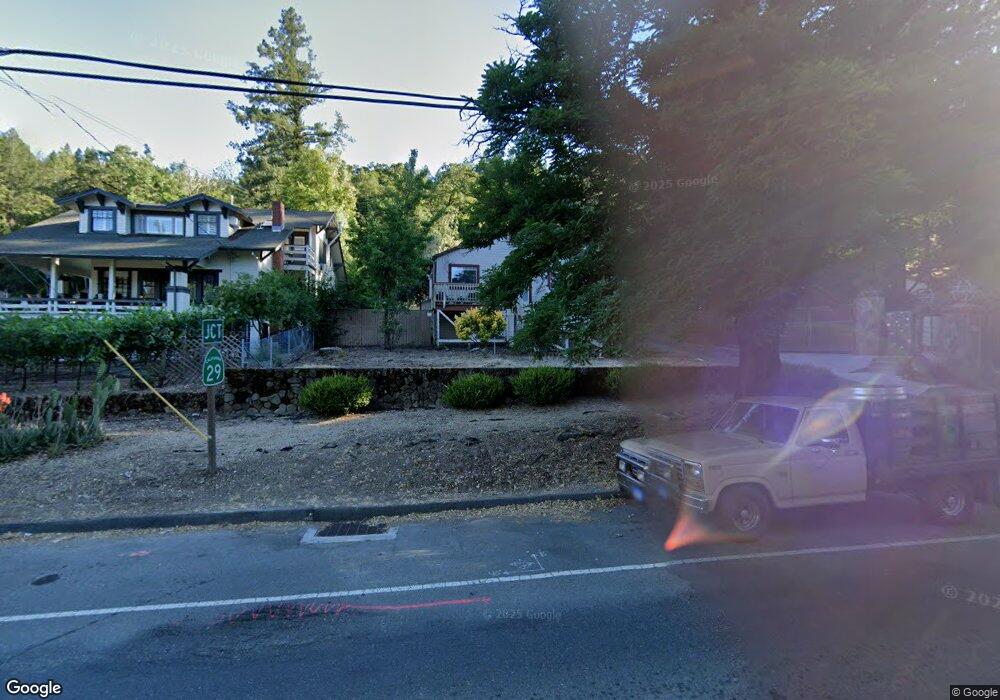

1303 Foothill Blvd Calistoga, CA 94515

Estimated Value: $611,000 - $911,000

2

Beds

1

Bath

700

Sq Ft

$1,035/Sq Ft

Est. Value

About This Home

This home is located at 1303 Foothill Blvd, Calistoga, CA 94515 and is currently estimated at $724,556, approximately $1,035 per square foot. 1303 Foothill Blvd is a home located in Napa County with nearby schools including Calistoga Elementary School and Calistoga Junior/Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 13, 2014

Sold by

P B Hein Installations Inc

Bought by

Kite Nicholas J and Kite Gillian M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,000

Outstanding Balance

$192,221

Interest Rate

4.12%

Mortgage Type

New Conventional

Estimated Equity

$532,335

Purchase Details

Closed on

Apr 15, 2014

Sold by

Stevens Mike and Stevens Rebecca R

Bought by

Pb Hein Installation Inc and R&A Napa Properties Inc

Purchase Details

Closed on

Jan 5, 1994

Sold by

Frediani Steven M and Frediani Alfred A

Bought by

Stevens Mike and Stevens Rebecca R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$116,350

Interest Rate

6.8%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kite Nicholas J | $315,000 | First American Title Company | |

| Pb Hein Installation Inc | $110,439 | None Available | |

| Stevens Mike | $150,000 | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kite Nicholas J | $252,000 | |

| Previous Owner | Stevens Mike | $116,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,093 | $378,573 | $240,367 | $138,206 |

| 2024 | $4,093 | $371,151 | $235,654 | $135,497 |

| 2023 | $4,093 | $363,875 | $231,034 | $132,841 |

| 2022 | $3,839 | $356,741 | $226,504 | $130,237 |

| 2021 | $3,720 | $349,747 | $222,063 | $127,684 |

| 2020 | $3,678 | $346,162 | $219,787 | $126,375 |

| 2019 | $3,631 | $339,376 | $215,478 | $123,898 |

| 2018 | $3,585 | $332,722 | $211,253 | $121,469 |

| 2017 | $3,512 | $326,199 | $207,111 | $119,088 |

| 2016 | $3,418 | $319,803 | $203,050 | $116,753 |

| 2015 | $3,379 | $315,000 | $200,000 | $115,000 |

| 2014 | $1,984 | $183,005 | $124,777 | $58,228 |

Source: Public Records

Map

Nearby Homes

- 1423 Foothill Blvd

- 1510 Foothill Blvd

- 18276 California 128 Unit A

- 1607 Foothill Blvd

- 1610 Myrtle St

- 3027 Foothill Blvd

- 3567 California 128

- 1619 Foothill Blvd

- 511 Kortum Canyon Rd

- 1722 Foothill Blvd

- 800 Washington St

- 1411 4th St

- 1431 4th St

- 375 Kortum Canyon Rd

- 1437 4th St

- 304 High St

- 1422 N Oak St

- 1438 Grant St

- 1557 Silverado Terrace Loop

- 1551 Silverado Terrace Loop

- 1213 Foothill Blvd

- 1305 Foothill Blvd

- 0 California 128

- 12139 California 128

- 1304 Foothill Blvd

- 1313 Foothill Blvd

- 1207 Foothill Blvd

- 1302 Foothill Blvd

- 1306 Foothill Blvd

- 1308 Foothill Blvd

- 1104 Elm St

- 1106 Elm St

- 1117 Lincoln Ave

- 1323 Foothill Blvd

- 1125 Lincoln Ave

- 1109 Elm St

- 1305 Myrtle St

- 1102 Spring St

- 1311 Myrtle St

- 1101 Foothill Blvd Unit 1-7