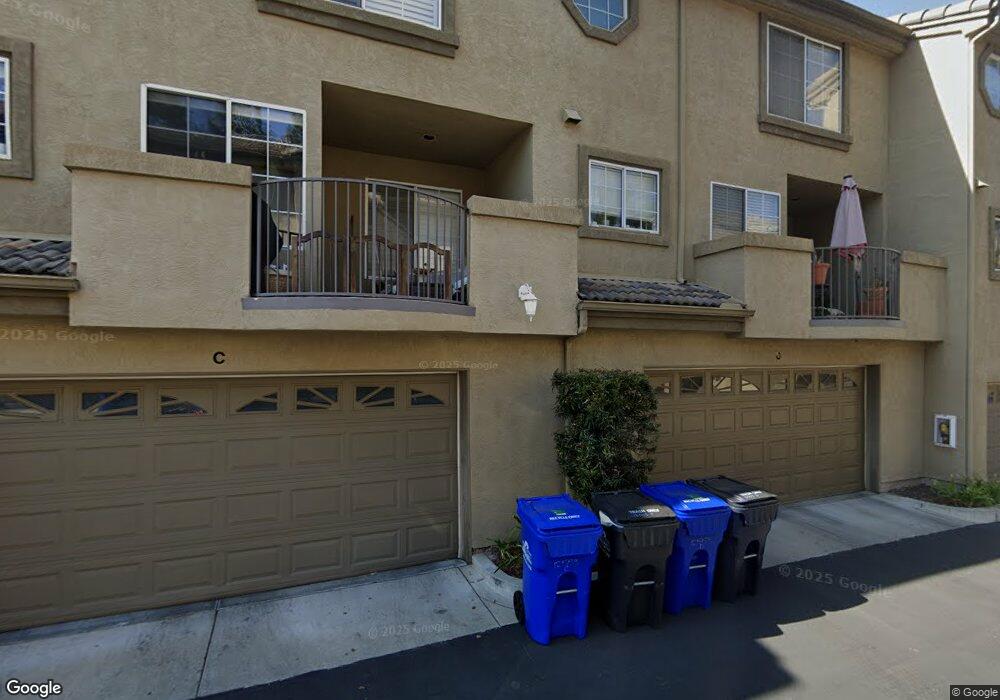

12553 El Camino Real Unit C San Diego, CA 92130

Carmel Valley NeighborhoodEstimated Value: $1,141,000 - $1,350,000

3

Beds

3

Baths

1,533

Sq Ft

$801/Sq Ft

Est. Value

About This Home

This home is located at 12553 El Camino Real Unit C, San Diego, CA 92130 and is currently estimated at $1,227,703, approximately $800 per square foot. 12553 El Camino Real Unit C is a home located in San Diego County with nearby schools including Carmel Del Mar Elementary School, Del Mar Hills Elementary School, and Del Mar Heights School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 20, 2016

Sold by

Macier Marc and Macier Christina

Bought by

Macier Family Trust

Current Estimated Value

Purchase Details

Closed on

Jun 16, 2004

Sold by

The Betsy A Macier Declaration Of Trust

Bought by

Macier Marc and Macier Christina

Purchase Details

Closed on

Oct 23, 2002

Sold by

The Betsy A Macier Declaration Of Trust

Bought by

Macier Robert R and Macier Betsy A

Purchase Details

Closed on

Feb 24, 1999

Sold by

Macier Robert R and Macier Betsy A

Bought by

The Betsy A Macier Declaration Of Trust

Purchase Details

Closed on

Jan 15, 1998

Sold by

Dmg Associates Inc

Bought by

Macier Robert R and Macier Betsy A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$171,200

Outstanding Balance

$29,476

Interest Rate

7.05%

Estimated Equity

$1,198,227

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Macier Family Trust | -- | None Available | |

| Macier Marc | -- | -- | |

| Macier Robert R | -- | Fidelity National Title | |

| The Betsy A Macier Declaration Of Trust | -- | -- | |

| Macier Robert R | $214,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Macier Robert R | $171,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,352 | $341,680 | $95,790 | $245,890 |

| 2024 | $4,352 | $334,981 | $93,912 | $241,069 |

| 2023 | $4,380 | $328,414 | $92,071 | $236,343 |

| 2022 | $4,318 | $321,975 | $90,266 | $231,709 |

| 2021 | $4,191 | $315,663 | $88,497 | $227,166 |

| 2020 | $4,221 | $312,427 | $87,590 | $224,837 |

| 2019 | $4,155 | $306,302 | $85,873 | $220,429 |

| 2018 | $4,009 | $300,297 | $84,190 | $216,107 |

| 2017 | $3,949 | $294,410 | $82,540 | $211,870 |

| 2016 | $3,847 | $288,638 | $80,922 | $207,716 |

| 2015 | $3,802 | $284,303 | $79,707 | $204,596 |

| 2014 | $3,742 | $278,735 | $78,146 | $200,589 |

Source: Public Records

Map

Nearby Homes

- 12585 Ruette Alliante Unit 152

- 4065 Carmel View Rd Unit 24

- 4049 Carmel View Rd Unit 74

- 4049 Carmel View Rd Unit 75

- 3545 Caminito el Rincon Unit 237

- 3537 Caminito el Rincon Unit 259

- 3550 Caminito el Rincon Unit 69

- 3686 Ruette de Ville

- 3519 Caminito el Rincon Unit 300

- 3857 Pell Place Unit 406

- 3877 Pell Place Unit 108

- 3718 Mykonos Ln Unit 158

- 12364 Carmel Country Rd Unit C306

- 4042 Moratalla Terrace

- 12221 Caminito Mira Del Mar

- 12165 Caminito Mira Del Mar

- 12368 Carmel Country Rd Unit 303

- 12213 Carmel Vista Rd Unit 234

- 12370 Carmel Country Rd Unit 202

- 12372 Carmel Country Rd Unit 207

- 12553 El Camino Real

- 12553 El Camino Real Unit A

- 12553 El Camino Real Unit B

- 12553 El Camino Real Unit D

- 12553 El Camino Real Unit E

- 12557 El Camino Real Unit A

- 12557 El Camino Real Unit B

- 12557 El Camino Real Unit C

- 12557 El Camino Real Unit D

- 12545 El Camino Real Unit B

- 12547 El Camino Real

- 12551 El Camino Real

- 12551 El Camino Real Unit B

- 12545 El Camino Real Unit B

- 12547 El Camino Real Unit B

- 12547 El Camino Real Unit C

- 12547 El Camino Real Unit D

- 12547 El Camino Real Unit E

- 12547 El Camino Real Unit F

- 12545 El Camino Real Unit F