1303 Queensgate Ct SE Unit 3 Smyrna, GA 30082

Estimated Value: $656,000 - $842,000

4

Beds

4

Baths

3,374

Sq Ft

$226/Sq Ft

Est. Value

About This Home

This home is located at 1303 Queensgate Ct SE Unit 3, Smyrna, GA 30082 and is currently estimated at $761,716, approximately $225 per square foot. 1303 Queensgate Ct SE Unit 3 is a home located in Cobb County with nearby schools including King Springs Elementary School, Griffin Middle School, and Campbell High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 10, 2024

Sold by

Miller Seth D and Miller Jennifer S

Bought by

Samford Real Estate Llc

Current Estimated Value

Purchase Details

Closed on

Nov 19, 2014

Sold by

Orston Todd A

Bought by

Miller Seth D and Miller Jennifer S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$394,787

Interest Rate

3.95%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 4, 2001

Sold by

Traton Corp Of Cobb Inc

Bought by

Orston Todd A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,000

Interest Rate

7.44%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Samford Real Estate Llc | $795,000 | None Listed On Document | |

| Miller Seth D | $429,000 | -- | |

| Orston Todd A | $345,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Miller Seth D | $394,787 | |

| Previous Owner | Orston Todd A | $275,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,096 | $298,088 | $80,000 | $218,088 |

| 2024 | $6,401 | $298,088 | $80,000 | $218,088 |

| 2023 | $5,134 | $256,460 | $44,000 | $212,460 |

| 2022 | $4,557 | $197,464 | $44,000 | $153,464 |

| 2021 | $4,582 | $197,464 | $44,000 | $153,464 |

| 2020 | $4,536 | $195,032 | $44,000 | $151,032 |

| 2019 | $4,536 | $195,032 | $44,000 | $151,032 |

| 2018 | $4,197 | $177,212 | $44,000 | $133,212 |

| 2017 | $3,993 | $177,212 | $44,000 | $133,212 |

| 2016 | $3,685 | $160,820 | $48,000 | $112,820 |

| 2015 | $3,765 | $160,820 | $48,000 | $112,820 |

| 2014 | $3,197 | $129,812 | $0 | $0 |

Source: Public Records

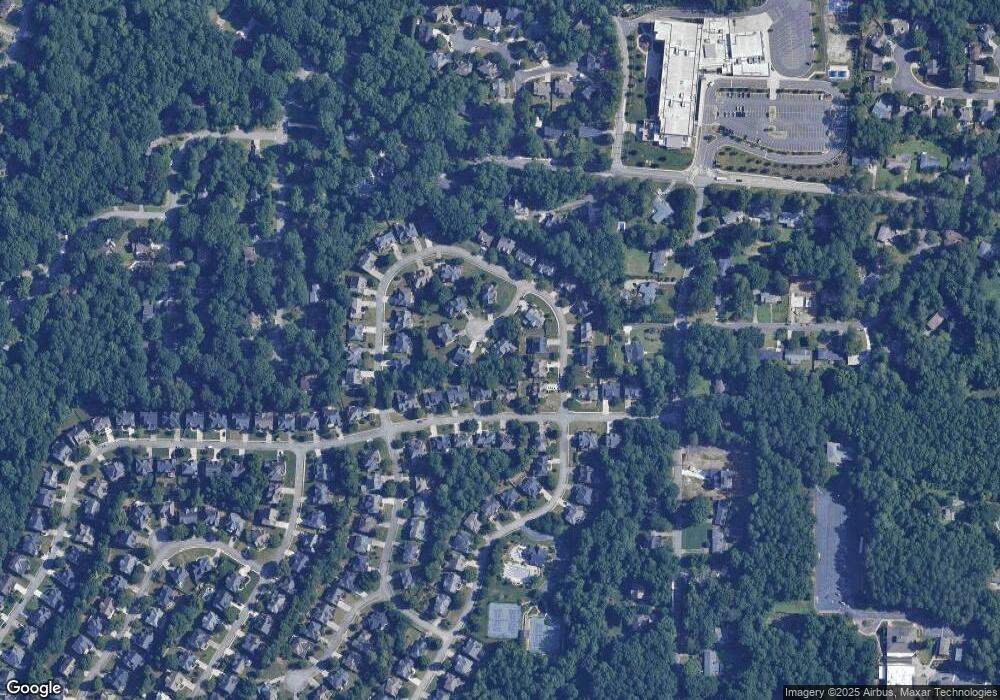

Map

Nearby Homes

- 1224 Kenway Cir SE

- 951 Reed Rd SE

- 931 Hidden Falls Ln SE

- 608 Green Valley Dr

- 608 & 612 Green Valley Dr

- 634 Green Valley Dr SE

- 4381 King Valley Dr SE

- 4398 King Valley 3-5 Dr SE

- 505 Bridge Ln SE

- 502 Bridge Ln SE

- 904 Bridge Ln SE

- 3941 Lake Dr SE

- 1181 Parkland Run SE

- 303 Mill Pond Ct SE

- 702 Mill Pond Dr SE

- 204 Kenninghall Ln SE Unit 6

- 606 Mill Pond Dr SE

- 609 Mill Pond Dr SE

- 610 Mill Pond Dr SE

- 1203 Kenway Cir SE

- 1305 Queensgate Ct SE

- 1157 Queensgate Dr SE

- 0 Queensgate Ct Unit 7438312

- 0 Queensgate Ct Unit 7265757

- 1301 Queensgate Ct SE

- 1201 Kenway Cir SE

- 1159 Queensgate Dr SE

- 1300 Queensgate Ct SE

- 1304 Queensgate Ct SE

- 1155 Queensgate Dr SE

- 1302 Queensgate Ct SE

- 0 Kenway Cir Unit 7413934

- 0 Kenway Cir Unit 7377611

- 0 Kenway Cir Unit 7240485

- 0 Kenway Cir Unit 3271542

- 0 Kenway Cir Unit 8740374

- 0 Kenway Cir Unit 8463983

- 0 Kenway Cir Unit 7446038

- 0 Kenway Cir Unit 3141579