1303 Michael Ct Unit 172 Bayside, NY 11360

Bayside NeighborhoodEstimated Value: $997,978 - $1,049,000

--

Bed

--

Bath

1,800

Sq Ft

$566/Sq Ft

Est. Value

About This Home

This home is located at 1303 Michael Ct Unit 172, Bayside, NY 11360 and is currently estimated at $1,018,745, approximately $565 per square foot. 1303 Michael Ct Unit 172 is a home located in Queens County with nearby schools including P.S. 209 - Clearview Gardens, J.H.S. 194 William Carr, and Bayside High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2025

Sold by

Kim Hae Soog and Kim Hyunji

Bought by

Li Wen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$498,000

Outstanding Balance

$495,836

Interest Rate

6.76%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$522,909

Purchase Details

Closed on

Jan 6, 2014

Sold by

Zecher Caroline

Bought by

Kim Hae Soog and Kim Hyunji

Purchase Details

Closed on

Apr 30, 1996

Sold by

Zecher Alfred and Zecher Caroline

Bought by

Zecher Caroline

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Li Wen | $994,800 | -- | |

| Li Wen | $994,800 | -- | |

| Kim Hae Soog | $730,000 | -- | |

| Kim Hae Soog | $730,000 | -- | |

| Zecher Caroline | -- | First American Title Ins Co | |

| Zecher Caroline | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Li Wen | $498,000 | |

| Closed | Li Wen | $498,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,125 | $50,410 | $4,040 | $46,370 |

| 2024 | $10,125 | $50,410 | $4,415 | $45,995 |

| 2023 | $9,970 | $49,640 | $3,808 | $45,832 |

| 2022 | $9,349 | $61,297 | $5,046 | $56,251 |

| 2021 | $9,298 | $54,417 | $5,046 | $49,371 |

| 2020 | $8,892 | $55,271 | $5,046 | $50,225 |

| 2019 | $8,788 | $56,736 | $5,046 | $51,690 |

| 2018 | $8,433 | $41,367 | $3,960 | $37,407 |

| 2017 | $7,955 | $39,026 | $3,815 | $35,211 |

| 2016 | $7,360 | $39,026 | $3,815 | $35,211 |

| 2015 | $4,002 | $35,007 | $5,046 | $29,961 |

| 2014 | $4,002 | $35,345 | $5,046 | $30,299 |

Source: Public Records

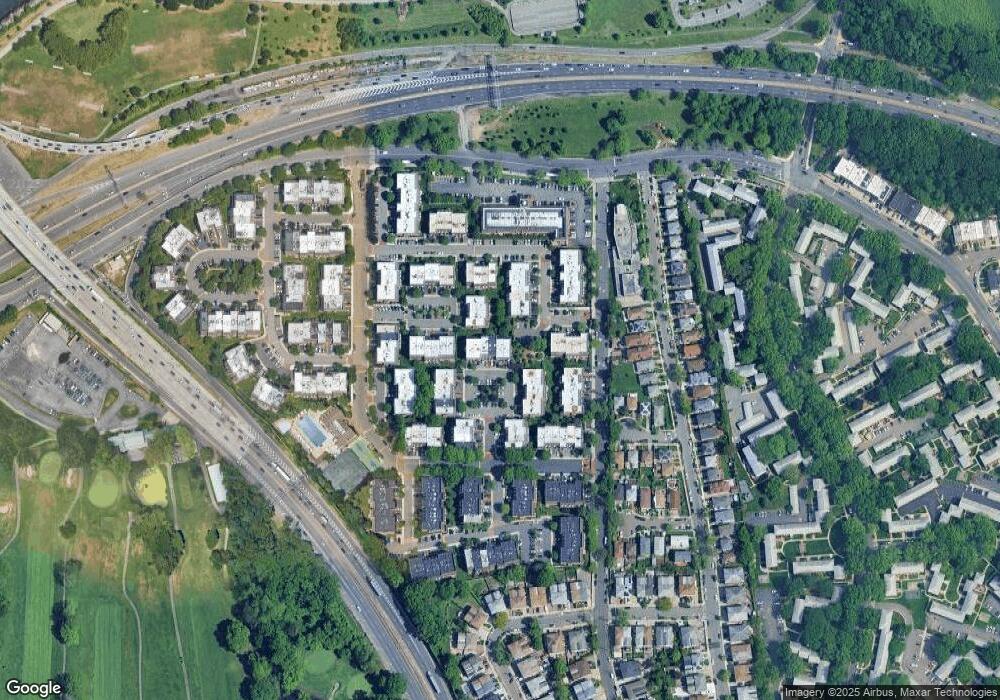

Map

Nearby Homes

- 13-25 Estates Ln Unit 3F

- 14-04 Michael Place Unit 113 U

- 12-34 Diane Place Unit 205 U

- 12-32 Diane Place Unit 204L

- 208-06 Robert Rd Unit 2

- 14-14 Bonnie Ln

- 1404 Bonnie Ln Unit 15803

- 208-08 Estates Dr Unit 22125

- 12-36 Estates Ln Unit 49 L

- 12-30 Estates Ln Unit 2

- 12-35 Robin Ln Unit Upper

- 1338 Robin Ln Unit 1212

- 12-31 Robin Ln Unit Triplex

- 210 E 15th St Unit 2N

- 210 E 15th St Unit 1A

- 20607 Emily Rd Unit 3

- 208-18 15th Rd

- 13-40 212th St Unit 141

- 12-06 Robin Ln Unit 1028

- 13-10 212th St Unit 118

- 1303 Michael Ct

- 1303 Michael Ct Unit 1621

- 1303 Michael Ct Unit 1622

- 1305 Michael Ct

- 1305 Michael Ct

- 1305 Michael Ct

- 1301 Michael Ct

- 1301 Michael Ct

- 1301 Michael Ct Unit 1624

- 1301 Michael Ct Unit 1623

- 1302 Michael Ct

- 1302 Michael Ct Unit 174B

- 1302 Michael Ct Unit 1625

- 1302 Michael Ct Unit 1626

- 13-03 Michael Ct Unit 172 U

- 13-03 Michael Ct Unit 2FL

- 13-03 Michael Ct

- 13-03 Michael Ct Unit 1Fl

- 13-05 Michael Ct

- 13-05 Michael Ct Unit 171 U