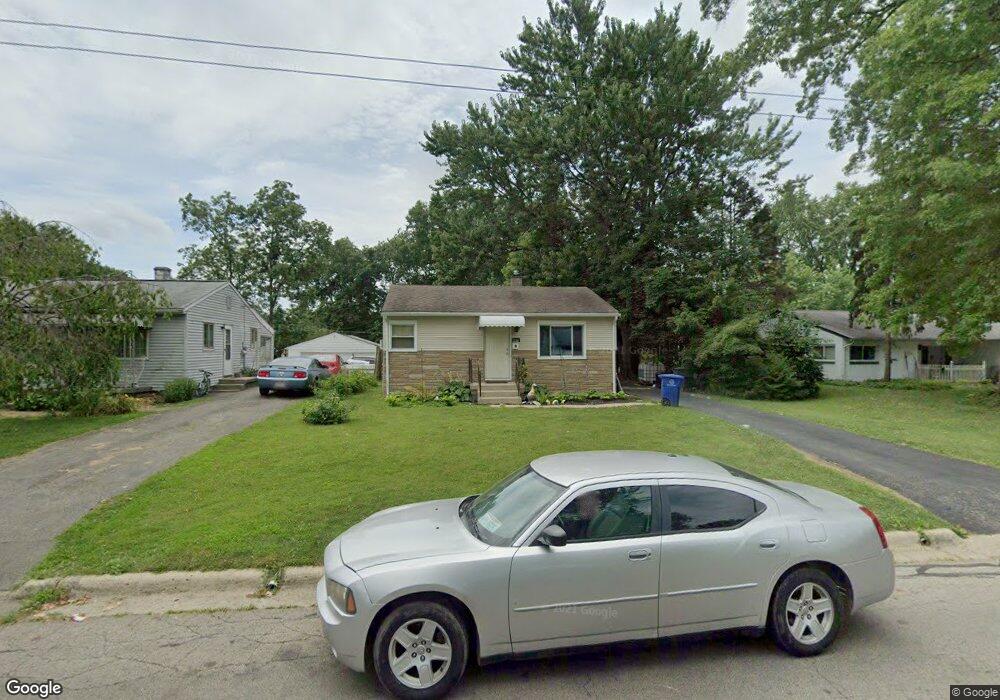

1261 Elmore Ave Columbus, OH 43224

North Linden NeighborhoodEstimated Value: $238,000 - $265,000

3

Beds

2

Baths

1,232

Sq Ft

$206/Sq Ft

Est. Value

About This Home

This home is located at 1261 Elmore Ave, Columbus, OH 43224 and is currently estimated at $253,220, approximately $205 per square foot. 1261 Elmore Ave is a home located in Franklin County with nearby schools including Maize Road Elementary School, Medina Middle School, and Mifflin High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 9, 2023

Sold by

Wbh Ohio Llc

Bought by

Haines Lucas

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,000

Outstanding Balance

$170,447

Interest Rate

6.49%

Mortgage Type

New Conventional

Estimated Equity

$82,773

Purchase Details

Closed on

Dec 27, 2022

Sold by

Wbh Ohio Llc

Bought by

Haines Lucas

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,000

Outstanding Balance

$170,447

Interest Rate

6.49%

Mortgage Type

New Conventional

Estimated Equity

$82,773

Purchase Details

Closed on

Apr 22, 2022

Sold by

Short Taja M

Bought by

Wbh Ohio Llc

Purchase Details

Closed on

Jan 22, 2010

Sold by

Stephens Conrad and Stephens Patricia D

Bought by

Short Taja M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,659

Interest Rate

5.37%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 28, 2000

Sold by

Bruening Michael F and Bruening Marianne F

Bought by

Stephens Conrad and Stephens Patricia D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$82,311

Interest Rate

7.98%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 29, 1995

Sold by

Roy F Boyd Trst

Bought by

Michael F Bruening

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,689

Interest Rate

8.91%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 3, 1994

Sold by

Murphy Sally Ann

Bought by

Roy F Boyd Trst

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Haines Lucas | $220,000 | Stewart Title | |

| Haines Lucas | $220,000 | Stewart Title | |

| Wbh Ohio Llc | $150,000 | Axxis Title | |

| Short Taja M | $74,000 | Attorney | |

| Stephens Conrad | $83,000 | Chicago Title | |

| Michael F Bruening | $68,000 | -- | |

| Roy F Boyd Trst | $44,229 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Haines Lucas | $176,000 | |

| Closed | Haines Lucas | $176,000 | |

| Previous Owner | Short Taja M | $72,659 | |

| Previous Owner | Stephens Conrad | $82,311 | |

| Previous Owner | Michael F Bruening | $67,689 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,017 | $65,840 | $17,150 | $48,690 |

| 2023 | $2,631 | $58,140 | $17,150 | $40,990 |

| 2022 | $1,861 | $35,880 | $8,190 | $27,690 |

| 2021 | $1,864 | $35,880 | $8,190 | $27,690 |

| 2020 | $1,867 | $35,880 | $8,190 | $27,690 |

| 2019 | $1,711 | $28,210 | $6,580 | $21,630 |

| 2018 | $1,622 | $28,210 | $6,580 | $21,630 |

| 2017 | $1,710 | $28,210 | $6,580 | $21,630 |

| 2016 | $1,693 | $25,550 | $6,020 | $19,530 |

| 2015 | $1,536 | $25,550 | $6,020 | $19,530 |

| 2014 | $1,540 | $25,550 | $6,020 | $19,530 |

| 2013 | $799 | $26,880 | $6,335 | $20,545 |

Source: Public Records

Map

Nearby Homes

- 1382 Elmore Ave

- 1283 Pauline Ave

- 1507 Elmore Ave

- 1090 Pauline Ave

- 3585 Gerbert Rd

- 3808 Maize Rd

- 3749 Ganson Dr

- 1279 Carolyn Ave

- 1496 E Cooke Rd

- 3519 Gerbert Rd

- 1440 E Cooke Rd

- 3941 Karl Rd Unit 326

- 3939 Karl Rd Unit 108

- 3965 Karl Rd Unit 208

- 3967 Karl Rd Unit 125

- 1258 Urana Ave

- 1270 Urana Ave

- 3401 Walmar Dr

- 995 Overbrook Service Dr

- 924 Northridge Rd

- 1269 Elmore Ave

- 1275 Elmore Ave

- 1255 Elmore Ave

- 1281 Elmore Ave

- 1243 Elmore Ave

- 1285 Elmore Ave

- 1237 Elmore Ave

- 1246 Elmore Ave

- 1264 Elmore Ave

- 1270 Elmore Ave

- 1258 Elmore Ave

- 1293 Elmore Ave

- 1276 Elmore Ave

- 1252 Elmore Ave

- 1240 Elmore Ave

- 1284 Elmore Ave

- 3740 Atwood Terrace

- 1234 Elmore Ave

- 1290 Elmore Ave

- 1299 Elmore Ave