Estimated Value: $487,000 - $545,255

3

Beds

3

Baths

1,281

Sq Ft

$410/Sq Ft

Est. Value

About This Home

This home is located at 12941 Saddleback Place, Chino, CA 91710 and is currently estimated at $525,564, approximately $410 per square foot. 12941 Saddleback Place is a home located in San Bernardino County with nearby schools including Dickson Elementary, Ramona Junior High School, and Don Antonio Lugo High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 25, 2017

Sold by

Sqml Llc

Bought by

The Graciela Beatriz Quirino Living Trus

Current Estimated Value

Purchase Details

Closed on

Mar 5, 2016

Sold by

Quirino Graciela Beatriz

Bought by

Gqml Llc

Purchase Details

Closed on

Aug 19, 1999

Sold by

Hud

Bought by

Quirino Graciela B and Lospennato Marisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,306

Interest Rate

7.86%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 24, 1999

Sold by

Nationsbanc Mtg Corp

Bought by

Hud

Purchase Details

Closed on

Jul 30, 1998

Sold by

Akintunde Adebayo and Akintunde Ruth

Bought by

Nationsbanc Mtg Corp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| The Graciela Beatriz Quirino Living Trus | -- | None Available | |

| Gqml Llc | -- | None Available | |

| Quirino Graciela B | $85,000 | First Southwestern Title Co | |

| Hud | -- | Fidelity National Title Ins | |

| Nationsbanc Mtg Corp | $97,051 | Fidelity National Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Quirino Graciela B | $84,306 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,961 | $364,107 | $127,438 | $236,669 |

| 2024 | $3,961 | $356,967 | $124,939 | $232,028 |

| 2023 | $3,851 | $349,967 | $122,489 | $227,478 |

| 2022 | $3,829 | $343,105 | $120,087 | $223,018 |

| 2021 | $3,754 | $336,377 | $117,732 | $218,645 |

| 2020 | $3,706 | $332,928 | $116,525 | $216,403 |

| 2019 | $3,641 | $326,400 | $114,240 | $212,160 |

| 2018 | $3,561 | $320,000 | $112,000 | $208,000 |

| 2017 | $3,243 | $290,700 | $102,000 | $188,700 |

| 2016 | $1,191 | $110,360 | $32,459 | $77,901 |

| 2015 | $1,168 | $108,702 | $31,971 | $76,731 |

| 2014 | $1,145 | $106,573 | $31,345 | $75,228 |

Source: Public Records

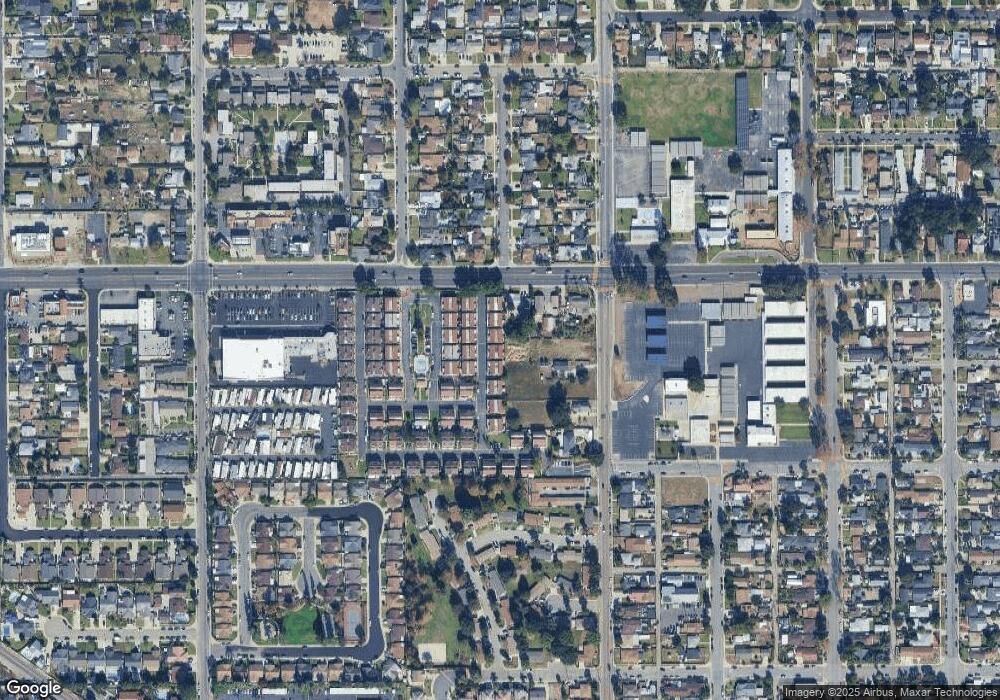

Map

Nearby Homes

- 13115 Monte Vista Ave

- 13066 3rd St

- 13123 2nd St

- 13116 3rd St

- 12940 4th St

- 4862 Lincoln Ave

- 12939 5th St

- 13257 2nd St

- 12686 3rd St

- 4539 Carmen St

- 4621 Chino Ave

- 4449 Carmen St

- 4440 Carmen St

- 4912 G St

- 12958 Boston Ave

- 12635 Franklin Ct Unit 8b

- 13401 Wisteria Place

- 12801 Norton Ave

- 12540 Ramona Ave

- 0 C St

- 12947 Saddleback Place

- 12955 Saddleback Place

- 12961 Saddleback Place

- 12935 Saddleback Place Unit 54

- 12929 Saddleback Place

- 12942 Saddleback Place

- 12954 Saddleback Place

- 12965 Saddleback Place

- 12936 Saddleback Place

- 12960 Saddleback Place

- 12923 Saddleback Place

- 12930 Saddleback Place

- 12969 Saddleback Place

- 12917 Saddleback Place

- 12917 Saddleback Plaza

- 4838 Ranch Rd

- 12924 Saddleback Place

- 12945 Royal Palm Cir

- 12939 Royal Palm Cir

- 4834 Ranch Rd