12621 Moordale Cir Unit A Stanton, CA 90680

Estimated Value: $593,000 - $603,000

2

Beds

2

Baths

1,014

Sq Ft

$592/Sq Ft

Est. Value

About This Home

This home is located at 12621 Moordale Cir Unit A, Stanton, CA 90680 and is currently estimated at $599,782, approximately $591 per square foot. 12621 Moordale Cir Unit A is a home located in Orange County with nearby schools including Wakeham Elementary School, Alamitos Intermediate School, and Pacifica High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 18, 2012

Sold by

Rylander Kent A

Bought by

Rylander Kent A and Riles Christopher A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,800

Outstanding Balance

$11,285

Interest Rate

3.88%

Mortgage Type

New Conventional

Estimated Equity

$588,497

Purchase Details

Closed on

Dec 2, 1993

Sold by

Rylander Kent A and Rylander Wesley

Bought by

Rylander Kent A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,000

Interest Rate

7.09%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rylander Kent A | -- | Equity Title Company | |

| Rylander Kent A | -- | Continental Lawyers Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rylander Kent A | $98,800 | |

| Closed | Rylander Kent A | $127,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,776 | $212,443 | $111,525 | $100,918 |

| 2024 | $2,776 | $208,278 | $109,338 | $98,940 |

| 2023 | $2,723 | $204,195 | $107,195 | $97,000 |

| 2022 | $2,665 | $200,192 | $105,093 | $95,099 |

| 2021 | $2,639 | $196,267 | $103,032 | $93,235 |

| 2020 | $2,603 | $194,255 | $101,976 | $92,279 |

| 2019 | $2,557 | $190,447 | $99,977 | $90,470 |

| 2018 | $2,507 | $186,713 | $98,016 | $88,697 |

| 2017 | $2,473 | $183,052 | $96,094 | $86,958 |

| 2016 | $2,376 | $179,463 | $94,210 | $85,253 |

| 2015 | $2,344 | $176,768 | $92,795 | $83,973 |

| 2014 | $2,215 | $173,306 | $90,977 | $82,329 |

Source: Public Records

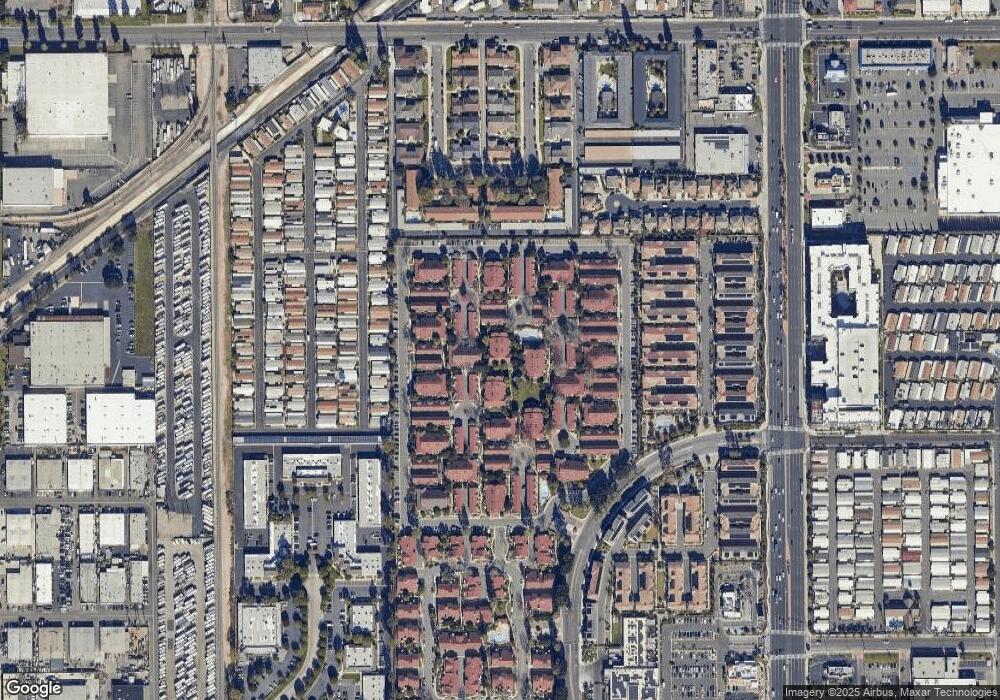

Map

Nearby Homes

- 7720 Elmdale Way Unit E

- 7720 Elmdale Way Unit H

- 12683 Ferndale Cir

- 7774 Ramsdale Way Unit 278

- 12651 Glendale Cir

- 183 Lantana Dr

- 7700 Lampson Ave Unit 117

- 7700 Lampson Ave Unit 52

- 7700 Lampson Ave Unit 94

- 7700 Lampson Ave Unit 62

- 7700 Lampson Ave Unit 15

- 7700 Lampson Ave Unit 100

- 7700 Lampson Ave Unit 138

- 8111 Stanford Ave Unit 128

- 8111 Stanford Ave Unit 98

- 8111 Stanford Ave Unit 127

- 12361 Santa Rosalia St

- 13202 Hoover St Unit 42

- 834 Chateau Ct

- 12162 Fieldgate St

- 12621 Moordale Cir

- 12621 Moordale Cir Unit H

- 12621 Moordale Cir Unit D

- 12621 Moordale Cir Unit K

- 12621 Moordale Cir

- 12621 Moordale Cir Unit B

- 12621 Moordale Cir Unit 219

- 12621 Moordale Cir Unit 225

- 12621 Moordale Cir Unit 226

- 12621 Moordale Cir Unit E

- 12621 Moordale Cir Unit I

- 12621 Moordale Cir Unit 227

- 12621 Moordale Cir Unit 223

- 12621 Moordale Cir Unit F

- 12621 Moordale Cir Unit 230

- 12621 Moordale Cir Unit J

- 12621 Moordale Cir Unit 224

- 12621 Moordale Cir Unit 220

- 7730 Briarglen Loop Unit K

- 7730 Briarglen Loop Unit H

Your Personal Tour Guide

Ask me questions while you tour the home.