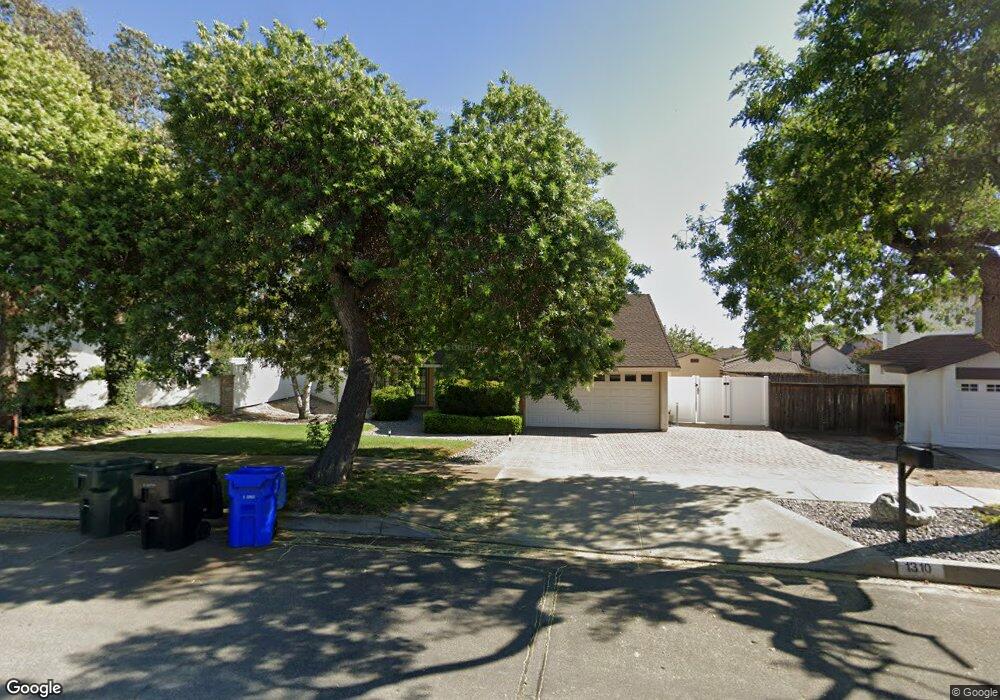

1310 W Clark St Upland, CA 91784

Estimated Value: $850,000 - $961,000

4

Beds

3

Baths

2,068

Sq Ft

$434/Sq Ft

Est. Value

About This Home

This home is located at 1310 W Clark St, Upland, CA 91784 and is currently estimated at $896,518, approximately $433 per square foot. 1310 W Clark St is a home located in San Bernardino County with nearby schools including Pepper Tree Elementary, Pioneer Junior High School, and Upland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 16, 2000

Sold by

Bennett Gary A

Bought by

Peel Richard V and Peel Katawnya C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Outstanding Balance

$82,422

Interest Rate

7.86%

Estimated Equity

$814,096

Purchase Details

Closed on

Nov 11, 2000

Sold by

Bennett Gary A and Bennett Cynthia Lee

Bought by

Peel Richard V and Peel Katawnya C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$224,000

Outstanding Balance

$82,422

Interest Rate

7.86%

Estimated Equity

$814,096

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Peel Richard V | -- | First American Title Ins Co | |

| Peel Richard V | $280,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Peel Richard V | $224,000 | |

| Closed | Peel Richard V | $42,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,897 | $444,080 | $147,672 | $296,408 |

| 2024 | $4,740 | $435,372 | $144,776 | $290,596 |

| 2023 | $4,667 | $426,835 | $141,937 | $284,898 |

| 2022 | $4,565 | $418,466 | $139,154 | $279,312 |

| 2021 | $4,558 | $410,260 | $136,425 | $273,835 |

| 2020 | $4,433 | $406,053 | $135,026 | $271,027 |

| 2019 | $4,417 | $398,091 | $132,378 | $265,713 |

| 2018 | $4,309 | $390,285 | $129,782 | $260,503 |

| 2017 | $4,183 | $382,632 | $127,237 | $255,395 |

| 2016 | $3,974 | $375,129 | $124,742 | $250,387 |

| 2015 | $3,882 | $369,494 | $122,868 | $246,626 |

| 2014 | $3,781 | $362,256 | $120,461 | $241,795 |

Source: Public Records

Map

Nearby Homes

- 1238 Fairway Cir

- 1798 Wilson Ave

- 1830 Wilson Ave

- 1631 Carmel Cir E

- 1640 Lakewood Ave

- 1614 Carmel Cir W

- 1613 Erin Ave

- 1611 N Kelly Ave

- 1243 Jacaranda Place

- 1567 Brentwood Ave

- 1931 Eloise Way

- 1671 N Rocky Rd

- 1705 Almond Tree Place

- 1647 Purple Heart Place

- 1582 Foxdale Ct

- 1742 N Albright Ave

- 1520 Cantabria Place

- 1267 Preston Ct

- 1496 Lemon Grove Dr

- 1669 N San Antonio Ave

- 1328 W Clark St

- 1300 W Clark St

- 1290 Celia Ct

- 1320 N North Hills Dr

- 1308 N North Hills Dr

- 1336 W Clark St

- 1326 N North Hills Dr

- 1294 Shadow Cir

- 1311 W Clark St

- 1329 W Clark St

- 1332 N North Hills Dr

- 1296 Shadow Cir

- 1280 Celia Ct

- 1297 W Clark St

- 1335 W Clark St

- 1324 Shadow Cir

- 1344 W Clark St

- 1336 N North Hills Dr

- 1298 Shadow Cir

- 1268 Celia Ct

Your Personal Tour Guide

Ask me questions while you tour the home.