1301 Marylyn Cir Unit 42 Petaluma, CA 94954

Adobe NeighborhoodEstimated Value: $557,148 - $681,000

3

Beds

2

Baths

1,456

Sq Ft

$419/Sq Ft

Est. Value

About This Home

This home is located at 1301 Marylyn Cir Unit 42, Petaluma, CA 94954 and is currently estimated at $610,037, approximately $418 per square foot. 1301 Marylyn Cir Unit 42 is a home located in Sonoma County with nearby schools including La Tercera Elementary School, Kenilworth Junior High School, and Casa Grande High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2019

Sold by

Mallin Nicole Marie and Mallin Alexander X

Bought by

Mallin Alexander X and Mallin Nicole M

Current Estimated Value

Purchase Details

Closed on

Nov 18, 2017

Sold by

Mallin Nicole Marie

Bought by

Mallin Nicole Marie and Mallin Alexander X

Purchase Details

Closed on

Jun 6, 2017

Sold by

Mallin Nicole Marie and The Melba Mccord 2015 Revocabl

Bought by

Mallin Nicole Marie

Purchase Details

Closed on

Aug 24, 2015

Sold by

Mccord Melba P

Bought by

Mccord Melba Pauline and Melba Mccord 2015 Revocable Tr

Purchase Details

Closed on

May 4, 2010

Sold by

Mccord Clyde and Mccord Melba

Bought by

Mccord Clyde L and Mccord Melba P

Purchase Details

Closed on

Jun 27, 2000

Sold by

Guadagni Catherine M

Bought by

Mccord Clyde and Mccord Melba

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$276,000

Outstanding Balance

$101,557

Interest Rate

8.63%

Mortgage Type

Stand Alone First

Estimated Equity

$508,480

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mallin Alexander X | -- | None Available | |

| Mallin Nicole Marie | -- | None Available | |

| Mallin Nicole Marie | -- | None Available | |

| Mccord Melba Pauline | -- | None Available | |

| Mccord Clyde L | -- | None Available | |

| Mccord Clyde | $276,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mccord Clyde | $276,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,332 | $116,149 | $22,612 | $93,537 |

| 2024 | $1,332 | $113,872 | $22,169 | $91,703 |

| 2023 | $1,332 | $111,640 | $21,735 | $89,905 |

| 2022 | $1,303 | $109,452 | $21,309 | $88,143 |

| 2021 | $1,289 | $107,307 | $20,892 | $86,415 |

| 2020 | $1,297 | $106,207 | $20,678 | $85,529 |

| 2019 | $1,285 | $104,125 | $20,273 | $83,852 |

| 2018 | $1,249 | $102,084 | $19,876 | $82,208 |

| 2017 | $1,232 | $100,084 | $19,487 | $80,597 |

| 2016 | $1,106 | $98,122 | $19,105 | $79,017 |

| 2015 | $1,078 | $96,650 | $18,819 | $77,831 |

| 2014 | $1,066 | $94,758 | $18,451 | $76,307 |

Source: Public Records

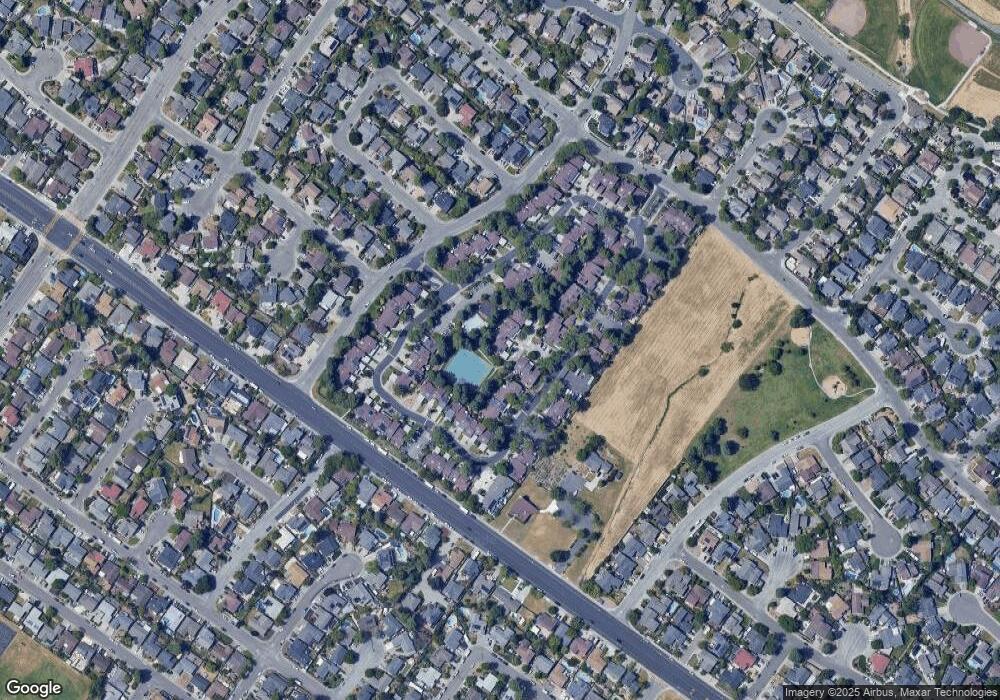

Map

Nearby Homes

- 1103 Marylyn Cir

- 602 Marylyn Cir

- 601 Marylyn Cir Unit 21

- 1711 Capistrano Dr

- 2189 Saint Augustine Cir

- 724 Garfield Dr

- 4 Starling Dr

- 1627 Juliet Dr

- 642 Albert Way

- 1513 Elizabeth Dr

- 2014 Crinella Dr

- 29 Palomino Ct

- 12 Birnam Wood Ct

- 1241 Del Rancho Way

- 2053 Vista Ln

- 2044 Willow Dr

- 2038 Crinella Dr

- 859 S Mcdowell Blvd

- 2 Wedgewood Ct

- 1917 Falcon Ridge Dr

- 1302 Marylyn Cir

- 1303 Marylyn Cir

- 1304 Marylyn Cir

- 1203 Marylyn Cir

- 1202 Marylyn Cir

- 1305 Marylyn Cir

- 1005 Marylyn Cir

- 1201 Marylyn Cir

- 1004 Marylyn Cir

- 1003 Marylyn Cir

- 1401 Marylyn Cir

- 1002 Marylyn Cir

- 1402 Marylyn Cir

- 2404 Marylyn Cir

- 1001 Marylyn Cir

- 201 Marylyn Cir

- 2403 Marylyn Cir

- 1404 Marylyn Cir

- 503 Marylyn Cir

- 202 Marylyn Cir