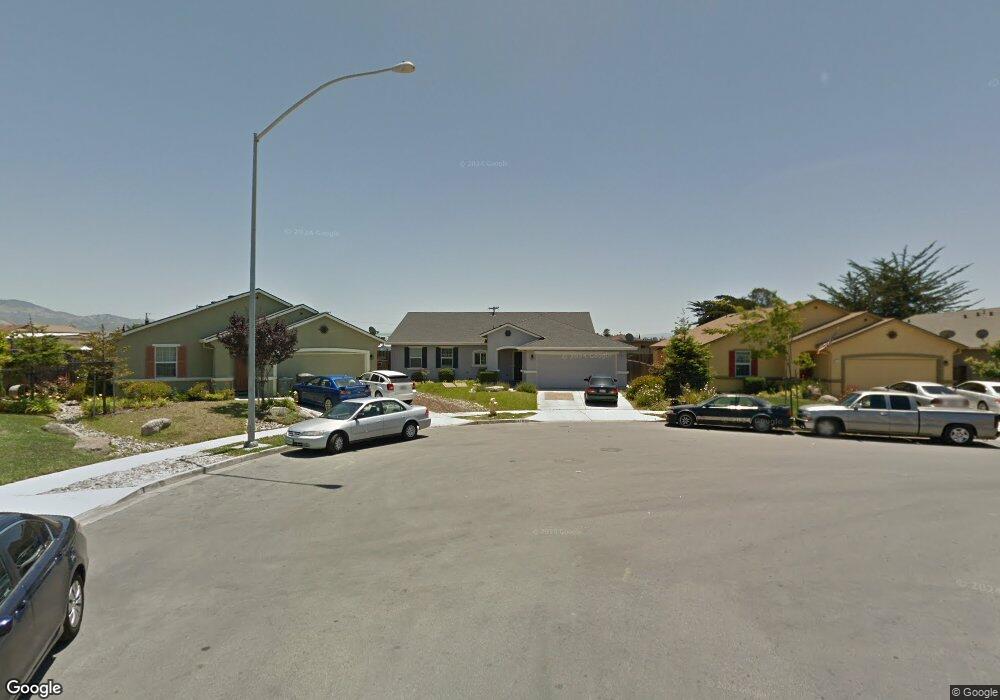

1278 Pacific Ave Salinas, CA 93905

East Salinas NeighborhoodEstimated Value: $674,000 - $868,000

4

Beds

3

Baths

1,838

Sq Ft

$409/Sq Ft

Est. Value

About This Home

This home is located at 1278 Pacific Ave, Salinas, CA 93905 and is currently estimated at $751,053, approximately $408 per square foot. 1278 Pacific Ave is a home located in Monterey County with nearby schools including Frank Paul Elementary School, La Paz Middle School, and Alisal High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 28, 2009

Sold by

Deutsche Bank Trust Company Americas

Bought by

Meza Maria De Jesus

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$219,387

Outstanding Balance

$138,010

Interest Rate

5.01%

Mortgage Type

Unknown

Estimated Equity

$613,043

Purchase Details

Closed on

May 15, 2008

Sold by

Montejano Martha

Bought by

Deutsche Bank Trust Co Americas

Purchase Details

Closed on

May 19, 2006

Sold by

Ortiz Eduardo Salgado

Bought by

Montejano Martha

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,000

Interest Rate

6.46%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

May 17, 2006

Sold by

Rancho Amistoso Llc

Bought by

Montejano Martha

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$143,000

Interest Rate

6.46%

Mortgage Type

Credit Line Revolving

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meza Maria De Jesus | $215,000 | First American Title | |

| Deutsche Bank Trust Co Americas | $361,800 | First American Title | |

| Montejano Martha | -- | First American Title Co | |

| Montejano Martha | $715,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Meza Maria De Jesus | $219,387 | |

| Previous Owner | Montejano Martha | $143,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,652 | $276,853 | $64,380 | $212,473 |

| 2024 | $3,652 | $271,425 | $63,118 | $208,307 |

| 2023 | $3,586 | $266,104 | $61,881 | $204,223 |

| 2022 | $3,227 | $260,887 | $60,668 | $200,219 |

| 2021 | $3,229 | $255,773 | $59,479 | $196,294 |

| 2020 | $3,194 | $253,152 | $58,870 | $194,282 |

| 2019 | $3,295 | $248,189 | $57,716 | $190,473 |

| 2018 | $3,106 | $243,324 | $56,585 | $186,739 |

| 2017 | $3,224 | $238,554 | $55,476 | $183,078 |

| 2016 | $3,058 | $233,878 | $54,389 | $179,489 |

| 2015 | $3,032 | $230,366 | $53,573 | $176,793 |

| 2014 | $2,923 | $225,854 | $52,524 | $173,330 |

Source: Public Records

Map

Nearby Homes

- 1046 C St

- 755 Pino Way

- 11 Fresa Place

- 948 Rider Ave

- 1544 Saguaro Dr Unit 4

- 11 Saguaro Cir

- 933 Acosta Plaza Unit 35

- 18 Hancock Cir

- 1725 Great Island St

- 10 Rex Cir

- 11 E Laurel Dr

- 15 Cheswick Cir

- 11 Hill Cir

- 609 Saint George Dr

- 544 Saint George Dr

- 1914 Whitman St

- 1858 Bradbury St

- 1849 Bradbury St

- 230 Paloma Ave

- 1671 Cambrian Dr

- 840 Amarillo Way

- 836 Amarillo Way

- 855 Amarillo Way

- 844 Amarillo Way

- 832 Amarillo Way

- 843 Bermuda Way

- 839 Bermuda Way

- 848 Amarillo Way

- 847 Bermuda Way

- 835 Bermuda Way

- 828 Amarillo Way

- 851 Bermuda Way

- 839 Amarillo Way

- 835 Amarillo Way

- 843 Amarillo Way

- 831 Bermuda Way

- 831 Amarillo Way

- 824 Amarillo Way Unit 1

- 847 Amarillo Way

- 829 Amarillo Way

Your Personal Tour Guide

Ask me questions while you tour the home.