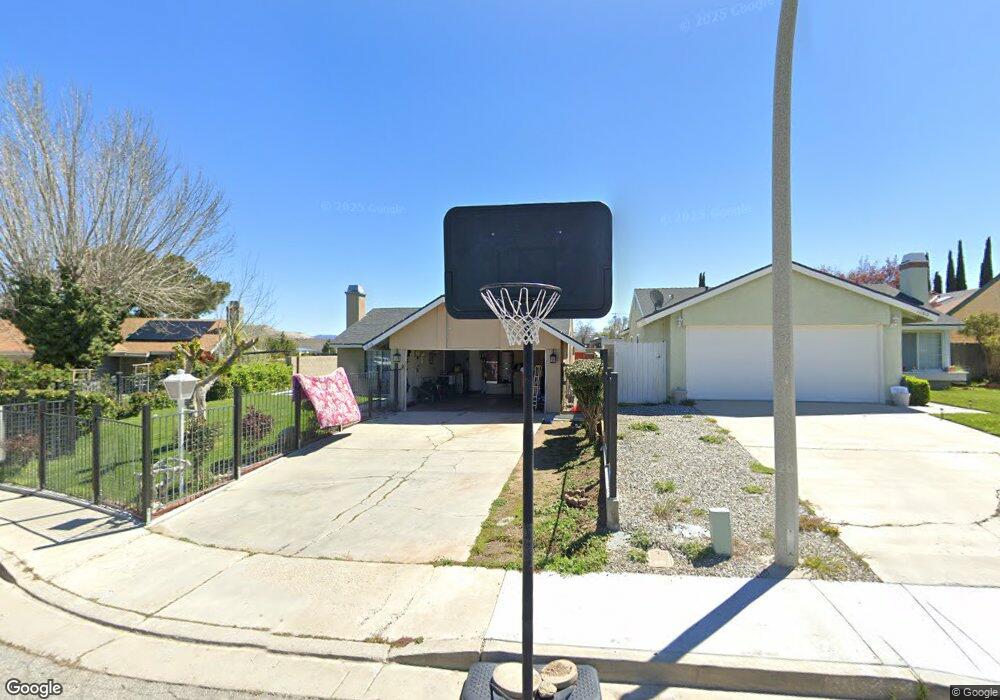

1260 Alder Ave Tehachapi, CA 93561

Estimated Value: $307,000 - $329,000

3

Beds

2

Baths

1,155

Sq Ft

$277/Sq Ft

Est. Value

About This Home

This home is located at 1260 Alder Ave, Tehachapi, CA 93561 and is currently estimated at $319,686, approximately $276 per square foot. 1260 Alder Ave is a home located in Kern County with nearby schools including Tompkins Elementary School, Jacobsen Middle School, and Tehachapi High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 14, 2010

Sold by

Embry Sherrie Lynn

Bought by

Embry Gail Ann

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Outstanding Balance

$52,418

Interest Rate

4.91%

Mortgage Type

New Conventional

Estimated Equity

$267,268

Purchase Details

Closed on

May 6, 2005

Sold by

Embry Timothy Wade

Bought by

Embry Sherrie Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,000

Interest Rate

7.4%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 8, 2005

Sold by

Embry Timothy Wade and Embry Sherrie Lynn

Bought by

Embry Sherrie Lynn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Embry Gail Ann | $115,000 | Chicago Title Company | |

| Embry Sherrie Lynn | -- | Ticor Title | |

| Embry Sherrie Lynn | -- | Ticor Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Embry Gail Ann | $80,000 | |

| Previous Owner | Embry Sherrie Lynn | $133,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,871 | $148,430 | $51,627 | $96,803 |

| 2024 | $1,802 | $145,520 | $50,615 | $94,905 |

| 2023 | $1,802 | $142,668 | $49,623 | $93,045 |

| 2022 | $1,781 | $139,871 | $48,650 | $91,221 |

| 2021 | $1,737 | $137,130 | $47,697 | $89,433 |

| 2020 | $1,733 | $135,724 | $47,208 | $88,516 |

| 2019 | $1,732 | $135,724 | $47,208 | $88,516 |

| 2018 | $1,673 | $130,456 | $45,376 | $85,080 |

| 2017 | $1,671 | $127,899 | $44,487 | $83,412 |

| 2016 | $1,627 | $125,392 | $43,615 | $81,777 |

| 2015 | $1,550 | $123,509 | $42,960 | $80,549 |

| 2014 | $1,533 | $121,091 | $42,119 | $78,972 |

Source: Public Records

Map

Nearby Homes

- 210 Pinon St Unit 11

- 210 Pinon St Unit 18

- 210 Pinon St Unit 4

- 210 Pinon St Unit 1

- 210 Pinon St Unit 6

- 210 Pinon St Unit 15

- 210 Pinon St Unit 5

- 210 Pinon St Unit 9

- 210 Pinon St Unit 7

- 210 Pinon St Unit 13

- 210 Pinon St Unit 8

- 210 Pinon St Unit 3

- 210 Pinon St Unit 16

- 210 Pinon St Unit 19

- 210 Pinon St Unit 10

- 210 Pinon St Unit 12

- 210 Pinon St Unit 14

- 210 Pinon St Unit 17

- 0 Pinon St

- 1309 Clasico Dr

- 1264 Alder Ave

- 1256 Alder Ave

- 1268 Alder Ave

- 213 Meadowbrook Ct

- 1252 Alder Ave

- 211 Meadowbrook Ct

- 1233 Alder Ave

- 1269 Alder Ave

- 209 Meadowbrook Ct

- 1267 Alder Ave

- 1248 Alder Ave

- 1229 Alder Ave

- 1244 Alder Ave

- 1240 Alder Ave

- 207 Meadowbrook Ct

- 214 Meadowbrook Ct

- 216 Meadowbrook Ct

- 212 Meadowbrook Ct

- 305 Meadowbrook Ct

- 305 Meadowbrook Ct