1310 Walters Point Monument, CO 80132

Estimated Value: $344,000 - $385,000

3

Beds

3

Baths

1,486

Sq Ft

$248/Sq Ft

Est. Value

About This Home

This home is located at 1310 Walters Point, Monument, CO 80132 and is currently estimated at $368,016, approximately $247 per square foot. 1310 Walters Point is a home located in El Paso County with nearby schools including Bear Creek Elementary School, Lewis-Palmer Middle School, and Lewis-Palmer High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 30, 2016

Sold by

Hpa Burrower 2016 Llc

Bought by

Gideon Lanca and Gideon Kristina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$207,095

Outstanding Balance

$165,867

Interest Rate

3.43%

Mortgage Type

New Conventional

Estimated Equity

$202,149

Purchase Details

Closed on

Aug 27, 2015

Sold by

Farnand William R

Bought by

Hp Colorado I Llc

Purchase Details

Closed on

Jan 31, 2006

Sold by

Pulte Home Corp

Bought by

Farnand William R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,366

Interest Rate

6.24%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gideon Lanca | $213,500 | Stewart Title | |

| Hp Colorado I Llc | $195,000 | Stewart Title | |

| Farnand William R | $186,221 | Land Title Guarantee Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gideon Lanca | $207,095 | |

| Previous Owner | Farnand William R | $192,366 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,418 | $25,340 | -- | -- |

| 2024 | $1,315 | $25,580 | $3,750 | $21,830 |

| 2022 | $1,308 | $19,340 | $3,160 | $16,180 |

| 2021 | $1,353 | $19,890 | $3,250 | $16,640 |

| 2020 | $1,220 | $17,190 | $2,720 | $14,470 |

| 2019 | $1,214 | $17,190 | $2,720 | $14,470 |

| 2018 | $1,079 | $14,480 | $2,230 | $12,250 |

| 2017 | $1,079 | $14,480 | $2,230 | $12,250 |

| 2016 | $975 | $13,970 | $2,230 | $11,740 |

| 2015 | $974 | $13,970 | $2,230 | $11,740 |

| 2014 | $930 | $12,740 | $2,070 | $10,670 |

Source: Public Records

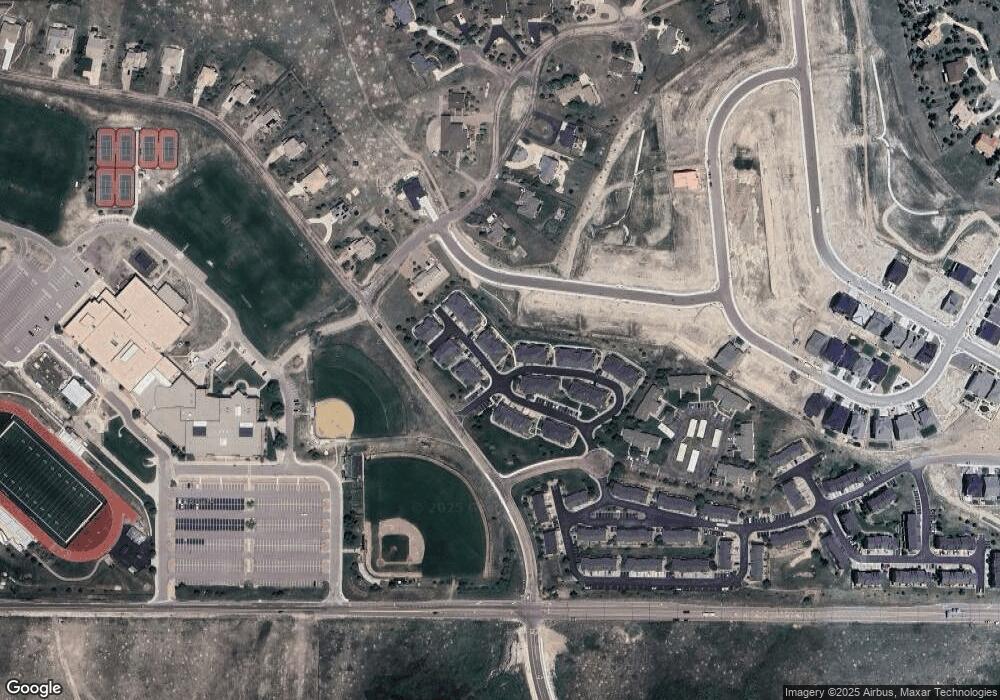

Map

Nearby Homes

- 1316 Walters Point

- 1243 Timber Run Heights

- 1675 Bowstring Rd

- 1109 White Clover Dr

- 17358 Crimson Clover Dr

- 1126 Yellow Dogwood Heights

- 17271 Crimson Clover Dr

- 17258 Alsike Clover Ct

- 17242 Alsike Clover Ct

- 17234 Alsike Clover Ct

- 17209 Alsike Clover Ct

- 17182 Crimson Clover Dr

- 932 Burning Bush Point

- 17174 Crimson Clover Dr

- Coralberry Plan at Cloverleaf - Pinnacle Collection

- Tullahoma Plan at Cloverleaf - Mountainview Collection

- Standley Plan at Cloverleaf - Pinnacle Collection

- Wolford Plan at Cloverleaf - Mountainview Collection

- Erindale II Plan at Cloverleaf - Pinnacle Collection

- Prospect Plan at Cloverleaf - Mountainview Collection

- 1304 Walters Point

- 1322 Walters Point

- 1296 Timber Run Heights

- 1328 Walters Point

- 1290 Timber Run Heights

- 1311 Walters Point

- 1317 Walters Point

- 1305 Walters Point

- 1323 Walters Point

- 1329 Walters Point

- 1297 Timber Run Heights

- 1340 Walters Point

- 1278 Timber Run Heights

- 1335 Walters Point

- 1346 Walters Point

- 1285 Timber Run Heights

- 1352 Walters Point

- 1279 Timber Run Heights

- 1299 Walters Point

- 1272 Timber Run Heights