126 Middle Point Ct Gaithersburg, MD 20877

Estimated Value: $313,000 - $445,000

3

Beds

3

Baths

1,554

Sq Ft

$260/Sq Ft

Est. Value

About This Home

This home is located at 126 Middle Point Ct, Gaithersburg, MD 20877 and is currently estimated at $404,212, approximately $260 per square foot. 126 Middle Point Ct is a home located in Montgomery County with nearby schools including Summit Hall Elementary School, Forest Oak Middle School, and Gaithersburg High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 25, 2009

Sold by

Marquez Digna

Bought by

Bank Of New York Mellon

Current Estimated Value

Purchase Details

Closed on

Dec 23, 2005

Sold by

Lopez Liberato and Lopez C

Bought by

Marquez Digna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$289,600

Interest Rate

7.75%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Jun 22, 2000

Sold by

Mu Ruiquing

Bought by

Lopez Liberato and Lopez C

Purchase Details

Closed on

May 2, 1994

Sold by

Nguyen Q H

Bought by

Mu Ruiqing

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,000

Interest Rate

7.7%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bank Of New York Mellon | $305,000 | -- | |

| Marquez Digna | $362,000 | -- | |

| Marquez Digna | $362,000 | -- | |

| Lopez Liberato | $124,000 | -- | |

| Mu Ruiqing | $120,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Marquez Digna | $289,600 | |

| Previous Owner | Marquez Digna | $72,400 | |

| Previous Owner | Mu Ruiqing | $108,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,299 | $330,967 | -- | -- |

| 2024 | $4,299 | $312,133 | $0 | $0 |

| 2023 | $3,333 | $293,300 | $120,000 | $173,300 |

| 2022 | $3,618 | $287,233 | $0 | $0 |

| 2021 | $3,183 | $281,167 | $0 | $0 |

| 2020 | $6,009 | $275,100 | $120,000 | $155,100 |

| 2019 | $2,952 | $272,700 | $0 | $0 |

| 2018 | $2,925 | $270,300 | $0 | $0 |

| 2017 | $2,823 | $267,900 | $0 | $0 |

| 2016 | $3,158 | $254,933 | $0 | $0 |

| 2015 | $3,158 | $241,967 | $0 | $0 |

| 2014 | $3,158 | $229,000 | $0 | $0 |

Source: Public Records

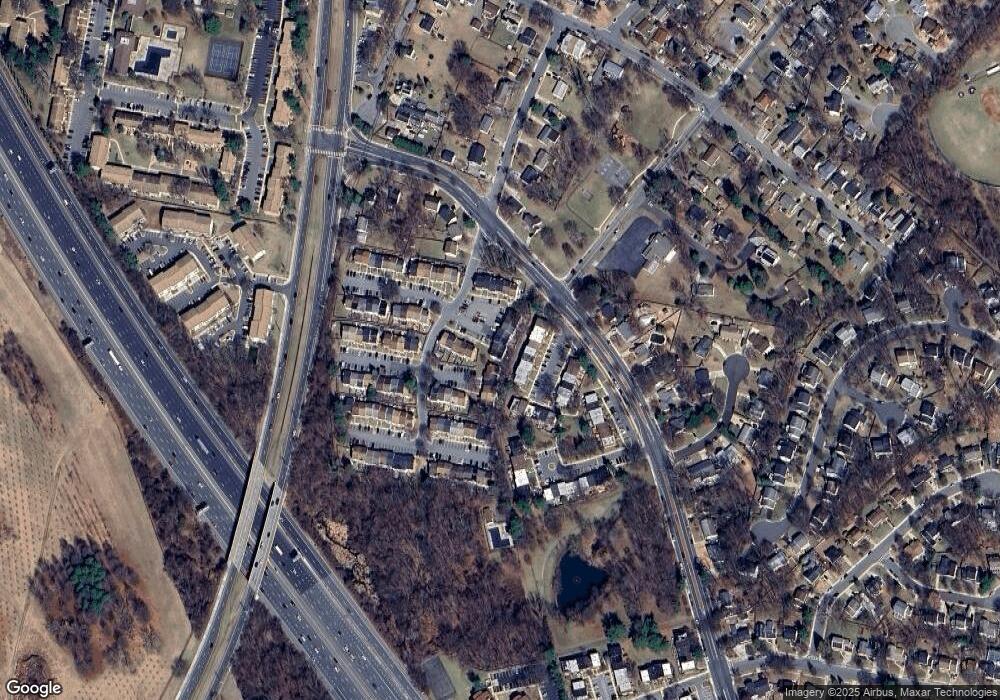

Map

Nearby Homes

- 11 Briarstone Ln

- 105 Autumn Hill Way

- 102 Duvall Ln

- 106 Duvall Ln

- 111 Spring St

- 112 Duvall Ln Unit 304

- 17100 King James Way

- 118 Duvall Ln Unit 115-203

- 215 Summit Hall Rd

- 30 Spring St

- 130 Duvall Ln Unit 187-T-3

- 138 Duvall Ln Unit 301

- 758 W Side Dr Unit 7G

- 571 W Diamond Ave

- 551 W Diamond Ave

- 1132 W Side Dr

- 502 Cobbler Place

- 763 Cobbler Place

- 303 Palmspring Dr Unit 10

- 501 Palmtree Dr Unit 3

- 124 Middle Point Ct

- 128 Middle Point Ct

- 122 Middle Point Ct

- 120 Middle Point Ct

- 102 Misty Dale Way

- 118 Middle Point Ct

- 109 Middle Point Ct

- 104 Misty Dale Way

- 210 W Deer Park Rd

- 107 Middle Point Ct

- 212 W Deer Park Rd Unit 27C

- 116 Middle Point Ct

- 214 W Deer Park Rd Unit 104

- 206 W Deer Park Rd Unit 27F

- 206 W Deer Park Rd

- 106 Misty Dale Way

- 204 W Deer Park Rd

- 216 W Deer Park Rd

- 105 Middle Point Ct

- 202 W Deer Park Rd