Estimated Value: $255,000 - $310,000

3

Beds

2

Baths

1,530

Sq Ft

$177/Sq Ft

Est. Value

About This Home

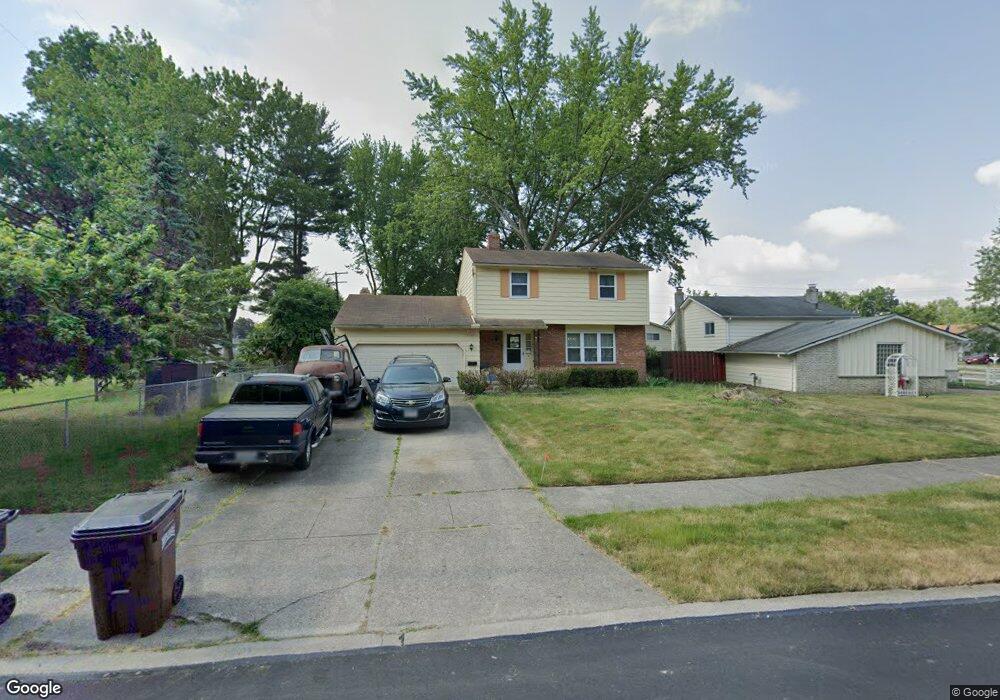

This home is located at 12921 List Ln, Parma, OH 44130 and is currently estimated at $271,338, approximately $177 per square foot. 12921 List Ln is a home located in Cuyahoga County with nearby schools including Pleasant Valley Elementary School, Greenbriar Middle School, and Valley Forge High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 24, 1999

Sold by

Berda Michael J and Berda Gale A

Bought by

Berda Michael J and Berda Gale A

Current Estimated Value

Purchase Details

Closed on

Sep 22, 1997

Sold by

Est Deann Sunkel

Bought by

Berda Michael J and Berda Gail A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,000

Outstanding Balance

$15,998

Interest Rate

6.2%

Mortgage Type

New Conventional

Estimated Equity

$255,340

Purchase Details

Closed on

Aug 20, 1990

Sold by

Sunkel Fred G and Sunkel Deann L

Bought by

Sunkel De Ann

Purchase Details

Closed on

Apr 3, 1985

Sold by

Sunkel Fred G and Sunkel Deann L

Bought by

Sunkel Fred G and Sunkel Deann L

Purchase Details

Closed on

Jan 1, 1975

Bought by

Sunkel Fred G and Sunkel Deann L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Berda Michael J | -- | -- | |

| Berda Michael J | $125,500 | -- | |

| Sunkel De Ann | -- | -- | |

| Sunkel Fred G | -- | -- | |

| Sunkel Fred G | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Berda Michael J | $116,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,019 | $75,390 | $14,700 | $60,690 |

| 2023 | $3,531 | $58,700 | $12,950 | $45,750 |

| 2022 | $4,081 | $58,700 | $12,950 | $45,750 |

| 2021 | $4,201 | $58,700 | $12,950 | $45,750 |

| 2020 | $3,981 | $49,320 | $10,890 | $38,430 |

| 2019 | $3,828 | $140,900 | $31,100 | $109,800 |

| 2018 | $3,849 | $49,320 | $10,890 | $38,430 |

| 2017 | $3,381 | $40,080 | $7,600 | $32,480 |

| 2016 | $3,359 | $40,080 | $7,600 | $32,480 |

| 2015 | $3,200 | $40,080 | $7,600 | $32,480 |

| 2014 | $3,200 | $40,080 | $7,600 | $32,480 |

Source: Public Records

Map

Nearby Homes

- 12890 List Ln

- 12972 W Sprague Rd

- 7728 Klein Dr

- 7596 W 130th St

- 12631 Pinebrook Dr

- 7601 W 130th St

- 8761 Windfall Ct

- 7547 N Linden Ln

- 8290 Crystal Creek Dr

- 7664 Gerald Dr

- 13541 Indian Creek Dr

- 7517 Zona Ln

- 12658 Gardenside Dr

- 8963 Abbey Rd

- 14015 Byron Blvd

- 8960 Wildwood Dr

- 12990 Bagley Rd

- 12939 W Pleasant Valley Rd

- 7330 Maplewood Rd

- 7316 Oakwood Rd