12913 8th Ave S Zimmerman, MN 55398

Estimated Value: $317,000 - $337,000

2

Beds

2

Baths

2,250

Sq Ft

$144/Sq Ft

Est. Value

About This Home

This home is located at 12913 8th Ave S, Zimmerman, MN 55398 and is currently estimated at $324,320, approximately $144 per square foot. 12913 8th Ave S is a home located in Sherburne County with nearby schools including Zimmerman Elementary School, Westwood Elementary School, and Zimmerman Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2022

Sold by

The Revocable Living Trust Of Michael Th

Bought by

Horner Luke

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$260,000

Outstanding Balance

$242,735

Interest Rate

3.69%

Mortgage Type

New Conventional

Estimated Equity

$81,585

Purchase Details

Closed on

Mar 7, 2016

Sold by

Zajicek Michael T and Zajicek Michael Thomas

Bought by

The Revocable Living Trust Of Michael Th

Purchase Details

Closed on

Oct 8, 2012

Sold by

Minnesota Housing Finance Agency

Bought by

Zajicek Michael T

Purchase Details

Closed on

Feb 21, 2012

Sold by

Alexander Shay L

Bought by

Minnesota Housing Finance Agency

Purchase Details

Closed on

Aug 20, 2004

Sold by

Woodland Development Corp

Bought by

Drake Construction Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$32,300

Interest Rate

8%

Mortgage Type

Land Contract Argmt. Of Sale

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Horner Luke | $260,000 | -- | |

| The Revocable Living Trust Of Michael Th | -- | Attorney | |

| Zajicek Michael T | $126,000 | None Available | |

| Minnesota Housing Finance Agency | $165,820 | None Available | |

| Drake Construction Inc | $35,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Horner Luke | $260,000 | |

| Previous Owner | Drake Construction Inc | $32,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,594 | $298,900 | $86,400 | $212,500 |

| 2024 | $3,466 | $294,700 | $86,400 | $208,300 |

| 2023 | $3,326 | $290,600 | $86,400 | $204,200 |

| 2022 | $3,036 | $266,000 | $61,800 | $204,200 |

| 2020 | $2,762 | $210,200 | $35,100 | $175,100 |

| 2019 | $2,394 | $196,400 | $32,500 | $163,900 |

| 2018 | $2,298 | $183,400 | $32,500 | $150,900 |

| 2017 | $2,118 | $170,300 | $32,000 | $138,300 |

| 2016 | $1,958 | $156,500 | $26,000 | $130,500 |

| 2015 | $1,914 | $118,800 | $20,800 | $98,000 |

| 2014 | $1,622 | $116,100 | $19,000 | $97,100 |

| 2013 | -- | $91,400 | $15,500 | $75,900 |

Source: Public Records

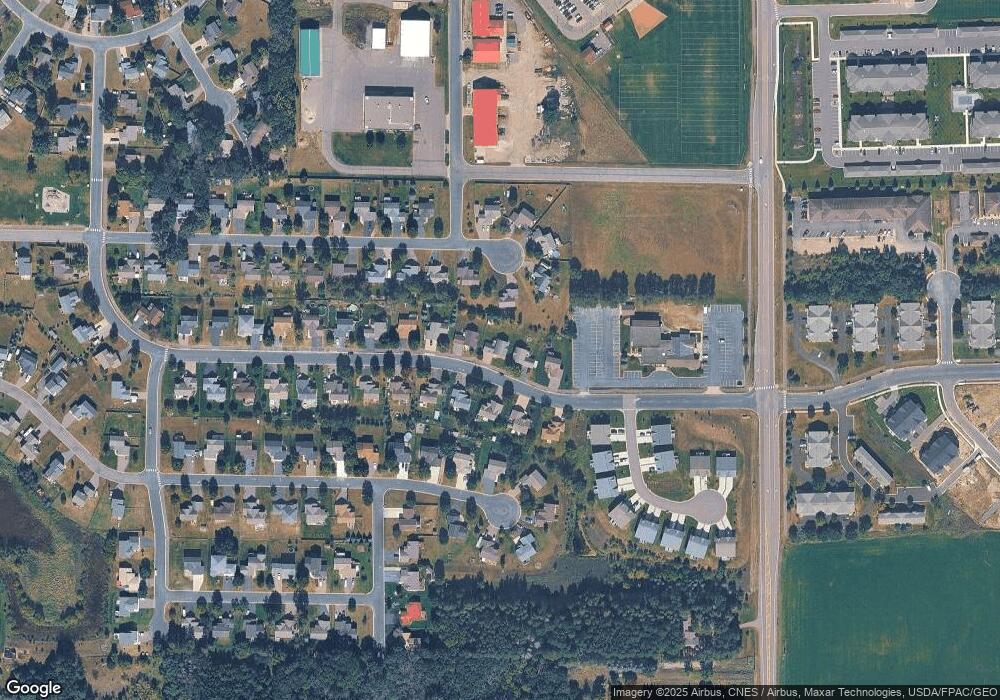

Map

Nearby Homes

- 12966 8th Ave S

- 12726 8th Ave S

- The Hazelwood Plan at South Side Townhomes

- The Birchwood Plan at South Side Townhomes

- 12660 Pond View Rd

- 12659 Pond View Rd

- 12658 Pond View Rd

- 12655 Pond View Rd

- 25886 8th St W

- 12598 Pond View Rd

- 25965 9th St W

- 13113 11th St W

- 13134 11th St W

- 13106 11th St W

- 13103 11th St W

- 13048 12th Ave S

- 13036 12th Ave S

- 13037 13th Ave S

- 13021 13th Ave S

- 26285 1st St W

- 12905 8th Ave S

- 12925 8th Ave S

- 12913 12913 8th-Avenue-s

- 12912 12912 7th-Avenue-s

- 12912 7th Ave S

- 12937 8th Ave S

- 12887 8th Ave S

- 12924 7th Ave S

- 12904 7th Ave S

- 12916 12916 8th-Avenue-s

- 12916 8th Ave S

- 12928 8th Ave S

- 12940 8th Ave S

- 12936 7th Ave S

- 12906 8th Ave S

- 12940 8th Ave S

- 12949 8th Ave S

- 12949 12949 8th-Avenue-s

- 12890 8th Ave S

- 12890 8th Ave S