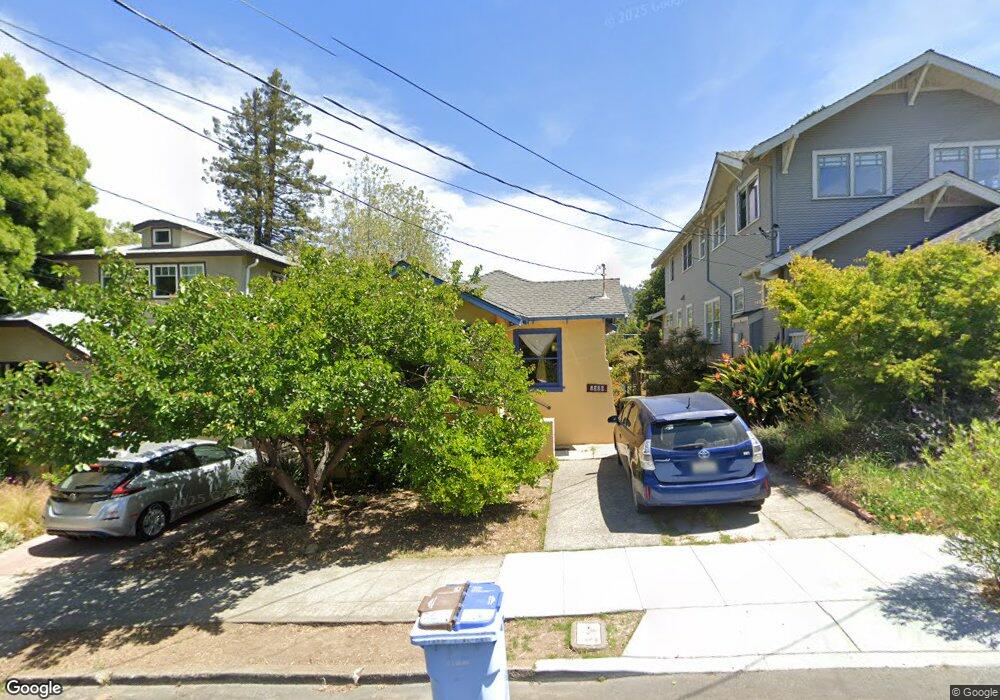

1315 Carlotta Ave Berkeley, CA 94703

North Berkeley NeighborhoodEstimated Value: $1,460,000 - $1,684,000

3

Beds

2

Baths

1,340

Sq Ft

$1,181/Sq Ft

Est. Value

About This Home

This home is located at 1315 Carlotta Ave, Berkeley, CA 94703 and is currently estimated at $1,582,038, approximately $1,180 per square foot. 1315 Carlotta Ave is a home located in Alameda County with nearby schools including Ruth Acty Elementary, Thousand Oaks Elementary School, and Berkeley Arts Magnet at Whittier School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 9, 2024

Sold by

Roach Scott David

Bought by

Clark Dana L

Current Estimated Value

Purchase Details

Closed on

Apr 19, 2012

Sold by

Roach Scott David and Clark Dana L

Bought by

Clark Dana L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$342,000

Interest Rate

3.9%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 15, 2002

Sold by

Kimlinger Roseanne and Anne V Kimlinger Trust

Bought by

Clark Dana L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$316,000

Interest Rate

6.87%

Purchase Details

Closed on

May 29, 2000

Sold by

Rachelle Kimlinger Roseanne and Rachelle Hearte

Bought by

Kimlinger Roseanne

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clark Dana L | -- | None Listed On Document | |

| Clark Dana L | -- | First American Title Company | |

| Clark Dana L | $395,000 | Old Republic Title Company | |

| Kimlinger Roseanne | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Clark Dana L | $342,000 | |

| Previous Owner | Clark Dana L | $316,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,737 | $583,493 | $175,048 | $408,445 |

| 2024 | $9,737 | $572,054 | $171,616 | $400,438 |

| 2023 | $9,527 | $560,840 | $168,252 | $392,588 |

| 2022 | $9,339 | $549,843 | $164,953 | $384,890 |

| 2021 | $9,349 | $539,064 | $161,719 | $377,345 |

| 2020 | $8,807 | $533,537 | $160,061 | $373,476 |

| 2019 | $8,416 | $523,078 | $156,923 | $366,155 |

| 2018 | $8,265 | $512,824 | $153,847 | $358,977 |

| 2017 | $7,963 | $502,771 | $150,831 | $351,940 |

| 2016 | $7,677 | $492,915 | $147,874 | $345,041 |

| 2015 | $7,571 | $485,513 | $145,654 | $339,859 |

| 2014 | $7,508 | $476,005 | $142,801 | $333,204 |

Source: Public Records

Map

Nearby Homes

- 1515 Rose St

- 1833 Sonoma Ave

- 1521 Josephine St

- 1015 Merced St

- 1482 Lincoln St

- 1609 Bonita Ave Unit 3

- 1609 Bonita Ave Unit 5

- 1127 Key Route Blvd

- 1444 Walnut St

- 1322 Virginia St

- 1929 California St

- 1682 Oxford St

- 2201 Virginia St Unit 2

- 1728 Curtis St

- 2118 California St

- 2218 -2222 Grant St

- 2340 Virginia St

- 2201 McGee Ave

- 1919 Curtis St

- 1623 10th St

- 1311 Carlotta Ave

- 1319 Carlotta Ave

- 1321 Carlotta Ave

- 1309 Carlotta Ave

- 1325 Carlotta Ave

- 1327 Carlotta Ave

- 1329 Carlotta Ave

- 1316 Carlotta Ave

- 1318 Carlotta Ave

- 1314 Carlotta Ave

- 1322 Carlotta Ave

- 1310 Carlotta Ave

- 1626 Hopkins St

- 1628 Hopkins St

- 1302 Carlotta Ave Unit 1

- 1333 Carlotta Ave

- 1304 Carlotta Ave Unit 2

- 1326 Carlotta Ave

- 1624 Hopkins St

- 1335 Carlotta Ave