Estimated Value: $105,000 - $120,455

2

Beds

1

Bath

976

Sq Ft

$113/Sq Ft

Est. Value

About This Home

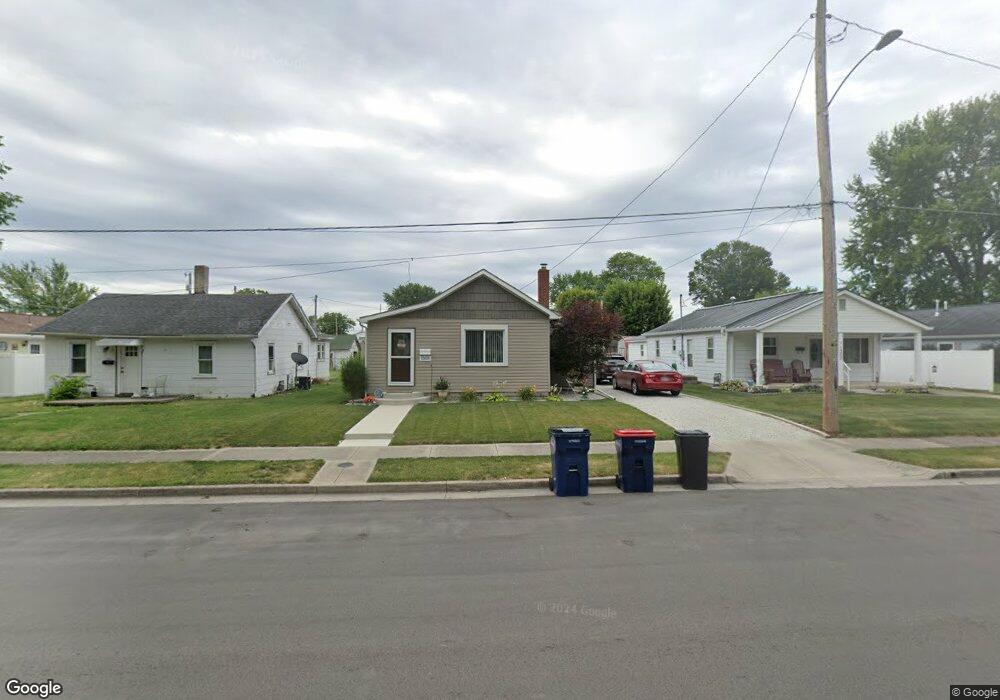

This home is located at 1305 Clark Ave, Piqua, OH 45356 and is currently estimated at $109,864, approximately $112 per square foot. 1305 Clark Ave is a home located in Miami County with nearby schools including Piqua Junior High School, Piqua High School, and Piqua Sda Christian School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 4, 2025

Sold by

Queen Roger D

Bought by

Schwable Robbi Lynn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,000

Outstanding Balance

$63,000

Interest Rate

5.85%

Mortgage Type

New Conventional

Estimated Equity

$46,864

Purchase Details

Closed on

Oct 9, 2012

Sold by

Larck Edward R

Bought by

Queen Roger D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,657

Interest Rate

3.75%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 12, 2008

Sold by

Hud

Bought by

Larck Edward R

Purchase Details

Closed on

Mar 14, 2008

Sold by

Gilmore Martin K

Bought by

Hud

Purchase Details

Closed on

May 8, 2002

Sold by

Weber Willis L and Weber Carnetta

Bought by

Gilmore Martin K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$57,817

Interest Rate

7.24%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 9, 1999

Sold by

Estate Of Norbert J Phlipot and Phlipot Harry L

Bought by

Weber Willis L and Weber Carnetta

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schwable Robbi Lynn | $113,000 | None Listed On Document | |

| Queen Roger D | $46,500 | Republic Title Agency Inc | |

| Larck Edward R | -- | -- | |

| Hud | -- | -- | |

| Gilmore Martin K | $58,275 | -- | |

| Weber Willis L | $50,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Schwable Robbi Lynn | $63,000 | |

| Previous Owner | Queen Roger D | $45,657 | |

| Previous Owner | Weber Willis L | $57,817 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $914 | $22,230 | $6,620 | $15,610 |

| 2023 | $914 | $22,230 | $6,620 | $15,610 |

| 2022 | $930 | $22,230 | $6,620 | $15,610 |

| 2021 | $752 | $16,450 | $4,900 | $11,550 |

| 2020 | $737 | $16,450 | $4,900 | $11,550 |

| 2019 | $741 | $16,450 | $4,900 | $11,550 |

| 2018 | $766 | $16,240 | $4,900 | $11,340 |

| 2017 | $776 | $16,240 | $4,900 | $11,340 |

| 2016 | $767 | $16,240 | $4,900 | $11,340 |

| 2015 | $756 | $15,650 | $4,730 | $10,920 |

| 2014 | $756 | $15,650 | $4,730 | $10,920 |

| 2013 | $759 | $15,650 | $4,730 | $10,920 |

Source: Public Records

Map

Nearby Homes

- 708 Brice Ave

- 1005 South St

- 605 Boal Ave

- 1110 South St

- 730 Gordon St

- 825 Clark Ave

- 807 Brook St

- 801 Manier Ave

- 707 Leonard St

- 635 Clark Ave

- 1505 Amherst Ave

- 420 Summit St

- 1320 Arrowhead

- 1513 Arrowhead Dr

- 1502 Arrowhead Dr

- Ironwood Plan at Arrowhead Estates

- Juniper Plan at Arrowhead Estates

- Spruce Plan at Arrowhead Estates

- Aspen II Plan at Arrowhead Estates

- Norway Plan at Arrowhead Estates