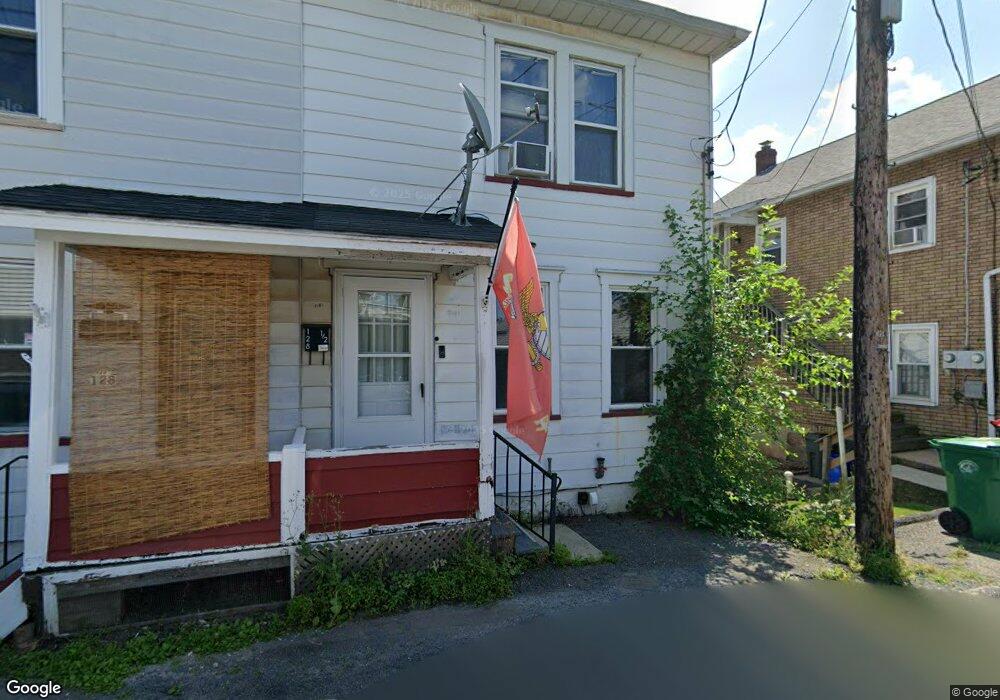

128 1/2 S 3rd St Lehighton, PA 18235

Estimated Value: $119,000 - $142,000

3

Beds

1

Bath

1,115

Sq Ft

$117/Sq Ft

Est. Value

About This Home

This home is located at 128 1/2 S 3rd St, Lehighton, PA 18235 and is currently estimated at $130,752, approximately $117 per square foot. 128 1/2 S 3rd St is a home located in Carbon County with nearby schools including Lehighton Area High School, Sts. Peter & Paul School, and Valley Ridge Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 8, 2024

Sold by

Windward Sail Re Holdings Llc

Bought by

Hans Hannah R

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$5,300

Outstanding Balance

$5,236

Interest Rate

6.94%

Estimated Equity

$125,516

Purchase Details

Closed on

Jul 10, 2020

Sold by

Keller David

Bought by

Windward Sail Re Holdings Llc

Purchase Details

Closed on

Nov 25, 2019

Sold by

Tax Claim Bureau

Bought by

Keller David

Purchase Details

Closed on

Nov 3, 2019

Sold by

Snyder Olive M and Schleicher Camilla

Bought by

Keller David

Purchase Details

Closed on

Oct 7, 1968

Bought by

Snyder Olive M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hans Hannah R | $106,000 | Paramount Abstract | |

| Windward Sail Re Holdings Llc | $35,000 | None Available | |

| Keller David | $7,793 | None Available | |

| Keller David | -- | None Available | |

| Snyder Olive M | $2,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hans Hannah R | $5,300 | |

| Open | Hans Hannah R | $102,820 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,783 | $22,350 | $4,300 | $18,050 |

| 2024 | $1,693 | $22,350 | $4,300 | $18,050 |

| 2023 | $1,677 | $22,350 | $4,300 | $18,050 |

| 2022 | $1,677 | $22,350 | $4,300 | $18,050 |

| 2021 | $1,618 | $22,350 | $4,300 | $18,050 |

| 2020 | $1,579 | $22,350 | $4,300 | $18,050 |

| 2019 | $1,512 | $22,350 | $4,300 | $18,050 |

| 2018 | $1,478 | $22,350 | $4,300 | $18,050 |

| 2017 | $1,467 | $22,350 | $4,300 | $18,050 |

| 2016 | -- | $22,350 | $4,300 | $18,050 |

| 2015 | -- | $22,350 | $4,300 | $18,050 |

| 2014 | -- | $22,350 | $4,300 | $18,050 |

Source: Public Records

Map

Nearby Homes

- 117 N 4th St

- 193 S 4th St

- 193 S 4th St Unit 191-193

- 230 S 2nd St

- 236 S 2nd St

- 231 Coal St

- 142 Bankway St

- 344 Ochre St

- 12 2nd Ave

- 230 Carbon St

- 470 N 8th St

- 410 S 8th St

- 0 Fairyland Rd Unit PM-136987

- 438 White St

- 17 Mahoning Dr E

- 0 Pine Hollow Dr Unit PACC2006714

- 0 Pine Hollow Dr Unit PM-135085

- 0 Pine Hollow Dr Unit 763487

- 201 Fairview St

- 361 Court St Unit REAR