Estimated Value: $580,584 - $613,000

3

Beds

4

Baths

2,200

Sq Ft

$273/Sq Ft

Est. Value

About This Home

This home is located at 127 Timothy Cir, Wayne, PA 19087 and is currently estimated at $599,646, approximately $272 per square foot. 127 Timothy Cir is a home located in Montgomery County with nearby schools including Roberts Elementary School, Upper Merion Middle School, and Upper Merion High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 31, 2011

Sold by

Barker Elizabeth Elaine and Kerins Joseph Robert

Bought by

Mo Bi and Tan Le Lian

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Outstanding Balance

$124,705

Interest Rate

4.89%

Estimated Equity

$474,941

Purchase Details

Closed on

Jan 27, 2006

Sold by

Strid Gerald and Strid Kristin M

Bought by

Barker Elizabeth Elaine and Kerins Joseph Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$316,000

Interest Rate

6.27%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mo Bi | $356,000 | None Available | |

| Barker Elizabeth Elaine | $395,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mo Bi | $180,000 | |

| Previous Owner | Barker Elizabeth Elaine | $316,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,651 | $215,810 | $49,230 | $166,580 |

| 2024 | $6,651 | $215,810 | $49,230 | $166,580 |

| 2023 | $6,415 | $215,810 | $49,230 | $166,580 |

| 2022 | $6,140 | $215,810 | $49,230 | $166,580 |

| 2021 | $5,950 | $215,810 | $49,230 | $166,580 |

| 2020 | $5,686 | $215,810 | $49,230 | $166,580 |

| 2019 | $5,589 | $215,810 | $49,230 | $166,580 |

| 2018 | $5,588 | $215,810 | $49,230 | $166,580 |

| 2017 | $5,388 | $215,810 | $49,230 | $166,580 |

| 2016 | $5,304 | $215,810 | $49,230 | $166,580 |

| 2015 | $5,108 | $215,810 | $49,230 | $166,580 |

| 2014 | $5,108 | $215,810 | $49,230 | $166,580 |

Source: Public Records

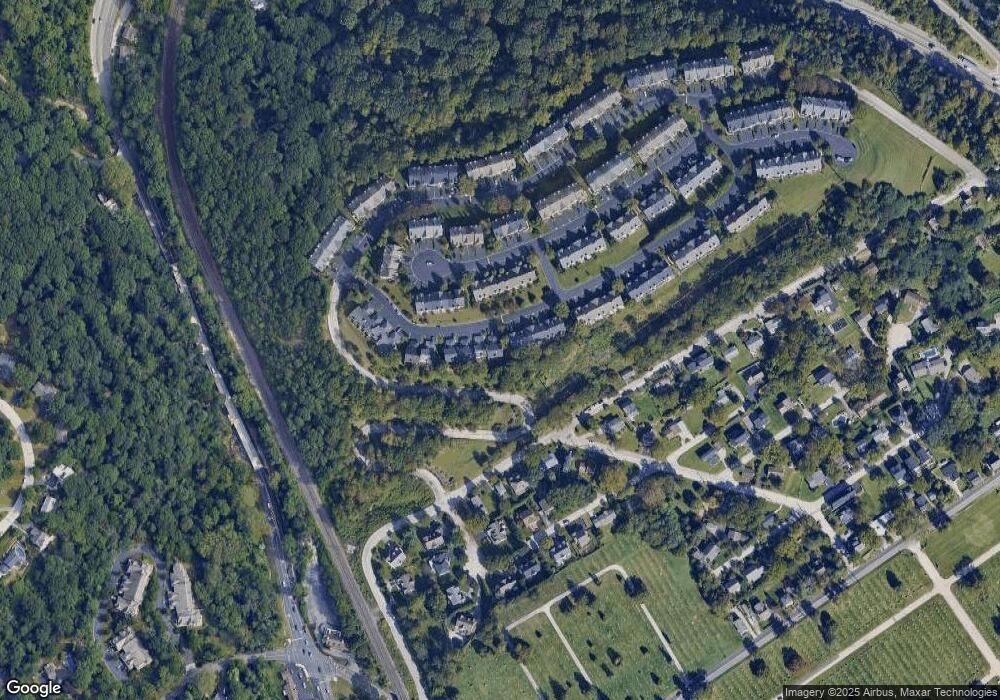

Map

Nearby Homes

- 105 Timothy Cir

- 97 Timothy Cir

- 235 Valley Forge Lookout Place

- 1212 Lemonton Ct

- 117 Arden Rd

- 223 Rebel Hill Rd

- 2 Arden Rd

- 4 Arden Rd

- Lot 1 Arden Rd

- Lot 3 Arden Rd

- 1212 Rebel Hill Rd

- 1196 Rebel Hill Rd

- 188 Arden Rd

- 258 Tennessee Ave

- 161 Lantern Ln

- 123 Gypsy Ln

- 156 Gypsy Ln

- 1266 Gulph Creek Dr

- 400 Highview Dr

- 1750 Cedar Ln

- 125 Timothy Cir

- 123 Timothy Cir

- 129 Timothy Cir Unit 30C

- 121 Timothy Cir

- 131 Timothy Cir

- 119 Timothy Cir

- 133 Timothy Cir

- 117 Timothy Cir

- 135 Timothy Cir

- 115 Timothy Cir

- 137 Timothy Cir

- 137 Timothy Cir Unit 30C

- 113 Timothy Cir

- 139 Timothy Cir Unit 30B

- 253 Lookout Place

- 255 Lookout Place Unit H20

- 253 Valley Forge Lookout Place

- 251 Lookout Place Unit 20F

- 249 Lookout Place Unit E

- 257 Valley Forge Lookout Place