13081 Pebblebrk Pt Cir Unit 101 Fort Myers, FL 33905

Verandah NeighborhoodEstimated Value: $283,144 - $318,000

2

Beds

2

Baths

1,532

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 13081 Pebblebrk Pt Cir Unit 101, Fort Myers, FL 33905 and is currently estimated at $307,286, approximately $200 per square foot. 13081 Pebblebrk Pt Cir Unit 101 is a home located in Lee County with nearby schools including Orange River Elementary School, Tice Elementary School, and Edgewood Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 24, 2019

Sold by

Williams Frederick and Williams Darlene

Bought by

Gleeson Stephen R and Gleeson Colleen C

Current Estimated Value

Purchase Details

Closed on

Mar 4, 2015

Sold by

Federal National Mortgage Association

Bought by

Williams Frederick and Williams Darlene

Purchase Details

Closed on

Sep 9, 2013

Sold by

Walters Timothy

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Mar 4, 2013

Sold by

Bank Of America National Association

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Jan 10, 2013

Sold by

Walters Timothy

Bought by

Bac Home Loans Servicing Lp

Purchase Details

Closed on

Sep 7, 2007

Sold by

Centex Homes

Bought by

Walters Timothy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,992

Interest Rate

6.37%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gleeson Stephen R | $215,000 | Title Professionals Of Fl | |

| Williams Frederick | $172,000 | Attorney | |

| Federal National Mortgage Association | -- | None Available | |

| Federal National Mortgage Association | -- | Bayview Title Services Inc | |

| Bac Home Loans Servicing Lp | $87,200 | None Available | |

| Walters Timothy | $200,000 | Commerce Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Walters Timothy | $159,992 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,823 | $229,815 | -- | $229,815 |

| 2024 | $4,692 | $242,748 | -- | -- |

| 2023 | $4,692 | $220,680 | $0 | $0 |

| 2022 | $4,013 | $200,618 | $0 | $0 |

| 2021 | $3,603 | $182,380 | $0 | $182,380 |

| 2020 | $3,691 | $187,340 | $0 | $187,340 |

| 2019 | $3,368 | $163,923 | $0 | $163,923 |

| 2018 | $3,425 | $164,730 | $0 | $164,730 |

| 2017 | $3,464 | $164,730 | $0 | $164,730 |

| 2016 | $3,423 | $159,566 | $0 | $159,566 |

| 2015 | $3,142 | $137,700 | $0 | $137,700 |

| 2014 | -- | $149,800 | $0 | $149,800 |

| 2013 | -- | $140,400 | $0 | $140,400 |

Source: Public Records

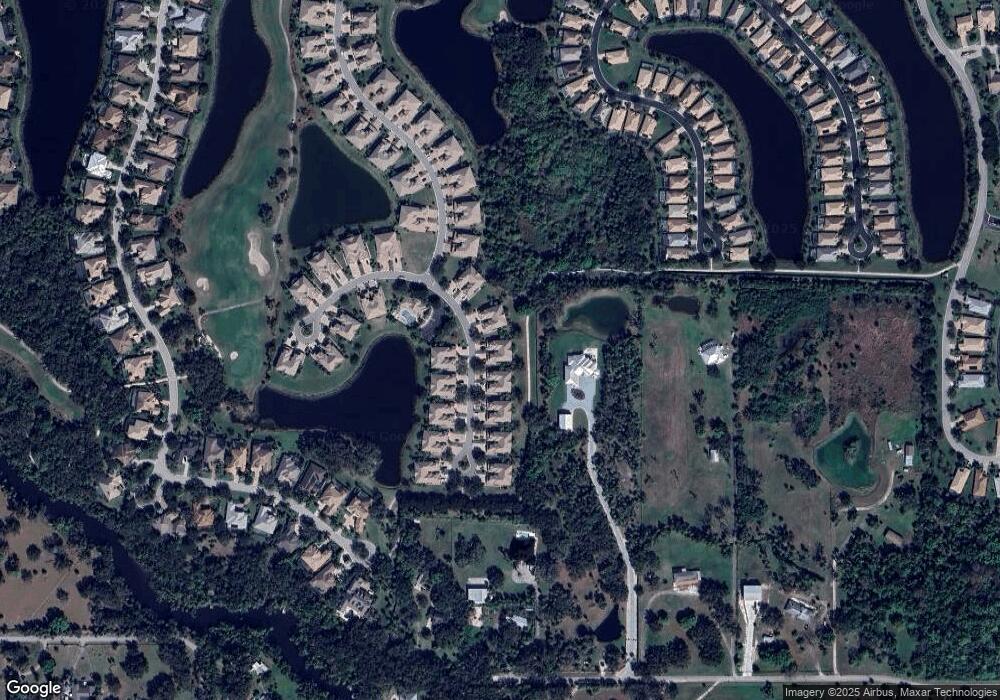

Map

Nearby Homes

- 3790 Pebblebrook Ridge Ct Unit 101

- 3791 Pebblebrook Ridge Ct Unit 101

- 13091 Pebblebrook Point Cir Unit 202

- 13091 Pebblebrook Point Cir Unit 101

- 13100 Pebblebrook Point Cir Unit 201

- 13111 Pebblebrook Point Cir Unit 201

- 13121 Pebblebrook Point Cir Unit 102

- 3470 Lakeview Isle Ct

- 3571 Lakeview Isle Ct

- 3431 Lakeview Isle Ct

- 3670 Lakeview Isle Ct

- 3811 Lakeview Isle Ct

- 3790 Lakeview Isle Ct

- 3850 Otter Bend Cir

- 3871 Otter Bend Cir

- 13405 Citrus Creek Ct

- 13461 Sabal Pointe Dr

- 3980 Otter Bend Cir

- 3681 Mossy Oak Dr

- 13570 Palmetto Grove Dr

- 13081 Pebblebrook Point Cir Unit 202

- 13081 Pebblebrook Point Cir Unit 102

- 13081 Pebblebrook Point Cir Unit 101

- 13081 Pebblebrk Pt Cir Unit 202

- 13081 Pebblebrk Pt Cir Unit 201

- 13081 Pebblebrk Pt Cir Unit 102

- 13091 Pebblebrk Pt Cir Unit 202

- 13091 Pebblebrk Pt Cir Unit 201

- 13091 Pebblebrk Pt Cir Unit 101

- 13091 Pebblebrk Pt Cir Unit 102

- 13071 Pebblebrook Point Cir Unit 202

- 13071 Pebblebrook Point Cir Unit 201

- 13071 Pebblebrook Point Cir Unit 101

- 13071 Pebblebrk Pt Cir Unit 202

- 13071 Pebblebrk Pt Cir Unit 201

- 13071 Pebblebrk Pt Cir Unit 102

- 13071 Pebblebrk Pt Cir Unit 101

- 13080 Pebblebrook Point Cir Unit 201

- 13080 Pebblebrook Point Cir Unit 202

- 13080 Pebblebrook Point Cir Unit 101