1305 Kiowa Dr E Gainesville, TX 76240

Estimated Value: $1,060,000 - $1,337,000

3

Beds

3

Baths

4,965

Sq Ft

$235/Sq Ft

Est. Value

About This Home

This home is located at 1305 Kiowa Dr E, Gainesville, TX 76240 and is currently estimated at $1,164,752, approximately $234 per square foot. 1305 Kiowa Dr E is a home located in Cooke County with nearby schools including Callisburg Elementary School, Callisburg Middle School, and Callisburg High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 1, 2024

Sold by

Bitsche Mark Christopher and Bitsche Tamera Rene

Bought by

Given John F and Given Cynthia L

Current Estimated Value

Purchase Details

Closed on

Mar 20, 2019

Sold by

Bitsche Mark Christopher and Bitsche Carole J Sabin

Bought by

Bitsche Mark Christopher

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$462,000

Interest Rate

4.3%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Jul 22, 2008

Sold by

Dowling Lee Hunt

Bought by

Franklin American Mortgage Company

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

6.36%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Given John F | -- | None Listed On Document | |

| Bitsche Mark Christopher | -- | None Available | |

| Franklin American Mortgage Company | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Bitsche Mark Christopher | $462,000 | |

| Previous Owner | Franklin American Mortgage Company | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,176 | $969,781 | $189,510 | $780,271 |

| 2024 | $10,176 | $1,000,380 | $189,510 | $810,870 |

| 2023 | $10,050 | $787,218 | $153,492 | $806,912 |

| 2022 | $10,615 | $869,045 | $140,833 | $728,212 |

| 2021 | $11,898 | $650,594 | $96,804 | $553,790 |

| 2020 | $11,590 | $594,682 | $90,199 | $504,483 |

| 2019 | $11,305 | $594,682 | $90,199 | $504,483 |

| 2018 | $10,333 | $527,501 | $90,199 | $437,302 |

| 2017 | $9,661 | $488,626 | $51,324 | $437,302 |

| 2015 | $8,823 | $467,606 | $45,821 | $421,785 |

| 2014 | $8,823 | $467,606 | $45,821 | $421,785 |

Source: Public Records

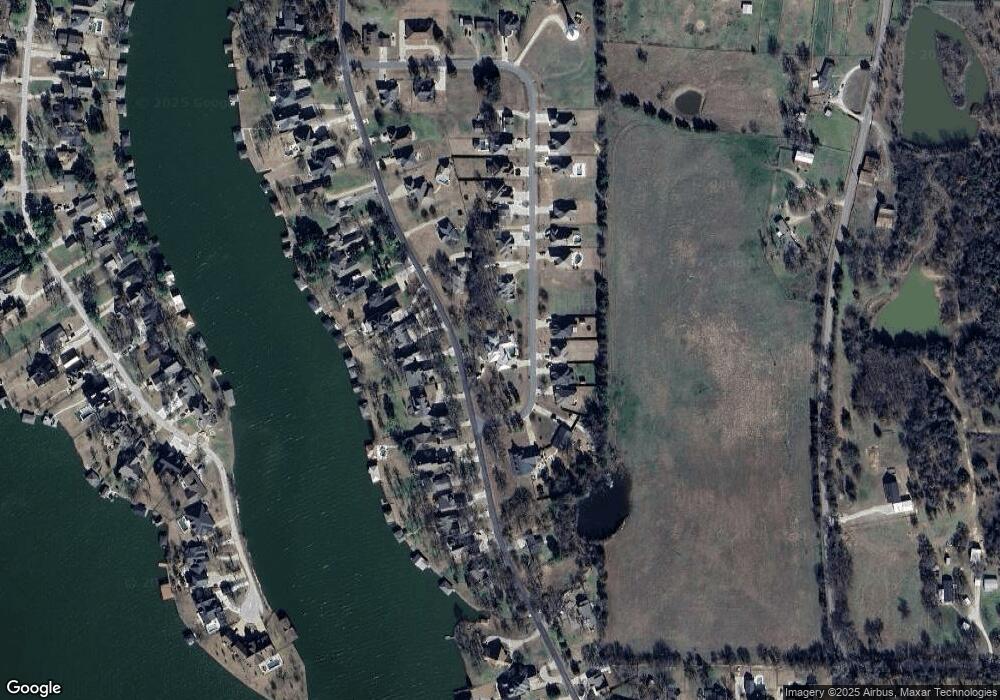

Map

Nearby Homes

- 1229 Kiowa Dr E

- 1321 Kiowa Dr E

- 143 Mohave Dr E

- 1214 Kiowa Dr E

- 329 Comanche Dr

- 1125 Kiowa Dr E

- 1107 Kiowa Dr E

- 912 Kiowa Dr W

- 205 San Chez Dr

- 422 Navajo Trail

- 101 Wasco Cove

- 117 Modoc Trail

- 122 Comanche Dr

- 116 Modoc Trail

- 206 Modoc Trail

- 409 Navajo Trail

- 315 Navajo Trail

- 300 Navajo Trail

- 230 Navajo Trail

- 111 Bowie Dr

- 1305 Kiowa Dr E

- 107 Mohave Dr E

- 112 Mohave Dr E

- 111 Mohave Dr E

- 109 Mohave Dr E

- 1306 Kiowa Dr E

- 1308 Kiowa Dr E

- 113 Mohave Dr E

- 1309 Kiowa Dr E

- 1233 Kiowa Dr E

- 1302 Kiowa Dr E

- 1310 Kiowa Dr E

- 1300 Kiowa Dr E

- 114 Mohave Dr E

- 126 Mohave Dr E

- 1240 Kiowa Dr E

- 1086 Witherspoon St

- 119 Mohave Dr E

- 1314 Kiowa Dr E

- 1312 Kiowa Dr E