Estimated Value: $863,000 - $975,239

4

Beds

3

Baths

2,227

Sq Ft

$413/Sq Ft

Est. Value

About This Home

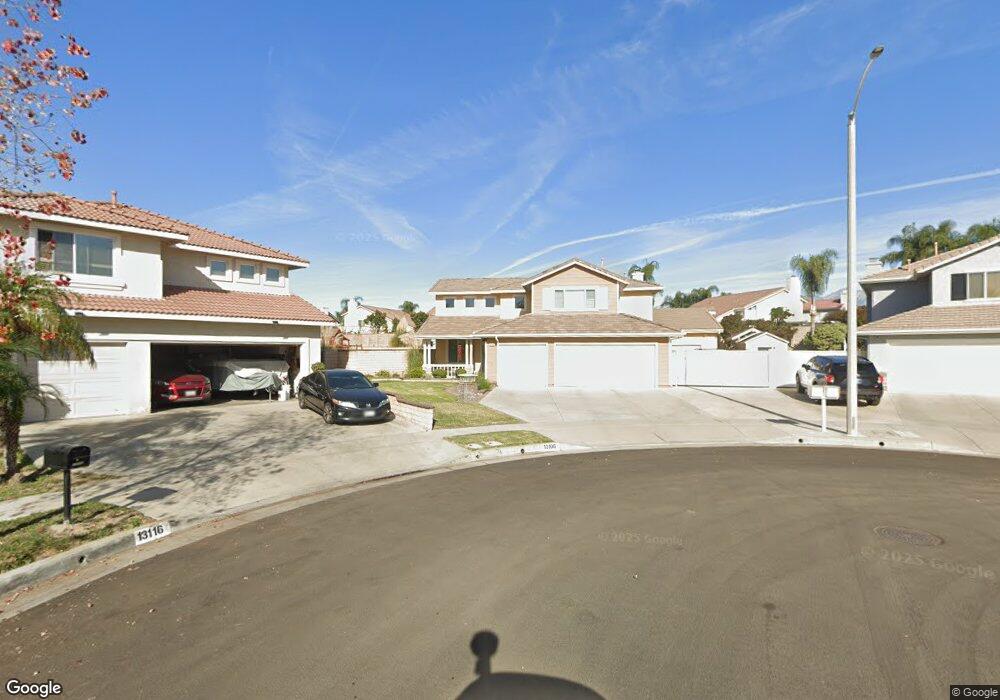

This home is located at 13106 Nighthawk Ct, Chino, CA 91710 and is currently estimated at $918,810, approximately $412 per square foot. 13106 Nighthawk Ct is a home located in San Bernardino County with nearby schools including Howard Cattle Elementary, Magnolia Junior High, and Chino High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 13, 2006

Sold by

Castaneda Amber Dawn

Bought by

Castaneda Amber D and The Amber D Castaneda Revocabl

Current Estimated Value

Purchase Details

Closed on

Apr 17, 2006

Sold by

Castaneda Amber Dawn

Bought by

Castaneda Amber Dawn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$114,867

Interest Rate

6.35%

Mortgage Type

Credit Line Revolving

Estimated Equity

$803,943

Purchase Details

Closed on

Aug 22, 2002

Sold by

Castaneda Eric W

Bought by

Castaneda Amber Dawn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

6.43%

Purchase Details

Closed on

Mar 25, 1997

Sold by

Tava Development Co

Bought by

Castaneda Eric W and Castaneda Amber Dawn

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Castaneda Amber D | -- | None Available | |

| Castaneda Amber Dawn | -- | Fidelity National Title | |

| Castaneda Amber Dawn | -- | Fidelity National Title Ins | |

| Castaneda Eric W | $200,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Castaneda Amber Dawn | $200,000 | |

| Closed | Castaneda Amber Dawn | $240,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,178 | $375,084 | $79,837 | $295,247 |

| 2024 | $4,178 | $367,730 | $78,272 | $289,458 |

| 2023 | $4,066 | $360,519 | $76,737 | $283,782 |

| 2022 | $4,041 | $353,450 | $75,232 | $278,218 |

| 2021 | $3,964 | $346,520 | $73,757 | $272,763 |

| 2020 | $3,915 | $342,967 | $73,001 | $269,966 |

| 2019 | $3,848 | $336,243 | $71,570 | $264,673 |

| 2018 | $3,766 | $329,650 | $70,167 | $259,483 |

| 2017 | $3,700 | $323,186 | $68,791 | $254,395 |

| 2016 | $3,468 | $316,849 | $67,442 | $249,407 |

| 2015 | $3,401 | $312,090 | $66,429 | $245,661 |

| 2014 | $3,336 | $305,977 | $65,128 | $240,849 |

Source: Public Records

Map

Nearby Homes

- 13035 Arlington Ln

- 6833 Renato Ct

- 13102 Melon Ave

- 6903 Montego St

- 6648 Riverside Dr Unit 3

- 12834 Zinnea Ave

- 6766 Foxcroft Ct

- 13022 Cypress Ave

- 6630 Mogano Dr

- 2890 S Via Belamaria

- 13360 Goldmedal Ave

- 13255 Copra Ave

- 6441 Susana St

- 209 W Via Rua Flores

- 13462 Mashona Ave

- 12689 Cypress Ave

- 6542 Hamilton St

- 13014 Bermuda Ave

- 12638 Verdugo Ave

- 12936 Cambridge Ct

- 13116 Nighthawk Ct

- 6759 Eagle Dr

- 13105 Nighthawk Ct

- 6751 Eagle Dr

- 13117 Pintail Ct

- 6767 Eagle Dr

- 13107 Pintail Ct

- 13126 Nighthawk Ct

- 6743 Eagle Dr

- 13115 Nighthawk Ct

- 13127 Pintail Ct

- 6735 Eagle Dr

- 13067 Arlington Ln

- 13136 Nighthawk Ct

- 13125 Nighthawk Ct

- 13112 Wren Ave

- 13137 Pintail Ct

- 13102 Wren Ave

- 6727 Eagle Dr

- 13122 Wren Ave