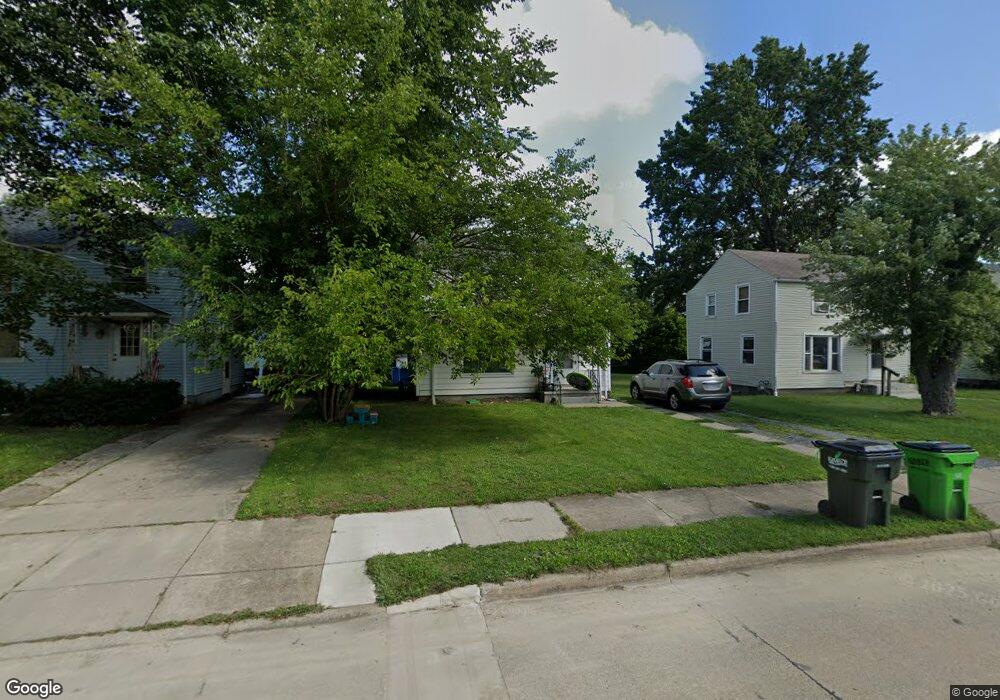

1256 Noble St Alliance, OH 44601

Estimated Value: $70,000 - $85,000

3

Beds

1

Bath

960

Sq Ft

$83/Sq Ft

Est. Value

About This Home

This home is located at 1256 Noble St, Alliance, OH 44601 and is currently estimated at $79,746, approximately $83 per square foot. 1256 Noble St is a home located in Stark County with nearby schools including Alliance Early Learning School, Alliance Intermediate School at Northside, and Alliance Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 2, 2025

Sold by

Lawson Carl E

Bought by

Claw Properties Llc

Current Estimated Value

Purchase Details

Closed on

Nov 21, 2017

Sold by

Deal Rescue L L C

Bought by

Lawson Carl E

Purchase Details

Closed on

Jul 21, 2017

Sold by

Harrold Ryan K

Bought by

Deal Rescue Llc

Purchase Details

Closed on

Aug 9, 2016

Sold by

Abbott Christopher

Bought by

Harrold Ryan K

Purchase Details

Closed on

Sep 3, 2015

Sold by

Globalcor Associates Llc

Bought by

Abbott Christopher

Purchase Details

Closed on

Feb 27, 2014

Sold by

Aeon Financial Llc

Bought by

Globalcor Associates Llc

Purchase Details

Closed on

Nov 14, 2013

Sold by

Hawkins Kay

Bought by

Aeon Financial Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Claw Properties Llc | -- | None Listed On Document | |

| Lawson Carl E | $8,000 | None Available | |

| Deal Rescue Llc | $154,300 | None Available | |

| Harrold Ryan K | $109,100 | None Available | |

| Abbott Christopher | $52,500 | North American Title Ins Co | |

| Globalcor Associates Llc | $6,000 | None Available | |

| Aeon Financial Llc | -- | Commonwealth Land Title Ins |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | -- | $13,970 | $3,890 | $10,080 |

| 2024 | -- | $13,970 | $3,890 | $10,080 |

| 2023 | $288 | $7,000 | $770 | $6,230 |

| 2022 | $290 | $7,000 | $770 | $6,230 |

| 2021 | $291 | $7,000 | $770 | $6,230 |

| 2020 | $213 | $4,800 | $560 | $4,240 |

| 2019 | $211 | $2,910 | $560 | $2,350 |

Source: Public Records

Map

Nearby Homes

- 314 Oak Ave

- 328 N Webb Ave

- 16190 River St NE

- 442 S Liberty Ave

- 361 E Main St

- 000 Lexington Rd

- V/L S Freedom Ave

- 955 E Summit St

- 22841 Lake Park Blvd

- 608 N Freedom Ave

- 432 S Linden Ave

- 11310 Webb Ave NE

- 15832 Waverly St NE

- 710 N Freedom Ave

- 838 Walnut Ave

- 452 E Summit St

- 62 E Market St

- 814 Milner St

- 11344 Walnut Ave NE

- 62 E High St