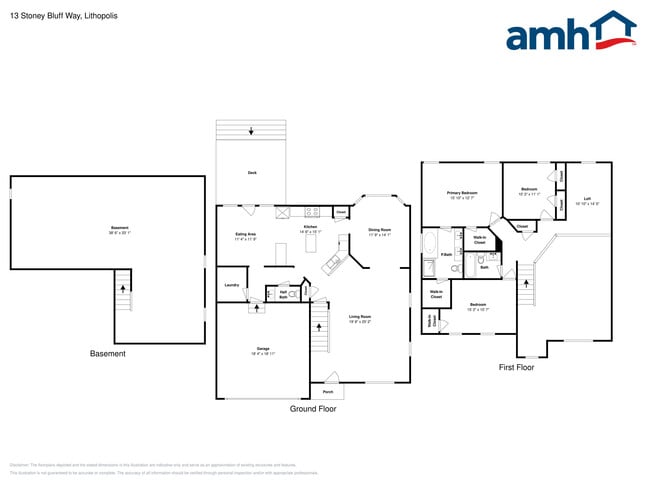

13 Stoney Bluff Way Lithopolis, OH 43136

Bloom NeighborhoodAbout This Home

Special offer: Pay just 75% of your base rent (taxes and fees not included) as your security deposit, valid for new applicants who sign a 12-month lease by December 31, 2025. Offer is contingent on application approval and execution of a lease agreement. Other terms and conditions may apply. This property is professionally managed by AMH Living, a leading single-family rental company. We work to simplify your rental experience by offering self-guided tours and a streamlined leasing process you can complete all online, all on your own schedule. Once moved in, we provide maintenance support that you can rely on, so you can enjoy your weekends stress-free. We look forward to welcoming you home! See Today, Sign Today™ Take a self-guided tour of this property using our Let Yourself In® service to view the space on your own schedule, without an agent. And if your documents are in order, you might even view a home and sign a lease on the same day! Utilities, taxes, and other fees may apply. Please verify and confirm all information before signing a lease. If you have questions, don’t hesitate to contact us at the telephone number on this property listing. All lease applications, documentation, and initial payments for this property, must be submitted directly through or by phone. The photos, renderings, or other images of the properties on our website, are for illustrative purposes only, and may vary from the features, amenities, or phase of construction. We do not advertise properties on Craigslist, Facebook Marketplace, or other classified advertising websites. If you believe one of our residences is listed there, please notify us. For further description of applicable fees, please go to our website.

Map

- 56 W Twin Maple Ave

- 526 Market St Unit 526

- 539 Market St Unit 539

- 549 Crestview Dr

- 73 E North St

- 11511 Lithopolis Rd NW

- 330 W Columbus St

- 0 Columbus St Unit 225023784

- 310 Abbey Ave

- 1505 Hansberry Dr

- 750 Faulkner Dr

- Harmony Plan at The Summit at Wagnalls Run

- Henley Plan at The Summit at Wagnalls Run

- Bellamy Plan at The Summit at Wagnalls Run

- Stamford Plan at The Summit at Wagnalls Run

- Aldridge Plan at The Summit at Wagnalls Run

- Fairton Plan at The Summit at Wagnalls Run

- Juniper Plan at The Summit at Wagnalls Run

- Chatham Plan at The Summit at Wagnalls Run

- Pendleton Plan at The Summit at Wagnalls Run

- 25 W Twin Maple Ave

- 71 W North St Unit C

- 109 Sandburg Dr

- 122 Faulkner Dr

- 6185 Dietz Dr

- 7037 Crescent Boat Ln

- 5691 Levi Kramer Blvd

- 6693 Jennyann Way

- 202 Kramer Mills Dr

- 204 Kramer Mills Dr

- 203 Kramer Mills Dr

- 207 Kramer Mills Dr

- 206 Kramer Mills Dr

- 205 Kramer Mills Dr

- 6340 Saddler Way

- 5512 Meadow Passage Dr

- 7505 Hemrich Dr

- 7525 Hemrich Dr

- 7474 Canal Highlands Blvd

- 5393 Blanchard Dr